Utica Shale | E&P | Marcellus | NGI All News Access | NGI The Weekly Gas Market Report

Appalachian E&Ps Working to Fend Off Cold, Keep NatGas Flowing

With single-digit lows continuing and forecasts calling for temperatures to plunge below zero on Friday and Saturday in the Pittsburgh region, small and large Appalachian natural gas producers were grappling with frigid temperatures in different ways.

While the region’s pipeline operators have been struggling to keep their systems in check since arctic air settled in over a wide swath of the country during the Christmas holiday, exploration and production (E&P) companies working across Ohio, Pennsylvania and West Virginia have had crews on call to keep the gas flowing.

In snowy Northwest Pennsylvania near the shores of Lake Erie, which has long been a hotspot for conventional production in formations like the Medina, producers have been working to keep their wells and equipment from seizing-up in the deep cold.

The recent weather “is making operations very difficult,” said Medina Revenue LLC owner Joe Fowler, who has 10 employees overseeing 550 conventional wells in Crawford and Erie counties.

The company sells into the National Fuel Gas Co. (NFG) pipeline system, which Fowler said is packed with gas to meet demand. At a line pressure of 400 pounds, NFG’s system is making it difficult for his low-pressure Medina wells to flow. During the cold snap, his compressors are that much more vital.

“The seven compressors that I have are experiencing freeze-offs and requiring daily maintenance. Before the start of the cold we went out and emptied all the drips,” he said, referring to the devices on flow lines that are connected to the wellheads and act similar to separators. “For the most part, our separators are not having a problem working to separate the water from the gas to prevent freeze-offs in the pipelines.”

Another problem affecting Medina Revenue and others in the region, Fowler said, is “house gas.” Unlike shale wells, leaseholders with legacy wells on their property are entitled to offtake some gas for free to meet their heating needs. That demand has spiked in the cold weather, resulting in less sales for conventional producers.

The region’s larger independents operating deeper shale wells face different problems. Higher operational pressures create a larger probability of gas freezing off.

The basin’s largest producer, EQT Corp., employs specialized heaters on its Marcellus wells to minimize freezing, spokesperson Linda Robertson said. If necessary, Robertson said the company also injects a methanol hydrate inhibitor into the gas stream, which lowers the freezing point of gas and helps to keep it flowing during stretches that bring the kind of arctic air the region has seen over the last week or so.

“We have had little to no lost time and do not foresee any immediate plans to slow down or delay drilling or completion operations due to the cold weather,” she said.

CNX Resources Corp. spokesperson Brian Aiello said earlier this week the company hasn’t experienced any “significant disruptions,” adding that CNX rigs and completion crews continue to work through the cold snap.

Aiello added that CNX prepares for the region’s colder winters, a point seconded by Cabot Oil & Gas Corp. spokesperson George Stark. Cabot works in a rural part of northeastern Pennsylvania, with all of its operations in Susquehanna County. Stark said as a result, the company has invested heavily in recent years to upgrade its production facilities to handle severe cold.

NFG on New Year’s Day was forced to ask residential, industrial and commercial customers in Western New York to turn down their thermostats because of an unspecified problem at a transmission facility in Potter County, PA, that affected deliverability on its system. While the problem was resolved the same day, NFG affiliate Seneca Resources Corp. saw some operational snags while the facility was down because its production passes through it, spokesman Rob Boulware said. After the issue was fixed, operations returned to normal, but he noted late Thursday that even colder weather is on the way that producers will have to deal with.

Upstream operators have been affected by freeze-offs across the Lower 48 states, a fact reflected by some industry research firms that are predicting output to decline as a result. BTU Analytics LLC noted earlier this week that the areas hardest hit by freeze-offs were in West Virginia, Oklahoma, North Dakota and Pennsylvania, with about 1 Bcf/d of declines recorded in the days leading up to Tuesday.

Even still, NGI’s Patrick Rau, director of Strategy and Research, said larger independents operating in Appalachia are likely coping with the cold fairly well. Their service contractors, he said, are sure to be keeping a closer eye on operations, compared to smaller E&Ps that might be stretched thin with smaller staffs and more sensitive equipment.

Even with warmer weather forecasted for later in the month, the cold has certainly helped the outlook for Northeast gas producers, Rau said, and perhaps made them less inclined to share more specifics about how it’s affecting their operations until they have to.

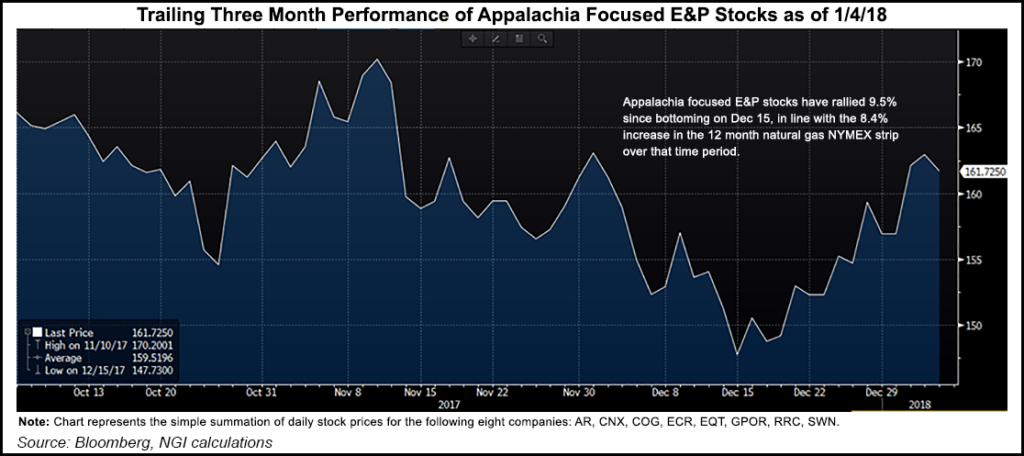

Appalachian E&P stocks have rallied 9.5% since a sharp dip on Dec. 15, which is in line with the 8.4% increase in the 12-month natural gas New York Mercantile Exchange strip over the same time, Rau noted.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |