NGI Data | Markets | NGI All News Access

Midcontinent Price Blowout Leads Bullish NatGas Cash; Futures Finally Taking Notice of Weather

Extreme frigid temperatures sent spot market prices across the middle of the country surging Thursday, including trades as high as $100/MMBtu in the Midcontinent. The NGI National Spot Gas Average jumped 86 cents to $5.78/MMBtu.

With weather driving up heating demand across the Midwest and East Coast this week, the futures market finally seemed to take notice. More cold changes to the outlook sparked an overnight rally, and the February contract maintained that momentum through to Thursday’s close, settling 18.2 cents higher at $2.914. March settled 17.9 cents higher at $2.878.

But the day’s most eye-catching price action took place in Ventura, IA, where day-ahead deliveries of natural gas traded at record-high levels, hearkening back to the polar vortex conditions of winter 2013/14 and leaving Northern Natural Gas and Northern Border pipelines prepared to take action to maintain balance on their systems (see related story).

Day-ahead deliveries at Northern Natural Ventura traded as high $100/MMBtu Thursday and were averaging $64.49, up $60.55 from the day before. At Northern Border Ventura, prices traded as high as $95 and were averaging $42.47, up $38.64 day/day.

Previously, the highest trade NGI ever recorded for Northern Natural Ventura was $80 on January 27, 2014. Prices that day averaged $55.62, Daily GPI historical data show. The previous record at Northern Border Ventura occurred that same day, when spot prices traded as high as $85 and averaged $49.30.

Prices in the Midwest didn’t blow out like in Ventura, but sustained heating demand sent the regional average more than $1 higher to $3.97. Prices at Chicago Citygate jumped 82 cents to $3.98.

“An arctic blast continues to bring the coldest weather in recent years to the eastern half of the U.S., increasing heating demand nationally,” MDA Information Systems said Thursday. “Low temperatures are expected to fall below zero in Chicago and into the lower single digits in Boston early next week while New Year’s Eve revelers in Central Park will have to contend with wind chills approaching 0 degrees F as the ball drops.”

According to MDA, this translates into a potential “record high total of gas-weighted heating degree days (GWHDD)” for the period from the last week of December through the first few days of January. That’s compared with records going back to 1950.

“In fact, the 10-day period from Christmas Day to Jan. 3 is expected to yield the highest number of GWHDDs of any 10-day period since 1997, exceeding some of the more notable recent cold outbreaks, including those during the frigid winter of 2013/14 in which the ‘polar vortex’ gained popularity,” the firm said.

On the East Coast, prices at a number of Northeast points pulled back Thursday after spiking earlier in the week. Algonquin Citygate gave up $3.20 to average a still-elevated $19.09. Transco Zone 6 New York fell 88 cents to $15.66. In Appalachia, Tetco M3 Delivery gave up $2.02 to average $15.23.

While most other regions gained around 20 cents on the day, mirroring the futures, West Texas prices enjoyed larger gains Thursday. Waha added 44 cents to finish at $3.02, while El Paso Permian also added 50 cents to $2.91.

Meanwhile, the impressive winter weather — including continued cold changes in the guidance — finally seemed to bring out the futures bulls. The already-surging February contract didn’t miss a beat Thursday even as the Energy Information Administration (EIA) reported a storage withdrawal that came in slightly below market expectations.

“As we suspected the markets could care less about” the storage miss “when colder trending data added a significantly greater amount of demand,” NatGasWeather.com said in a note to clients Thursday. “…The latest midday data retained colder trends, especially with a cold blast Jan. 3-6 over the eastern U.S. The data was also colder on the pattern Jan. 7-10, seeing any break between cold shots over the East as shorter and not as mild.”

Bespoke Weather Services said it viewed Thursday’s rally “as almost entirely weather-driven” and reflecting “concerns about gas shortages heading into the end of the winter season.”

Weather could be “the single strongest driver of price action” the next few weeks. “Should mid-January colder trends reverse, and a week or more of around- to above-average temperatures nationally arrive, we could easily see prices back down towards $2.75 or lower, as the market is confident it can easily refill storage once we get through the winter.”

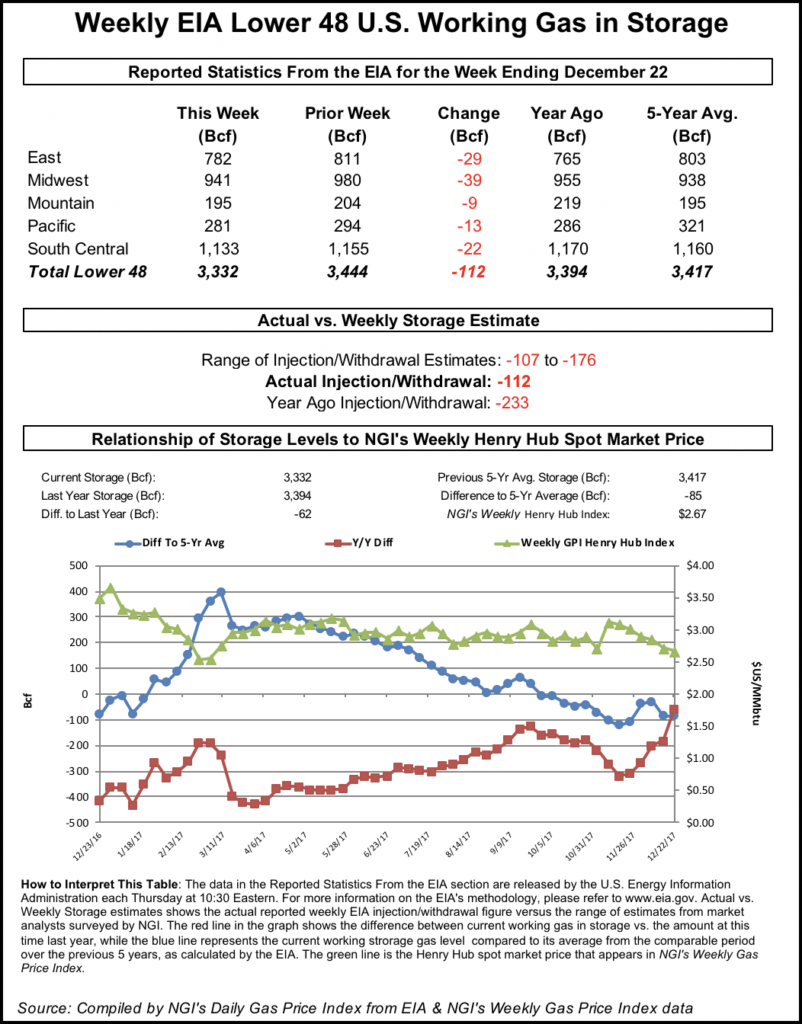

EIA reported a net 112 Bcf withdrawal for the week ending Dec. 22, versus 233 Bcf withdrawn a year ago, and a five-year average withdrawal of 111 Bcf. Last week, EIA reported a 182 Bcf withdrawal.

The February contract, taking over as the prompt-month Thursday, had already rallied roughly 15 cents from Wednesday’s settle to around $2.860-2.880 when the final number crossed trading desks at 10:30 a.m. EDT. February got a bump as the number came out and marched higher from there.

By 11 a.m. EDT, February had climbed above $2.910.

The final figure from EIA fell right in line with consensus estimates.

A Reuters survey of traders and analysts had called for an average withdrawal of 113 Bcf, with responses ranging from -107 Bcf to -176 Bcf.

Stephen Smith Energy Associates, in a report issued over the holiday weekend, predicted a 107 Bcf withdrawal. The firm said this compares to a seasonally normal draw of 82 Bcf, based on 2006-2010 norms.

PointLogic Energy on Tuesday predicted a withdrawal of 111 Bcf. ION Energy’s Kyle Cooper called for a 109 Bcf withdrawal.

Given the cold blast that moved into the Lower 48 this week, the market will now look with great interest to the next few storage reports.

Analytics firm Genscape Inc. told clients earlier this week that its preliminary estimate based on pipeline supply/demand balance pointed to a storage draw of around 191 Bcf for the week ending Dec. 29, with the estimate for the week ending Jan. 5 increasing from a draw of 240 Bcf to a draw of 255 Bcf.

Total working gas in underground storage stood at 3,332 Bcf as of Dec. 22, according to EIA. The year-on-five-year deficit increased by one to -85 Bcf for the period, while the deficit versus last year shrank from -183 Bcf to -62 Bcf, EIA data show.

By region, the largest weekly withdrawals came from the East (-29 Bcf) and Midwest (-39 Bcf). The Pacific region saw a 13 Bcf withdrawal for the period, while 9 Bcf was withdrawn in the Mountain region. In the South Central, 22 Bcf was withdrawn, including 6 Bcf from salt and 16 Bcf from nonsalt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |