NGI The Weekly Gas Market Report | Markets | NGI All News Access | NGI Data

Frigid Temps Expected to Ring in the New Year; January NatGas Rallies Before Expiration

With below-normal temperatures spread across the eastern two-thirds of the country, natural gas spot prices continued to strengthen Wednesday, while futures saw a late rally ahead of the January contract expiration. New England points moderated from Tuesday’s polar vortex-level price spikes, leaving the NGI National Spot Gas Average to finish 43 cents lower at $4.92/MMBtu.

The prompt-month channeled some bullish momentum Wednesday but encountered resistance around $2.75. January expired at $2.738, up 9.5 cents on the day after trading as high as $2.762. The February contract settled 7.8 cents higher at $2.732, while March added 6.8 cents to settle at $2.699.

INTL FCStone Financial Inc.’s Tom Saal, senior vice president, said short-covering likely played a factor in Wednesday’s action.

“It was a little disappointing,” Saal told NGI. “I thought we would get a little more bang out of it. I’m a little surprised we haven’t seen more of a rally given the weather.”

Saal said it’s probably going to take prolonged cold weather to bring out the bulls.

“I think the market’s waiting to see if this is a one-week wonder or if we’re going to see more of this,” he said. “We’re kind of in new territory here, new territory meaning we’ve had a huge liquidation of speculative length. They’ve got to come back in the fold here and want to be long natural gas. So we’ve probably got to work off some inventory. We’ll see what withdrawals are the next few weeks.”

Predictions have been rolling in for Thursday’s storage inventory report from the Energy Information Administration (EIA), showing another triple-digit withdrawal could be in play for the week ending Dec. 22. Last week, EIA reported a 182 Bcf withdrawal.

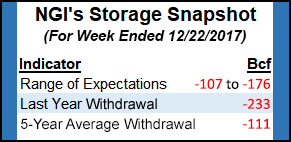

A Reuters survey of traders and analysts called for on average a 113 Bcf withdrawal from U.S. gas stocks for the week ending Dec. 22, with responses ranging from -107 Bcf to -176 Bcf. Last year, 233 Bcf was withdrawn, and the five-year average for the period stands at -111 Bcf.

Stephen Smith Energy Associates, in a report issued over the holiday weekend, predicted a 107 Bcf withdrawal. The firm said this compares to a seasonally normal draw of 82 Bcf, based on 2006-2010 norms.

PointLogic Energy on Tuesday predicted a withdrawal of 111 Bcf, pointing to higher production week/week and a decline in demand “spread across the middle and eastern half of the country” for the period.

ION Energy’s Kyle Cooper called for a 109 Bcf withdrawal.

When it comes to natural gas futures, “December has been frustrating,” Societe Generale analyst Breanne Dougherty said in a recent note. “First, erratic shifts in weather patterns have prevented any firm bullish sentiment from forming, even when the 15-day forecast turns constructive.

“Second, the market has decided to prove once again that it has a mind of its own and fundamental support isn’t always required,” she continued. “Third, the nature of trading in today’s market means that even a small shift in sentiment can become a dramatic self-fulfilling prophecy.”

Even with strong production and inconsistent demand, “there is a lot of winter left,” according to Dougherty, who noted that the firm is revising its Calendar 2018 price forecast lower by 20 cents to $3.05/MMBtu.

Production growth in 2018 “needs to continue outpacing demand growth in order to bring the market back to true equilibrium. Bottom line: The aggressive downward shift in the Calendar 2018 curve looks to us like it has gone too far…We see first quarter 2018 as undervalued especially.”

As far as Wednesday’s weather data, the extent of a break in the cold temperatures expected around the second week of January could prove pivotal, according to NatGasWeather.com.

“The data still favors a milder break across the eastern U.S. Jan. 7-10, but was also…slightly colder trending,” the firm said.

“The coming pattern is clearly frigid and bullish through Jan. 5-6, with very strong demand, regardless of subtle trends between successive model runs. What is most important is how long a milder break occurs over the eastern U.S. after Jan. 7, with the data mixed, but suggesting demand should ease to near normal for several days.”

A break in the cold would allow time to repack the pipes, building compression to prepare for the next onslaught.

In day-ahead trading Wednesday, New England prices moderated from Tuesday’s spikes as other regions — especially the Midwest — continued to gain. Forecasts were calling for the below-normal temperatures that flooded into the Lower 48 this week to stick around.

Genscape Inc. said in a note to clients Wednesday that it expected the frigid conditions that have driven up spot prices to last into January.

“The cold will continue into the start of the new year, with temps from Texas to Chicago to the Northeast forecast to run well below seasonal norms.” Genscape’s forecasts “show Lower 48 population-weighted heating degree days (HDD) climbing to near 350 HDDs by New Years Eve, roughly 120 HDDs colder than normal for this time of year. We show HDDs staying notably colder than normal until Jan. 4.”

Genscape said its preliminary estimate based on pipeline supply/demand balance shows a storage draw of 191 Bcf for the week ending Dec. 29, with the estimate for the week ending Jan. 5 increasing from a draw of 240 Bcf to a draw of 255 Bcf.

AccuWeather was predicting lows in the single digits to teens for the rest of the week in Chicago, and day-ahead prices at Chicago Citygate cracked $3 for the first time since November, adding 24 cents to average $3.16.

Pipeline operators continued to notify shippers of constraints and issue operational flow orders Wednesday due to elevated heating demand. Northern Natural had a safe operating limit alert in place through the end of the week, while Natural Gas Pipeline Co. of America issued an OFO for its market delivery zone. Northern Border Pipeline placed an OFO watch in effect for numerous locations across its system.

Prices at Northern Border Ventura and Northern Natural Ventura surged for the second straight day, adding 73 cents and 83 cents to average $3.83 and $3.94, respectively.

In New England, AccuWeather was calling for lows in the single digits to teens in Boston through the end of the week.

Prices at Algonquin Citygate retreated $11.74 to average $22.29. That’s after prices there spiked $22.76 to $34.03 on Tuesday, including trades as high as $55.

The Northeast cash price blowouts come “as some markets are seeing their coldest temps since winter 2014/15,” Genscape said.

The spike at Algonquin is to be expected given supply constraints and competition between residential/commercial demand and power demand in the region, according to Genscape.

“Because there is no storage or in-market production, serving demand is entirely dependent on pipeline imports and liquefied natural gas from Everett,” the firm said. “When those import pipelines become constrained, prices inside the market spike so that residential/commercial sources of demand take priority over power demand.”

Unsurprisingly, at least for those that have followed New England spot prices in recent years, it comes down to a lack of pipeline import capacity.

“When gas prices rise high enough, power bows out of the gas stack when it becomes cheaper for generators to burn fuel oil instead,” Genscape said. “This dynamic will continue to be a feature in New England until substantially more import capacity is built into the market, or gas demand contracts. The latter, though, is not likely. New England has actually been adding more gas-fired generation to replace coal and nuclear imports.”

Texas Eastern Transmission (Tetco) declared a force majeure Wednesday due to an unplanned outage at its Lilly Compressor Station in Lilly, PA. The outage reduced capacity at the central Pennsylvania station to 2,801,000 Dth. Tetco reported 3,010,000 Dth of capacity through the Lilly compressor for Tuesday’s gas day.

Tetco M3 Delivery prices surged $5.73 to $17.25, while Tetco M2 30 Receipt added 6 cents to $2.33.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |