Gains in SCOOP/STACK Help U.S. Net One Rig Overall

The U.S. rig count finished higher for the week ended Dec. 22, netting one additional unit overall to head into the holiday weekend on a positive note, according to data released Friday by Baker Hughes Inc. (BHI).

The United States added one natural gas-directed unit to end the week at 931 rigs, up from 653 rigs running a year ago. Four vertical units returned to the patch, while three directional units packed up, according to BHI. One net unit was added on land, while the Gulf of Mexico finished flat for the week.

Canada, meanwhile, dropped 28 rigs week/week to finish at 210 rigs.

The combined North American rig count finished at 1,141 rigs, down 27 week/week and up 264 from 877 rigs running a year ago.

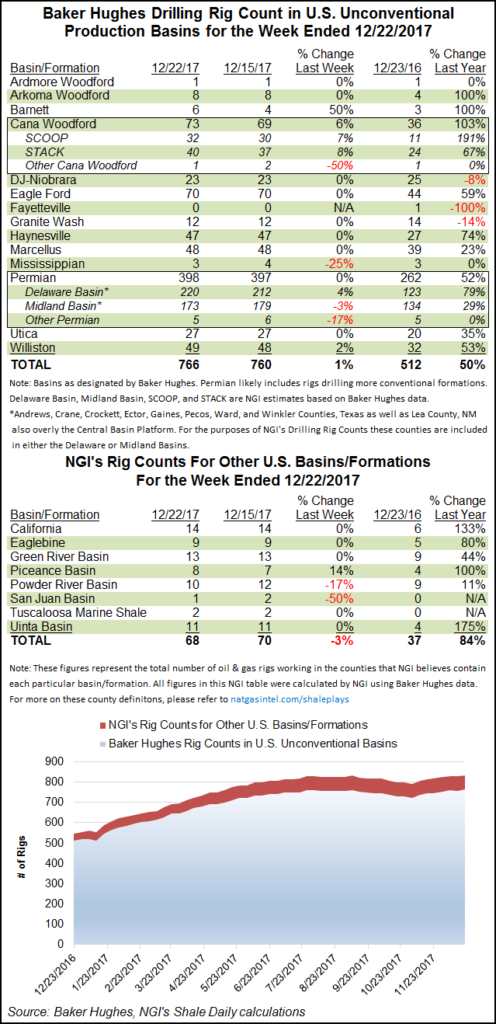

Among plays, BHI reported the largest week/week changes in Texas and the Midcontinent. The Cana Woodford led the way, adding four rigs to finish at 73, versus 36 running a year ago.

NGI‘s more detailed breakdown shows a gain of two rigs in the South Central Oklahoma Oil Province (aka, the SCOOP) and a gain of three rigs in the Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties (aka, the STACK). Offsetting was one Cana Woodford rig outside of the SCOOP/STACK exiting the patch.

Also among plays, the Barnett Shale saw two rigs return to grow its running tally to six, while the Permian and Williston basins each added a rig. The Mississippian Lime dropped a rig overall to finish at three, according to BHI’s breakdown.

Among states, New Mexico — sitting overtop part of the Permian — posted the largest gains for the week, adding four units to end at 75 overall (up from 33 a year ago). North Dakota added a lone rig to finish at 48 rigs (up from 32 a year ago).

Meanwhile, Texas (down two), Wyoming (down two) and Oklahoma (down one) each saw net losses for the week.

All signs continue to point to significant natural gas production growth — led by the Northeast — which seems to have weighed on futures prices as the new year approaches. Despite forecasts for cold weather to close out the month, and despite a sizeable 182 Bcf storage withdrawal reported by the Energy Information Administration (EIA) Thursday, the January contract was trading around $2.650/MMBtu Friday.

Earlier in the week, EIA released its Drilling Productivity Report, predicting that the Marcellus and Utica shales will lead gas production growth in January, averaging 26.37 Bcf/d, up from 26.03 Bcf/d in December.

Meanwhile, the Ohio Department of Natural Resources released data recently showing Utica Shale producers grew their output 27.5% year/year and 18.5% sequentially during the third quarter.

As of Friday, the combined Marcellus/Utica rig count stood at 75, up from 59 a year ago, according to BHI.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2158-8023 |