NatGas Rigs Up Three As U.S. Weekly Combined Count Falls By One

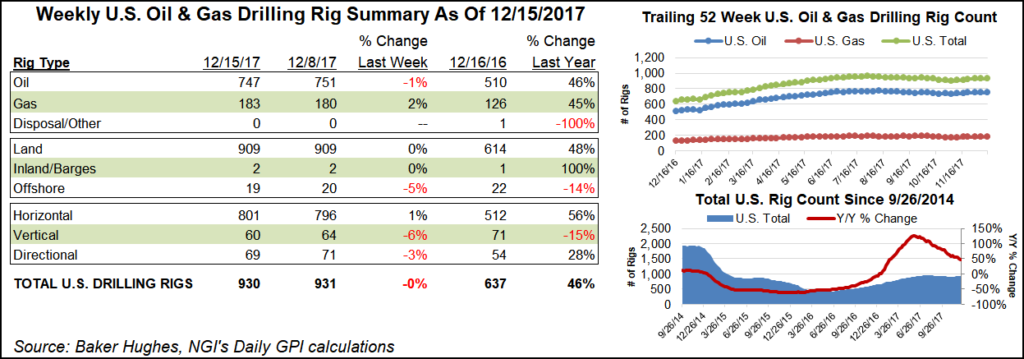

The United States added three natural gas-directed rigs for the week ended Friday, but a decline in oil drilling saw the domestic count fall by one overall, according to data from Baker Hughes Inc. (BHI).

The United States ended the week at 930 rigs, with four oil-directed rigs exiting the patch to offset the three gas units added. That’s versus 637 rigs running in the year-ago period, according to BHI.

The net decrease points to potential seasonality as the domestic tally fell week/week for the first time since early November, when the count hit a recent low of 898 rigs.

For the U.S. count, the declines included two directional rigs and four vertical, offsetting the addition of five horizontal units. One rig exited in the Gulf of Mexico, while land rigs remained flat week/week.

Canada, meanwhile, recorded a net gain of 19 rigs, with 22 oil-directed units offsetting a decline of three gas-directed.

The combined North American rig count finished the week at 1,168 rigs, up 18 from a week ago and up 297 year/year.

Among plays, the Marcellus led the way, adding three rigs week/week to finish at 48 (up from 40 in the year-ago). The gassy Haynesville added a rig to end at 47 (27 a year ago).

Other gainers included the Granite Wash — which added two units — and the Williston Basin, which added one.

The Cana Woodford in Oklahoma posted the largest decline among plays, dropping four rigs to end at 69 from 34 a year ago. The Permian Basin gave up three rigs to 397, still substantially higher than its year-ago total of 258 rigs.

Among states, given the gains in the Marcellus, Pennsylvania unsurprisingly added three rigs. North Dakota and Wyoming each added rigs as well. Texas and New Mexico each saw two rigs exit the patch for the week, while Louisiana saw one rig pack up shop.

Analysts with Evercore ISI, in their work tracking onshore drilling permit activity, said in a recently released monthly report that U.S. producers appear to have their “finger on the trigger” to accelerate heading into the new year.

The firm said the four-week trailing permit average was continuing to charge above multi-year highs, while the flattened rig count has lagged.

“From a fundamental standpoint, the recent disconnect between the four-week permit average and the active rig count can be explained by both seasonality and the fact that drilling programs have vastly outpaced completions,” said Evercore analyst James West and his team.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |