Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

U.S. E&P Permit Gains Indicate ‘Finger on the Trigger’ Heading into New Year

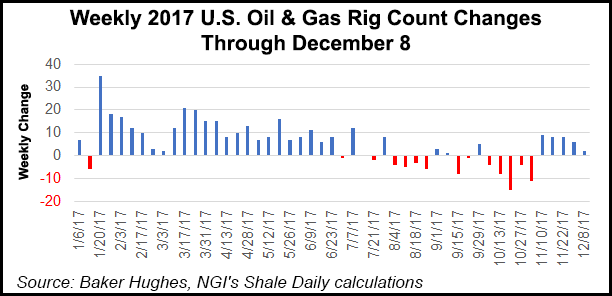

Onshore permit activity continues to quicken, a sign the U.S. rig count could strengthen into the new year.

Evercore ISI, in its monthly domestic drilling report issued on Tuesday, said the four-week trailing permit average was continuing to charge above multi-year highs, while the flattened rig count has lagged.

The monthly report covers all permitting activity for the major producing states and by the Department of Interior. Exploration and production (E&P) operators are required to file and receive approvals before drilling wells or bypassing/sidetracking existing wells. Most onshore permits are issued several months before drilling begins, while offshore permits often are secured even further in advance.

“From a fundamental standpoint, the recent disconnect between the four-week permit average and the active rig count can be explained by both seasonality and the fact that drilling programs have vastly outpaced completions,” said Evercore analyst James West and his team.

E&Ps appear to have their “finger on the trigger” to accelate, he said.

Permitting strength so late in the year is indicative of underlying commodity strength, yet there are bottlenecks in the fracture supply chain “and exhausted drilling budgets,” which preclude the continued drilling of drilled-but-uncompleted wells.

Historically, when permits outperform the rig count, it usually is set with a “relatively swift correction, whereby permits either inflect downward (e.g. late 2015, start of the downturn), or the rig count grows upward (April 2016-November 2016),” West said.

Since late September, U.S. permitting activity has been strong, which may suggest a correction in early 2018.

“We believe that commodity price improvement will yield continued permit growth, which likely results in a U.S. rig will count that grinds higher after stagnating during 4Q2017,” said the Evercore team.

“Come January, drilling budgets will be set, completion capacity should expand with pricing, and the rig count will break its sluggishness and move higher.”

Even with the Thanksgiving lull, permitting appears resilient to bolster December totals.

According to Evercore, U.S. land permits totaled 3,964 in November, up 1% from the October total of 3,908 and 52% higher from year-ago levels.

Year-to-date, 2017 has surpassed fiscal year 16 permit levels, up 60% from year-to-date 2016.

Texas is 53% higher from a year ago, followed by Oklahoma (50%), North Dakota (42%) and Louisiana (11%).

Last year permitting was down 38% from 2015 and off 46% from 2009, when activity was considered to be in another trough from the 2008 peak). The momentum year-to-date “indicates that year-end totals will finish significantly higher” than the estimated 40% increase in North American-focused capital expenditures, West said.

There was some weakness in November, with California permits off 4% from October, while Colorado permitting fell 14% month/month and North Dakota was down 24%. However, the declines were more than offset by a 25% month/month gain Oklahoma and in Wyoming, where permit activity rose 3% from October.

“Texas permitting exhibited a 2% sequential increase on the back of a 13% decrease the month before; with over half of the working U.S. oil rigs, Texas continues to be the single-most important state in terms of evaluating the magnitude and direction of U.S. permitting trends,” West said.

It also was another solid month for Gulf of Mexico activity, with November permits totaling 12 from 10 in September. It also was double the permit activity in November 2016. Shallow water permitting held flat at four, while six midwater permits were filed, up 50% from October.

Deepwater permits increased by one to two, with one new well and one bypass approved.

“No ultra-deepwater permits were filed in November, the fourth such zero permit month in the last five months,” West noted.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |