NGI Data | Markets | NGI All News Access

Slightly Bullish EIA Report Not Enough to Buck NatGas Downtrend; East Coast Cash Moderates

Despite a slightly bullish storage report from the Energy Information Administration (EIA), natural gas futures traded lower Thursday as the bears seemed firmly in control. In the spot market, except for the East Coast and California, most points traded close to even, and the NGI National Spot Gas Average dropped 20 cents to $2.85.

The January contract failed to build on Wednesday’s gains, settling 3.1 cents lower at $2.684. February settled 2.8 cents lower at $2.704.

After taking out support and breaking out of a long-standing range, the charts indicate natural gas could go even lower, said Powerhouse’s Elaine Levin, president of the Washington, DC-based risk management firm. Levin pointed to $2.75-2.80 as the new resistance, with $2.522 — the prompt-month low set in February — as the next support target.

“Something in the market’s mind changed,” she told NGI. Whether it’s a lack of significant cold or concerns about production, “the technicals say something has changed, and we’re out of the trading range, and typically when you go out of a trading range for so long you start to trend.”

Levin also noted that natural gas tends “to reach a seasonal top” in December and then decline moving into the start of the new year.

“It’s not out of the realm of possibility that we could be in a low down-move period, because that’s what we normally do,” she said.

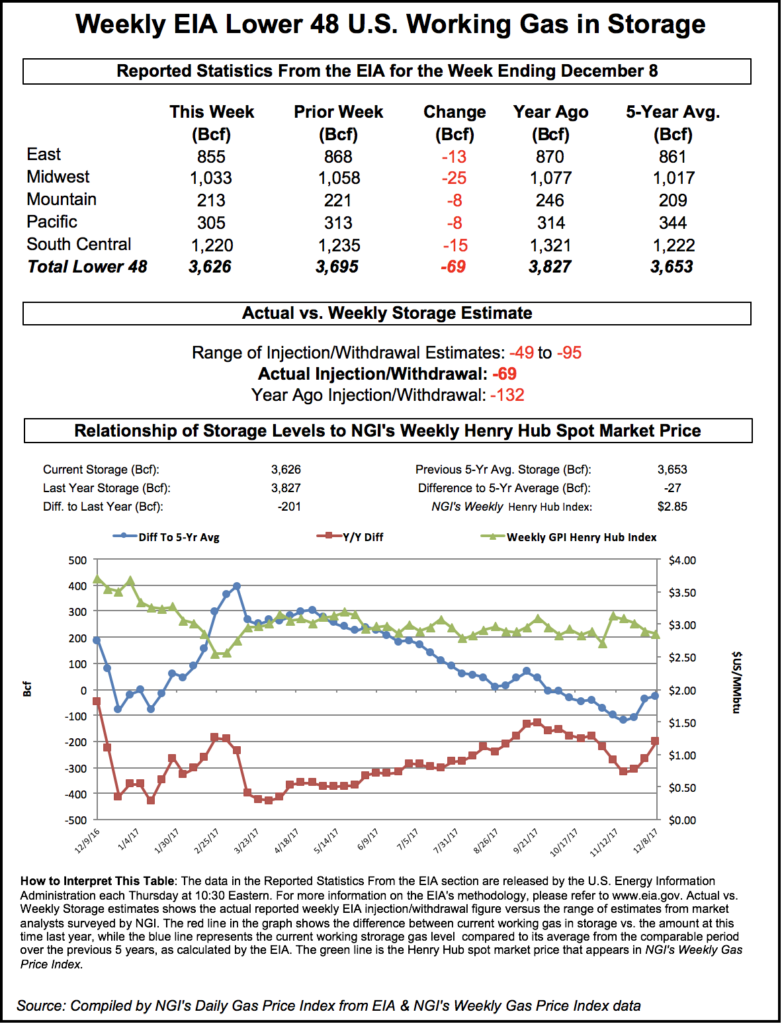

After a rare net injection last week, EIA reported a 69 Bcf withdrawal from U.S. gas stocks for the week ended Dec. 8, a slightly larger pull than what the market had been expecting.

In the minutes immediately following EIA’s 10:30 a.m. EDT report, the January contract dipped lower, trading as low $2.656 at 10:40 a.m. By 11 a.m. EDT, January was trading around $2.670-2.680, down from Wednesday’s settlement of $2.715.

Traders and analysts had been looking for a withdrawal slightly smaller than the actual figure.

A Reuters survey was on average calling for EIA to report a 60 Bcf net withdrawal from U.S. gas stocks for the week ended Dec. 8. Responses ranged from -49 Bcf to -95 Bcf. Last year, 132 Bcf was withdrawn, and the five-year average is a withdrawal of 78 Bcf.

Stephen Smith Energy Associates revised its estimate Tuesday to a 64 Bcf withdrawal for the week ended Dec. 7 after earlier calling for a 60 Bcf withdrawal. Kyle Cooper of ION Energy predicted a 61 Bcf withdrawal. PointLogic Energy was calling for a 57 Bcf withdrawal.

Total working gas in underground storage as of Dec. 8 was 3,626 Bcf, versus 3,827 Bcf a year ago and a five-year average 3,653 Bcf. This week, the deficit to the five-year average narrowed by 9 Bcf to -27 Bcf. The deficit to year-ago stocks decreased week/week from -264 Bcf to -201 Bcf, EIA historical data show.

Bespoke Weather Services said the number “shows a gradual tightening in the natural gas market at these lower price levels. Yet the reaction is not especially bullish” since “the number fell generally within expectations.

“We see it as confirming gradual tightening within the market and marginally decreasing downside,” the firm said. “It may increase support around the $2.65 level, but weather must improve again if prices are going to break back above the $2.75 level.”

By region, the largest week/week withdrawal came from the Midwest, which posted a net 25 Bcf decline. The East saw a 13 Bcf withdrawal, while the Mountain and Pacific regions each posted an 8 Bcf pull.

The South Central region, after recording a 21 Bcf injection the previous week, finished at -15 Bcf for the current report week, all from nonsalt.

As for weather, the market has been keeping an eye on a volatile outlook for a cold weather system expected in late December.

An afternoon run in the European model Thursday “trended a little colder this round, but mainly at the end of the run around Dec. 27-29,” said NatGasWeather.com. “The run is still not nearly as cold as the Global Forecast System with the ridge holding strong over the Southeast Dec. 24-26.”

However, the European model indicates “the ridge slowly weakening to allow at least modest cooling to gradually push into the East Dec. 27-29,” the firm said. “…If the weather data were to trend further colder overnight, especially the European model since it’s been to the warmer side, the markets could start to believe colder trends might actually stick.”

In the spot market, East Coast prices continued to adjust lower Thursday after surging earlier in the week with the arrival of frigid temperatures and wintry conditions at major cities like Philadelphia, New York, Boston and Washington, DC.

Algonquin Citygate dropped $1.85 to finish at a still-hefty $7.43. Iroquois Waddington dropped 57 cents to $3.12, while Tennessee Zone 6 200L fell $1.92 to $7.82. Transco Zone 6 New York bucked the trend, adding 65 cents to $5.07.

Further south on Transco Zone 5, prices pulled back 43 cents to average $2.99 after trading as high as $5.40 on Tuesday.

Transco was one of several Northeast pipelines — along with Algonquin Gas Transmission and Iroquois — to place an operational flow order in effect this week because of high demand and limited capacity.

New England has seen its coldest temperatures winter-to-date this week, “causing a rapid surge in basis as demand has spiked and imports cap out,” Genscape Inc. said in a note to clients Thursday, adding that these “conditions should persist into the weekend.”

The region’s population-weighted average temperatures have fallen into the low 30s, below seasonal norms, the firm said.

“Nominated aggregate demand for Thursday is above 4.1 Bcf/d, after having hovered around the 3.1 Bcf/d mark for most of this month-to-date,” Genscape said, noting that New England demand also crested the 4 Bcf/d mark around this time a year ago. “To meet this demand, pipeline imports have surged to a season-to-date high of 3.8 Bcf/d, which has pushed many import points to max capacity, including inflows from Vermont, Portland and Tennessee Gas Pipeline.

“Iroquois imports from Canada at Waddington are scheduled at 1,225 MMcf/d, their highest levels since 2015 and about 40 MMcf/d above reported operational capacity. Maritimes has flipped to importing from Canada, flowing about 270 MMcf/d, and inflows on Algonquin through the Southeast compressor are at 1,783 MMcf/d, about 40 MMcf/d shy of reported operational capacity.

Genscape said its meteorologists expect regional temperatures to stay below normal through the weekend.

In Appalachia, Tetco M3 Delivery also saw a bump with the weather this week, and prices there moderated Thursday. The pointed gave up 58 cents to trade at $2.86. Dominion South gained 2 cents to $2.14, while Columbia Gas traded flat at $2.55.

Out West, SoCal Citygate dropped 26 cents to $3.86, dipping below the $4 mark for the first time since late last month and setting a new two-week low in the process. The last time SoCal Citygate, which is dealing with supply constraints from pipeline outages and limited use on the Aliso Canyon storage field, traded below $4 was Nov. 22, when prices averaged $3.03.

Earlier this week, the California Public Utilities Commission (CPUC) issued a final supplemental report on winter reliability that loosened the restrictions on how much gas utility Southern California Gas (SoCalGas) may withdraw from Aliso Canyon.

CPUC said SoCalGas may now keep stocks at Aliso — the site of a leak in 2015 that drew public scrutiny and shut down the facility for months — within a range of 0 Bcf to 24.6 Bcf, versus a previous range of 14.8 Bcf to 23.6 Bcf.

With the changes, “SoCalGas can access 24.6 Bcf of the gas stored compared to 8.8 Bcf under the previous range,” CPUC said. “…The maximum of 24.6 Bcf of working gas may provide the withdrawal capacity needed to meet winter demand reliably.”

Through the middle of the country, price action was limited.

Henry Hub traded flat at $2.67, while Katy finished up a penny at $2.60. In West Texas, Waha also traded up a cent at $2.36.

In the Midwest, Chicago Citygate dropped a penny to $2.61, and so did Joliet, which also averaged $2.61

In the Rockies, Kern River added 2 cents to $2.57, while the Cheyenne Hub fell 2 cents to $2.37.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |