Potential for Chilly Late December Helps NatGas Futures Higher; Cash Posts Broad Declines

Natural gas futures nudged higher Wednesday, with visions of a frigid late December helping to ease concerns over frightful production numbers. In the spot market, moderating temperatures in the East accompanied broad declines most everywhere else, and the NGI National Spot Gas Average tumbled 14 cents to $3.05.

The January contract settled 3.7 cents higher Wednesday at $2.715, a modest recovery from Tuesday’s 15-cent sell-off. February settled 3.8 cents higher at $2.732.

While the bears have been in control as of late, the outlook for late December heating demand could offer some hope for the bulls.

PointLogic Energy analyst Alan Lammey said the firm’s 11-15 day outlook Wednesday showed the potential for “a hugely amplified” cold pattern that would “set the stage for a frigid Christmas week across a majority of the U.S.”

But Lammey cautioned that “there have been fairly wild gyrations in the models for this period over the last few days, so until there is some multi-day consistency and continued accord” between the Global Forecast System (GFS) and the European weather models “for the next several days, the extreme nature of the forecast should be approached with some level of caution.

“With that said, the European models have already been solidly showing for several days that intensely cold temperatures will plunge as far south as the Texas Gulf of Mexico coastline amid the development of a new trough,” he said. “…As of Wednesday, the GFS models, and especially the GFS ‘operational’ model are now in full agreement with this forecast idea, but are showing considerably colder temperatures (as much as 25 degrees below normal or more in some areas) dominating nearly all of the nation” except for Florida and parts of the Southeast.

But can the weather offer up enough to impress a market seemingly flush with supply?

“I am no fundamental expert, but it feels like this is a case of too many bulls in a market that saw fairly normal weather but some scary production numbers and signs that producer hedging was continuing even as futures began to slip,” Beacon Energy Group analyst Stephen Kessler said Wednesday.

Calling Tuesday’s break below $2.70 “a price virtually no one saw coming this early in the winter,” Kessler said, “If the market falls further the number of natural gas buyers is scary low.”

In a report published this week, analysts with EBW Analytics Group said natural gas prices could slip below $2.50 this spring given “rampant production growth” of around 6 Bcf/d year/year based on recent pipeline flow models.

“Looking ahead to 2018, ample Appalachian pipeline takeaway capacity and forecasts for strong associated gas growth will likely continue to drive production higher,” the analysts said. “As production increases continue to sharply outpace core demand gains, the market will become increasingly oversupplied — heightening the risk of another natural gas price collapse.”

The weather models have also shown a pattern of overestimating cold, according to the EBW analysts. They cited a recent “massive bearish move” in the weather guidance between Dec. 4 and Tuesday that reduced “expected weather-driven demand for the balance of December by 125 Bcf.

“…This pattern has been recurring for the past several winters, perhaps implying a greater underlying problem with models capturing changing climate patterns,” they said. While many meteorologists expect a colder-than-normal 1Q2018, “for natural gas bulls…even colder temperatures than those currently suggested by leading weather vendors will likely be needed to avert a dip in prices in 2018.”

Last week, the Energy Information Administration (EIA) reported a rare December storage injection that seemed to confirm fears of an oversupplied market. But traders and analysts aren’t expecting anything close to an injection Thursday.

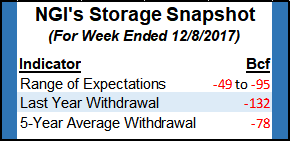

A Reuters survey on average is calling for EIA to report a 60 Bcf net withdrawal from U.S. gas stocks for the week ended Dec. 8. Responses ranged from -49 Bcf to -95 Bcf. Last year, 132 Bcf was withdrawn, and the five-year average is a withdrawal of 78 Bcf.

Stephen Smith Energy Associates revised its estimate Tuesday to a 64 Bcf withdrawal for the week ended Dec. 7 after earlier calling for a 60 Bcf withdrawal. PointLogic Energy was calling for a 57 Bcf withdrawal. Kyle Cooper of ION Energy predicted 61 Bcf withdrawal.

In the spot market Wednesday, points across the country posted double-digit declines.

MDA Weather Services’ said in its six- to 10-day outlook Wednesday that “a nearer term disturbance tracking through Alaska effectively cuts off the arctic connection and leaves a Pacific-oriented flow for most of this period, with the result being a widespread coverage of above normal temperatures which span most locales.

“The exceptions include a brief round of below normal temperatures in the mid-period through the East and a reestablished cold air connection bringing belows late in the Pacific Northwest and Rockies,” the firm said. “Relative to the previous outlook, changes were colder from the Interior West to the Plains/Texas, but minor elsewhere.”

With wintry temperatures expected to moderate Thursday, points along the East Coast retreated from Tuesday’s weather-driven gains.

AccuWeather was calling for highs in Boston and New York to creep back above freezing Thursday — still colder than normal but warmer compared to daytime temperatures in the 20s Wednesday. Philadelphia was expected to see highs in the upper 30s Thursday versus a high of 32 Wednesday.

Transco Zone 6 New York dropped $1.23 to $4.42, while Transco Zone 5 fell $1.62 to $3.42.

In New England, prices declined but remained elevated. Algonquin Citygate notched a 4 cent decrease to end at $9.28. Iroquois Waddington fell 52 cents to $3.69, and Iroquois Zone 1 dropped 14 cents to $5.41. Iroquois Zone 2 only declined 8 cents to $5.82.

Iroquois Gas Transmission issued an operational flow order (OFO) on its system Wednesday due to “high volumes and forecasted cold weather.” An OFO has been in effect on Algonquin Gas Transmission’s system since last week.

Prices fell by double digits at several Appalachian points, including Columbia Gas (down 13 cents to $2.55) and Dominion South (down 19 cents to $2.12). Tetco M3 Delivery moderated after seeing a weather-driven bump the day before, falling $1.23 to $3.44.

Meanwhile, forwards prices at several Marcellus points saw relatively large day/day declines in Tuesday’s trading, NGI‘s Forward Look shows.

Average January contract prices at Tennessee Zone 4 Marcellus, Tetco M2 30 Receipt and Dominion North each dropped 10% day/day Tuesday to average $1.943, $2.143 and $1.968, respectively, according to Forward Look.

In the Midwest, Genscape Inc. was forecasting demand to decline this week from 16.48 Bcf Tuesday to a just under 15 Bcf Friday.

Average day-ahead prices at Chicago Citygate dropped 11 cents to $2.62, and Joliet fell 9 cents to $2.62. In the Midcontinent, Northern Natural Demarcation gave up 10 cents to $2.56.

Rockies prices weakened as well, though Cheyenne Hub finished slightly higher at $2.39. Kern River gave up 6 cents to $2.55.

Outside of the constrained SoCal Citygate, prices generally fell by around a nickel or more in California, while in Arizona/Nevada, El Paso S. Mainline/N. Baja dropped 21 cents to $2.93.

Genscape was calling for demand across California and Nevada to drop from 7.84 Bcf Wednesday to just under 6 Bcf/d Thursday and Friday.

Malin fell 7 cents to $2.60, while PG&E Citygate gave up 8 cents to $2.91. SoCal Border Average dropped 4 cents to $2.84. SoCal Citygate recorded another wild swing, dropping $1.51 to $4.12. That’s the lowest finish for SoCal Citygate since it averaged $3.03 on Nov. 22, the last trade date before the Thanksgiving holiday, Daily GPI historical data show.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |