NGI Data | Markets | NGI All News Access

NatGas Futures Take Out $2.75 Support as East Coast Cash Prices Surge; Europe Gas Explosion Raises LNG Possibilities

Natural gas futures followed up last week’s selling by falling even further Tuesday, setting a new low for the January contract as the market appears to doubt whether winter demand can soak up ample production. Meanwhile, East Coast spot market buyers had no doubt about an increase in short-term demand, and big gains in the Northeast and Mid-Atlantic lifted the NGI National Spot Gas Average 21 cents to $3.19/MMBtu.

January settled 15 cents lower Tuesday to $2.678, taking out the previous all-time low for the contract set in Feb. 2016. That’s also the lowest prompt-month settlement since Feb. 24, when the March 2017 contract settled at $2.627. February 2018 settled 15.3 cents lower Tuesday at $2.694.

After some model disagreement overnight, midday weather data on Tuesday showed less confidence in the severity of a key cold weather system that had been expected to move through Dec. 22-26, according to NatGasWeather.com.

“The European model had trended notably milder across the East Dec. 22-26, with the Global Forecast System (GFS) also showing the arrival of cold air in recent runs,” said NatGasWeather in a note to clients. “This seemed to eventually weigh on prices after the official session open. The latest midday data maintained the trend of the warm upper ridge over the East holding longer and stronger Dec. 22-25. Essentially, the latest GFS has trended milder after Dec. 23 to be more like the European model.”

Like last week, Tuesday’s selling appeared to come from speculators getting out of long positions, according to INTL FCStone Financial Inc.’s Tom Saal, senior vice president.

Citing his work with Market Profile, Saal told NGI that “the profile would say they were continuing to liquidate length. They’ve been doing it for the last week or so, and I think it’s because they’re not convinced we’re going to have a cold winter.”

Still, at this point in the season, Saal said he didn’t think the longs would “have bailed out” Tuesday. “There’s still a lot of winter left. A lot can happen.”

After taking out support in the $2.75 area Tuesday, Saal pointed to the low set for the prompt-month contract back in February at $2.522. If January continues lower, “that’s probably a place where it would go to” in terms of support.

Bespoke Weather Services said it viewed the selling Tuesday as balance-driven more than weather-driven.

“Though initially it appeared a few gas-weighted degree day losses may be responsible for some of the selling, it became clear through the day that the market still does not yet appear balanced and that elevated production levels are driving oversupply fears,” Bespoke said. “Weather risks remain skewed bullish long-term, but to be realized the market first needs to balance itself.”

The firm also pointed to some of the strong weather-driven gains in the spot market Tuesday as potentially supportive for futures.

“Surprise cash strength on short-term cold trends over the next few days may actually help natural gas prices work back some of these recent losses,” Bespoke said. “Even more significant could be the late-month cold snap that could really spike demand at these lower prices. Calling a specific bottom would be foolish, but we expect a cold-driven short-covering rally by 2018.”

In terms of supply, Genscape Inc. said its updated Spring Rock daily pipe production estimates showed Lower 48 production falling by about 1.1 Bcf/d Tuesday after surpassing the 76 Bcf/d mark Sunday and Monday. Last week, maintenance on the Rover Pipeline, “a variety of Texas and Permian pipes and systems in the Gulf of Mexico drove production down to 74.9 Bcf/d by Dec. 8 [Friday], just days after the record high of 76.37 Bcf/d was established on Nov. 29.”

As far as Tuesday’s 1.1 Bcf/d drop, “nearly 0.37 Bcf/d of the declines are out of the Northeast, followed by a 0.17 Bcf/d drop in the New Mexico Permian, and both the Rockies and Texas showing 0.14 Bcf/d each,” Genscape said in a note to clients. The decline in Rockies production is “showing in nearly every basin in the region except the Bakken Shale, though no individual basin is showing more than a 100 MMcf/d day/day decline.”

While the North American gas markets come under continued pressure from loose fundamentals, a major gas hub explosion reported in Austria Tuesday led European energy prices higher amid concerns about potential shortages heading into winter. News outlets reported that the explosion occurred at a facility designed to import Russian gas and send it through to other parts of Europe.

According to reports, the explosion — which killed one person and injured more than 15 — followed an outage earlier this week on the Forties Pipeline System in the North Sea, which provides about 30% of UK’s oil and 10% of its natural gas, along with substantial European supply.

“The European gas market seems to be going through a perfect storm,” said Wood Mackenzie’s principal analyst Massimo Di-Odoardo, who focuses on gas and liquefied natural gas (LNG). “The Forties outage will take out more than 1.2 Bcf/d of gas production — more than 10% of UK gas demand. The explosion at Baumgarten has currently halted Russian imports to Italy, representing more than 30% of Italian gas demand.

“There is still plenty of storage across Europe to cope with this,” Di-Odoardo said. “But if supply does not resume soon and the cold weather continues, prices will remain strong through the winter. We might well see some competition between Europe and Asia to attract LNG this winter.”

With only Cheniere Energy Inc.’s Sabine Pass LNG terminal exporting currently and Dominion Energy Inc.’s Cove Point terminal not far behind, how much increased European LNG demand would impact U.S. prices this winter remains an open question.

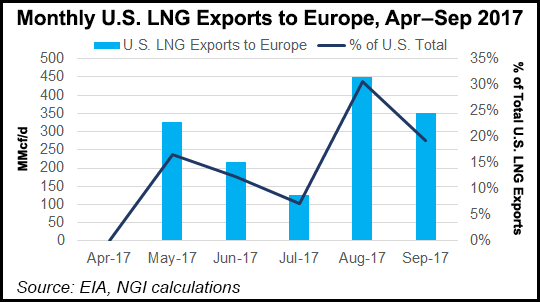

“Cove Point has more of a direct route to Europe than Sabine Pass, so the opportunity for the U.S. might be a bit greater” if the Maryland facility begins exporting soon, said NGI‘s Patrick Rau, director of Strategy and Research. “Exports to Europe from the U.S. ticked up in August and September, so that, along with the startup” of Cove Point and Sabine Pass Train 4 “indicate the U.S. should be able to take advantage of increased prices in Europe somewhat.

“…Overall, though, LNG is still only 3% or so of total U.S. natural gas demand, so the impact of worldwide LNG on U.S. prices is still somewhat muted,” Rau said. “It’s not like an increase in exports is going to throw the entire U.S. supply/demand balance out of whack for very long, especially with our ability to ramp up production in relatively short order. By 2020, exports could be more like 10% of U.S. demand, so it would have more of an impact then. But that is then, and this is now.”

The market may have its doubts about the relative strength of winter weather this month, but the spot market on Tuesday was a different story. Northeast and Mid-Atlantic prices surged as forecasts called for wintry conditions across major population centers along the East Coast.

AccuWeather was expecting “bitterly cold air and frigid winds” to hit major cities along the Interstate 95 corridor starting Tuesday night and into Wednesday. Daytime temperatures from Pennsylvania to Vermont might not surpass 20 F, and “chilly winds” might result in “real-feel” temperatures approaching freezing as far south as Raleigh, NC, according to the forecaster.

Algonquin Citygate jumped $2.86 to $9.32, while Tennessee Zone 6 200L gained $3.16 to $10.29. Transco Zone 6 New York surged to $5.65, up $1.88 on the day. Further south, Transco Zone 5 posted similar gains, jumping $1.21 to $5.04.

Elsewhere, moves were less pronounced.

After seeing temperatures in the 20s Tuesday, AccuWeather was forecasting highs in the mid-30s in Chicago Wednesday, and Chicago Citygate dropped 5 cents to $2.73. Joliet fell 7 cents to $2.71. In the Midcontinent, Northern Natural Demarcation slipped 4 cents to $2.66.

In the Rockies, Kern River added 6 cents to $2.61, while Opal tacked on 8 cents to $2.62.

In California, the supply-constrained SoCal Citygate swung lower by $1.40 to average $5.63 Tuesday, giving back most of the prior day’s $1.64 surge. SoCal Border Average fell 11 cents to $2.88, while Malin added 3 cents to $2.67.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |