NGI Data | Markets | NGI All News Access

Rare December Injection No Surprise For NatGas Futures as Bears Already in Control

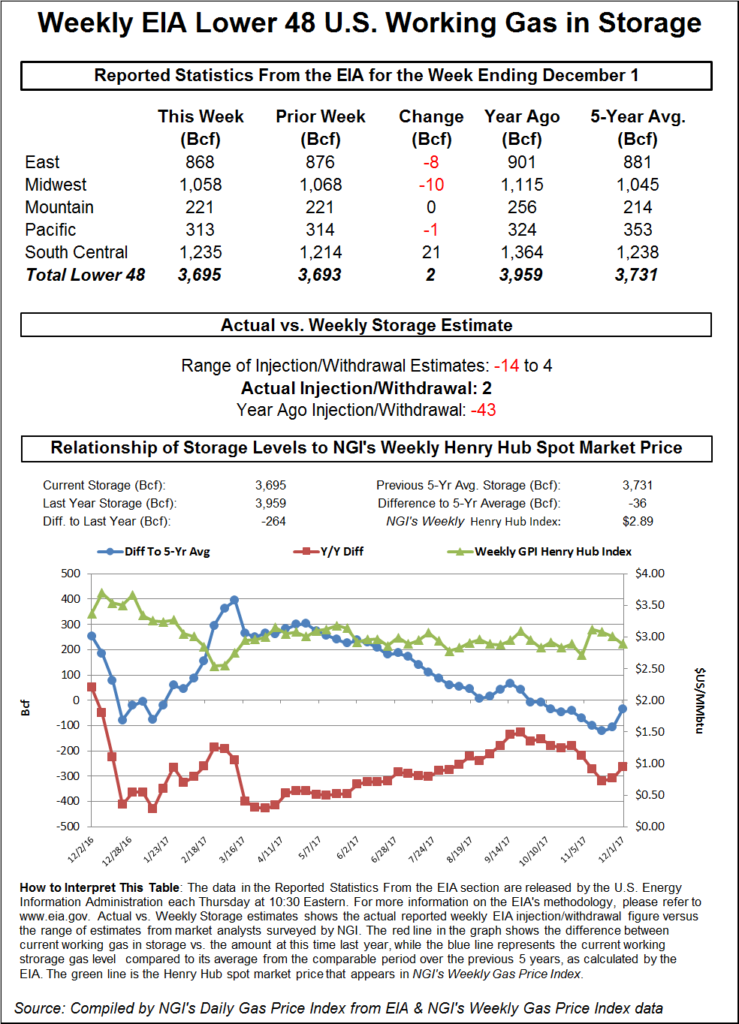

The Energy Information Administration (EIA) reported a net injection into U.S. gas stocks for the week ended Dec. 1, a bearish miss on what was already a bearish consensus leading up to the report.

EIA said in its weekly report that U.S. working gas in underground storage showed an implied 2 Bcf build for the period, an unseasonable number that’s far looser than the 43 Bcf withdrawn a year ago and a five-year average 69 Bcf withdrawal.

The market would have to go back five years to find the last time EIA reported a net injection during the month of December — a 2 Bcf build recorded for the week ended Dec. 7, 2012.

Word of a potential injection had spread earlier in the week, and the futures market seemed to have already baked in the news. January recorded a small bounce from pre-report levels in the minutes immediately following EIA’s 10:30 a.m. EDT release.

With some overnight warm changes in the weather outlook, January had fallen sharply from Wednesday’s $2.922 settle, pushing down into the $2.775-2.790 area in the lead-up to the report. By 11 a.m. EDT, January was trading around $2.790-2.800.

The market came into Thursday bracing for an unusually light withdrawal, though a net injection wasn’t out of the question, according to some analysts.

A weekly Reuters survey had revealed on average a 7 Bcf net withdrawal. Responses ranged from -66 Bcf to an injection of 3 Bcf. The -66 Bcf prediction was an outlier, with the next most-bullish survey response coming in at -25 Bcf. Responses to a Bloomberg survey ranged from -14 Bcf to +4 Bcf, with a median of -3 Bcf.

IAF Advisors analyst Kyle Cooper had been calling for a 1 Bcf build for the week, echoing Price Futures Group analyst Phil Flynn, who had also called for an injection. Stephen Smith Energy Associates had been looking for a 7 Bcf withdrawal, as had PointLogic Energy.

“The print missed slightly bearish to our estimates and confirms significant week-over-week loosening that the market has priced in recently,” said Bespoke Weather Services in a note issued shortly after the release of the number.

“Elevated production and very warm weather last week clearly allowed for such a print, which has moved us back far closer to the five-year average. However, it appears the surprise bearish print was not much of a surprise at all; prices moved little off the number, lending support to the idea that this may be a ”buy the rumor, sell the fact’ report. We still see $2.75 support as likely firm, though this print limits short-term upside too.”

The net injection for the week shrank the year-on-five-year deficit to -36 Bcf, versus -107 Bcf last week. Total U.S. gas stocks ended the week at 3,695 Bcf, versus a five-year average of 3,731 Bcf and year-ago stocks of 3,959 Bcf.

The East and Midwest regions recorded weekly withdrawals of 8 Bcf and 10 Bcf, respectively. The Pacific region saw a 1 Bcf withdrawal.

The South Central region injected 21 Bcf for the week, according to EIA, including 12 Bcf injected into salt and 9 Bcf into nonsalt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |