NGI All News Access | Infrastructure | Markets

NatGas Futures Straddle Support Amid Very Bearish Storage Predictions; Cash Not Helping Bulls

Natural gas futures traded in a holding pattern Wednesday as a seemingly loose supply/demand picture kept the bulls from gaining any traction despite the arrival of December cold.

Outside some strong gains along the East Coast, the cash market saw a mostly modest bump from a wintry near-term outlook; the NGI National Spot Gas Average climbed 12 cents to $2.98/MMBtu.

With elevated production and predictions for a potentially bearish storage inventory report from the Energy Information Administration (EIA), January failed to sustain any upward momentum after trading a few pennies higher prior to the open. January settled at $2.922 Wednesday, up 0.8 cents. February settled 0.4 cents higher at $2.924.

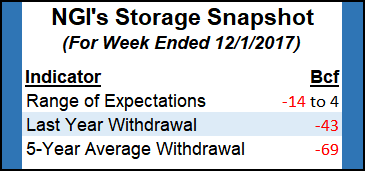

The consensus of estimates ahead of Thursday’s EIA report showed the market bracing for an unusually light withdrawal, one much lighter than year-ago and five-year totals. After the recent warmth, a net injection isn’t out of the question, according to some analysts.

A Reuters survey of traders and analysts revealed on average a 7 Bcf net withdrawal for the week ended Dec. 1. Responses to the Reuters survey ranged from -66 Bcf to an injection of 3 Bcf. The -66 Bcf prediction was an outlier, with the next most-bullish survey response coming in at -25 Bcf. Responses to a Bloomberg survey ranged from -14 Bcf to 4 Bcf, with a median of -3 Bcf.

Last year 43 Bcf was withdrawn, and the five-year average shows a withdrawal of 69 Bcf.

IAF Advisors analyst Kyle Cooper was calling for a 1 Bcf build for the week, echoing sentiments shared earlier in the week by Price Futures Group analyst Phil Flynn, who also was looking for a potential injection for the period.

Stephen Smith Energy Associates revised its estimate Tuesday from a 10 Bcf net withdrawal to a 7 Bcf withdrawal for the week ending Dec. 1, based on total degree days for the period coming in 43 below normal. The 7 Bcf draw “compares with a seasonally normal weekly draw of 160 Bcf” based on 2006-2010 norms, the firm said.

PointLogic Energy was also calling for a 7 Bcf net withdrawal for the period. “This significant decrease in week-on-week withdrawals comes amid demand falling by nearly 5 Bcf/d week-on-week,” the firm’s analysts said, pointing to a decline in Midwest residential/commercial demand as a key driver.

Last week, EIA reported a 33 Bcf withdrawal for the week ended Nov. 24, a figure that also came in bearish versus year-ago and five-year totals.

Adding to the looseness in the supply/demand picture is the recent production growth, driven by a surge in Northeast output.

PointLogic Energy data shows Lower 48 dry production out of the Northeast has increased sharply over the past month or so, averaging more than 26 Bcf/d for November and December month-to-date after averaging around 24.7 Bcf/d in October.

Analysts with Tudor Pickering Holt & Co. (TPH) said in a note to clients Wednesday that “supply growth is what matters right now, as Northeast volumes combined with robust fourth quarter associated gas growth could continue to loosen supply/demand dynamics over the next few months. In particular, we have been — and will continue to be — keenly focused on Northeast growth as the spike in production (up 2-3 Bcf/d over the last few months) may continue to ramp as incremental pipeline capacity comes on stream.”

With the next phase of the 3.25 Bcf/d Rover Pipeline slated for year-end service, along with other takeaway pipes coming online, “this will allow for exploration and production companies to turn in line completed wells awaiting infrastructure,” TPH said.

Bespoke Weather Services pointed to “balance-driven selling” to explain Wednesday’s price action. The firm said it expected January to find support at Wednesday’s levels, with the potential for bearish EIA inventory data already priced in and more seasonal heating demand about to show up in the spot market.

“Estimates for the EIA print Thursday remain extremely bearish…and we may be setting up for a classic sell the rumor, buy the news event should the print not actually surprise as bearish as some fear,” Bespoke said. Given the potential for cold in Week Three of the outlook “and prices holding above support today after intense selling, we continue to see more short-term upside than downside for prices, even with currently loose balances.”

Bespoke also noted that “the physical reaction to sustained cold has been rather weak, showing the market feels it can absorb the additional” heating demand “we expect to throw at it.”

If futures bulls were waiting to see how cash prices responded to the arrival of winter weather in parts of the country Wednesday, then they may have been disappointed. Most points firmed, especially in the Northeast, but sub-$3 prices persisted across much of the country.

In the one- to five-day outlook, U.S. population-weighted average temperatures are coming in “warmer than normal due to above normal temperatures predominant throughout the west and the last day or two of relative warmth along the east coast,” PointLogic analyst Alan Lammey wrote in a note to clients Wednesday.

“A significant cold front is taking shape, plunging into the U.S. and will continue do so for the next few days,” he said. “In fact, temperatures are coming in colder than originally forecast in locations such as Houston, where daytime highs will struggle to break above the mid-40s” and where snow and sleet could hit heading into the weekend.

“In the upper Midwest, downright icy temperatures are materializing in locations such as Chicago, where temperatures are already in the 20s and 30s, but are forecast to fall into the teens” over the next five days, according to Lammey. “By Friday, the eastern seaboard will be feeling the brunt of the Arctic cold front as temperatures transition from the 40s to the 20s by the weekend.”

As if to reinforce concerns about a looser supply/demand balance, prices in the Midwest hardly budged Wednesday. Chicago Citygate climbed 2 cents to $2.91, echoing action at Joliet, which added 2 cents to $2.89.

Kinder Morgan Inc.’s Natural Gas Pipeline Co. of America LLC (NGPL) declared a force majeure that went into effect for Tuesday’s gas day following a deadly explosion caused by a third party line strike on its 20-inch diameter Illinois Lateral in Lee County, IL. NGPL said its Illinois Lateral Line 1 would be out of service during the force majeure, with limited operations at the lateral’s Line 2.

Points in the perennially constrained Northeast recorded the largest day/day moves, including big jumps at Algonquin Citygate (up 72 cents to $4.15) and Tennessee Zone 6 200L (up $1.64 to $6.01). Transco Zone 6 NY tacked on 29 cents to $3.26.

Genscape Inc. analyst Molly Rosenstein told NGI Wednesday that the firm was seeing high volumes flowing on Algonquin Gas Transmission (AGT) at Stony Point and noted an operational flow order issued earlier in the day, the first there since Oct. 2.

“Also, there appears to be increased activity at the AGT-TGP Mendon interconnect, which when coupled with high utilization at Stony Point commonly leads to price volatility,” Rosenstein said. “On Wednesday Mendon flowed 134.8 MMcf/d, the highest observed flow this winter to-date.”

Further south, a 30 cent surge at Transco Zone 5 ($3.26 on the day) lifted the Southeast Regional Average. Florida Gas Zone 3 gained 6 cents to $2.92, while Transco Zone 4 added 6 cents to $2.92.

Appalachian prices got a weather-driven bump Wednesday. Dominion South added 21 cents to $2.54, and Tetco M-2 30 Receipt tallied a 22-cent increase to $2.50. Columbia Gas added 11 cents to $2.82.

While the mercury dropped to unusually low levels in Texas, day-ahead prices shrugged. The East Texas Regional Average added 3 cents to $2.84. Katy gained 3 cents to $2.89, while NGPL TexOk was flat at $2.74.

In Southern California, where state officials warned Wednesday of potential winter gas shortages amid ongoing import constraints affecting Southern California Gas Co. (SoCalGas), SoCal Citygate was uncharacteristically flat Wednesday, trading a penny higher while maintaining an elevated $6.02 average.

California Public Utilities Commission President Michael Picker said the state regulatory panel is “very concerned” about the ability of SoCalGas to serve its core customers in the face of heightened demand days this month and next.

SoCal Border Average fell 29 cents to $3.15 following a spike the previous day amid a reported restriction on SoCalGas’s receipts from El Paso Natural Gas at Ehrenberg, AZ.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |