Wild Swings Leave January Weekly NatGas Just A Penny Lower; California Adds 40 Cents Despite Easing Restrictions

There were four days of double-digit moves for natural gas futures and forwards markets, but when all was said and done, January prices averaged just a penny lower from Nov. 24 to 30, according to NGI’s Forward Look.

As has been the case for weeks, weather was front and center, sending Nymex futures on a roller coaster ride that began after the Thanksgiving holiday and didn’t let up. Friday brought about the first double-digit move, when the Nymex December futures contract plunged 15.5 cents amid “remarkably bearish forecasts shifts,” according to analysts at Mobius Risk Group.

Once traders were back at their desks last Monday (Nov. 27), the action continued as forecasts flipped colder, prompting a 11.5-cent gain for December futures. The expiring December contract added another 14.6 cents on Tuesday, with December rolling off the board at $3.074.

Although one could characterize Wednesday as somewhat of a breather, January futures managed to eke out another 5 cents to settle at $3.179. January sat 12 cents higher than where it settled the day before Thanksgiving, but it remained 13 cents below the high settle of $3.31 during the month of November.

However, the weather-driven rally was not to last, as some weather models suggested the cold snap arriving during the first week of December may not be as cold as once thought. Thursday’s storage report from the U.S. Energy Information Administration (EIA) only made matters worse for market bulls.

The EIA reported a 33 Bcf withdrawal from storage inventories for the week ending Nov. 24, below the 37 Bcf average withdrawal estimated by a Reuters survey of traders and analysts. Kyle Cooper of ION Energy expected a 33 Bcf withdrawal, while Stephen Smith Energy Associates was calling for a withdrawal of 41 Bcf, lower than an original estimate for a 45 Bcf withdrawal. PointLogic Energy models were predicting a 35 Bcf withdrawal.

Last year, 43 Bcf was withdrawn, and the five-year average for the period is a withdrawal of 47 Bcf. Total working gas in storage now stands at 3,693 Bcf, 309 Bcf less than last year at this time and 107 Bcf below the five-year average of 3,800 Bcf. The year-on-five-year deficit shrank week/week by 14 Bcf to -107 Bcf, the EIA data show.

Nymex January futures ended Thursday down a whopping 15.4 cents to settle at $3.025.

“I think the Thursday sell-off was the combination of three things: the somewhat bearish storage report, at least relative to expectations; short-term technical selling, likely fueled by the 20-day Bollinger Band; and traders simply focusing on January, following the expiration of the December contract on Tuesday,” said NGI’s Patrick Rau, director of Strategy and Commodity Research.

Although weather models overnight Thursday once again flipped to colder, traders appeared to be taking a more cautious approach as the Nymex January futures contract held a roughly 5-cent gain throughout most the day. Ultimately, however, the prompt month settled just 3.6 cents higher at $3.061.

Forecasters at NatGasWeather said the colder trends that showed up in the overnight data held in the mid-day Friday updates, but there were notable differences beginning around Dec. 12 where the Global Forecasting System has the core of the coldest air mass focused over the north-central United States, allowing some milder riding over the Southeast. The European model has a colder overall pattern with subfreezing conditions advancing deep into the southern U.S., while also having the core of the coldest air a little further east, placing the East Coast in a colder temperature regime.

“Subtle differences, but important for expectant demand,” NatGasWeather said.

In the meantime, a strong cold front was still on track to arrive into the West by late Sunday, opening the door for bitter cold air to pour across the northern and central Lower 48 on Tuesday. Cold conditions were to arrive in the East on Wednesday, with reinforcing cold shots lined up through Dec. 15.

NatGasWeather, in a midday Friday note to clients, said it would be interesting to see if Thursday’s sell-off “was a bluff and the markets are really more worried about the coming pattern than trade the past two days suggests,” especially when considering heating degree day, or HDD totals “are now greater than they were when prices began selling off early Thursday morning at $3.19.”

Taking a more in-depth look at the markets, most pricing hubs joined Nymex futures for the rollercoaster ride, ultimately ending the week not far from where they began. But it was a much different story in the Northeast, where some of the coldest temperatures and strongest demand in the weeks ahead lifted January prices there by as much as 30 cents. February prices posted even heftier increases.

At New England’s Algonquin Gas Transmission City-gates (AGT CG), January forward prices shot up 30 cents from Nov. 24-30 to reach $8.986, according to Forward Look. February was up 39 cents to $9.041, and the balance of winter (February-March) jumped 27 cents to $7.24.

For comparison, AGT CG prices over the entire winter of 2016-2017, which was one of the mildest on record, averaged $4.52. Prices for January averaged $4.76, while February averaged $3.79 and March averaged $4.39, according to historical data from NGI Daily Gas Price Index.

At Tennessee zone 6 200 leg, January forward prices rose 23 cents from Nov. 24-30 to reach $8.963, while February climbed 31 cents to hit $9 and the balance of winter (February-March) picked up 20 cents to reach $7.26.

The strength comes as demand in New England is expected to climb steadily for much of the next week, reaching a peak of 3.18 Bcf/d by Dec. 8, which is above the recent seven-day average of 2.94 Bcf/d, according to data and analytics company Genscape Inc. The following week is expected to see even stronger demand, with an average around 3.13 Bcf/d.

In New York, Transco zone 6-New York January forward prices rose 21 cents from Nov. 24 to 30 to reach $7.133, while February and the balance of winter (February-March) each tacked on 9 cents to hit $6.988 and $5.46, respectively, Forward Look shows.

Interestingly, Appalachian pricing hubs failed to move alongside Northeast points despite the colder weather on tap. Instead, prices held relatively steady like the Nymex. At Dominion South, January forward prices slipped just a penny to $2.592, February fell 3 cents to $2.612 and the balance of winter (February-March) shed 3 cents to $2.59.

The lack of significant movement at Dominion comes amid a short-term shut-in on Energy Transfer Partners LP’s Rover Pipeline. Rover on Thursday said operational capacity at the Cadiz Lateral, including the Cadiz-MW and Cadiz-ORS locations, would be reduced to 0 Dth/d from Dec. 5-6 to install the Cadiz Compressor Station.

As Rover Phase 1B is not yet in service, and gas cannot be sourced from points other than the Cadiz Lateral, this would represent a full shut-in of receipts onto the pipe, Genscape Inc. said. Since Oct. 10, when partial service through CS1 was approved, through early November, total receipts averaged 1,020 MMcf/d — hitting a max of 1,150 MMcf/d for three days on Nov. 4, 5 and 6. Volumes have dropped off since then; average total receipts since Nov. 7 decreased to 878 MMcf/d, and 846 MMcf/d was scheduled as of evening cycle nominations for gas day Nov. 30.

ANR has been receiving most of this gas at the Westrick location since Rover began operations, with lesser quantities going to Panhandle at the Falcon location, Genscape said. Average deliveries to ANR for the month of November so far have been 683 MMcf/d, and 258 MMcf/d has been delivered to Panhandle.

“With this being the first maintenance event of any kind on Rover, there are no prior events for comparison,” Genscape said.

The amount of gas from ORS (Ohio River System) and MarkWest that can be pushed back into the system versus being shut-in depends on contracts, demand and other factors. ORS might be able to reroute large quantities back to the Rockies Express Pipeline and Texas Eastern Transmission LP (Tetco), pipes Rover has been displacing since it began flowing, assuming they have had some lead time on this event, Genscape said.

California Volatility Continues But Restrictions Ease

California saw some of the highest levels of demand during the week, leading to substantial gains in cash and forward markets alike. While strong demand alone is enough to boost prices, the region is also grappling with several restrictions in supply.

As of Friday (Dec. 1), some of those restrictions were easing, as Southern California Gas said Thursday capacity at the Otay Mesa Mexican border point would be returned to the 400 Mcf/d by Saturday. Capacity had been at zero for the last 15 days because of gas quality issues, according to Genscape.

Otay Mesa has been a critical import point for California since October, when several unplanned maintenance events limited supplies into the region. While the easing of restrictions at Otay Mesa should help mitigate price increases at SoCal City-gate, volatility remains likely, especially during times of high demand.

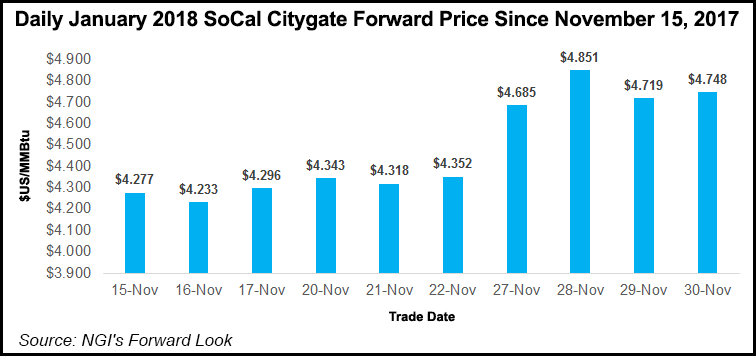

Indeed, SoCal City-gate January forward prices spiked by some 40 cents from Nov. 24-30 to reach $4.748, according to Forward Look. For comparison, cash prices for gas day Friday approached $6.

Genscape is projecting demand to average 6.03 Bcf/d for the first week of December, down from the recent seven-day average of 6.46 Bcf/d. The following week is expected to see even stronger demand, averaging close to 6.23 Bcf/d.

Whether regional traders are expecting milder weather for the rest of the winter or the current restrictions in place to be lifted, the rest of the SoCal City-gate curve saw only modest increases. February forwards rose 4 cents to $3.80, and the balance of winter (February-March) held steady at $3.42.

In a Nov. 29 note to clients, however, Morningstar Commodities Research said the various maintenance events on the SoCal system are expected to affect supply for most of the winter.

And while the lifting of restrictions on Otay Mesa will certainly aid in the supply picture, “this is not only less efficient but also more expensive than the traditional route, placing upward pressure on SoCal gas basis,” Morningstar said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9915 | ISSN © 2577-9877 |