Cold Weather on Tap in December NatGas Bidweek Action, But Markets Skittish After Getting Burned

Winter has arrived for the natural gas markets, as evidenced by the broad gains in NGI‘s December Bidweek Survey, where the National Average jumped 59 cents month/month to $3.12/MMBtu, which is also a mere 8 cents below December 2016’s $3.20/MMBtu.

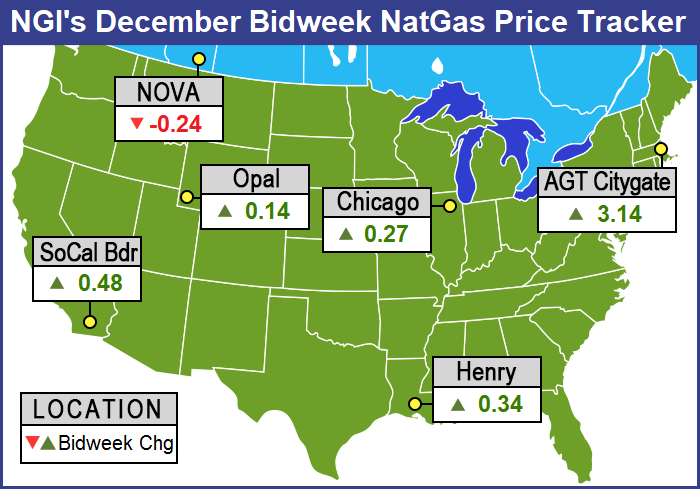

Strong December bidweek gains at points like Algonquin Citygate — up $3.14 for December to $5.81 — and Transco Zone 6 New York — up $1.72 to $4.33 — show traders prepping for legitimate cold weather.

In the Midwest, Dawn gained 52 cents to average $3.25, and Chicago Citygate added 27 cents to $3.10.

And in Appalachia, where producers should benefit from additional takeaway this winter thanks to the start-up of projects including Rover Pipeline, prices surged by $1.00 at some points. Dominion South jumped 95 cents to average $2.50 in December Bidweek, while Tetco M2 30 Receipt jumped $1.00 to $2.51.

However, coming off two warm winters in a row, the market has its doubts. Futures have been quick to flinch at any sign of a let-off in projected heating demand, even with overall confidence that significant cold will arrive by the end of the first week of December.

The December contract finished strong, coming off the board at $3.074, but it took an early-week surge to get there after trading as low as $2.797 just two sessions prior.

As for January, after gaining for three straight trading days on calls for a cold weather pattern to develop in the coming week, some overnight model runs that suggested that same cold pattern might not be as strong as previously thought prompted a 15.4 cent sell-off to test the $3.00 area Thursday.

The cold pattern that had excited the bulls a few days ago didn’t disappear, but it trended a little warmer, and that’s all it took, Commodity Weather Group President Matt Rogers told NGI.

“Every model came in warmer overnight” Wednesday to Thursday, Rogers said. “Basically, they didn’t get rid of the cold pattern, they just weakened it. But I’ll tell you, this market is so skittish because of how warm it’s been the past two winters that any sign of warming is an exit risk.”

And it wasn’t long before yet another overnight change — this time with some heating demand returning to the outlook — had January rebounding back to around $3.090 during the first trading day of December.

The swings have been larger with weather arriving, but gas continues to trade within a long-standing range, Powerhouse LLC President Elaine Levin told NGI Thursday.

“It’s also month-end, and natural gas had a heck of a run up the previous few days,” she said. “Maybe there was some profit-taking as well” in Thursday’s sell-off. “This has been a long-established range in prices. It’s been going for months. When you have a range-bound market, that’s what you do until it breaks out of the range. In a trendless market, you buy the low of the range and sell the top of the range, and we saw both in five sessions.

“If you start to move above $3.25, then you might be onto something.”

The fundamentals heading into the winter offer plenty for traders to mull. One the one hand, a year-on-year and year-on-five-year storage deficit, exports to Mexico and via liquefied natural gas (LNG). One the other, production above 76 Bcf/d, surging on the strength of output from the seemingly unleashed Northeast.

For the week ended Nov. 24, EIA reported a net 33 Bcf withdrawal from U.S. gas stocks. Last year 43 Bcf was withdrawn, and the five-year average for the period is a withdrawal of 47 Bcf.

The market had been anticipating a slightly larger withdrawal than the final number. A Reuters survey of traders and analysts had predicted on average a 37 Bcf withdrawal for the week, with responses ranging from -28 Bcf to -54 Bcf. Kyle Cooper of ION Energy expected a 33 Bcf withdrawal, while Stephen Smith Energy Associates was calling for a withdrawal of 41 Bcf, lower than an original estimate for a 45 Bcf withdrawal. PointLogic Energy models were predicting a 35 Bcf withdrawal.

Total working gas in storage now stands at 3,693 Bcf, versus year-ago stocks of 4,002 Bcf and a five-year average of 3,800 Bcf. The year-on-five-year deficit shrank week/week by 14 Bcf to -107 Bcf, the EIA data show.

Bespoke Weather Services judged the -33 Bcf figure as “slightly bearish,” coming in “a bit looser than last week’s print but on a 10-week basis is about flat.

“The market appears unimpressed, barely moving off the print as focus is instead on forward weather expectations and increasing production levels,” Bespoke said. “We see this number as confirming our concerns about elevated production being able to absorb additional demand as we move through the winter, and see current market balance as one key reason we have pulled back so significantly from highs despite only limited gas-weighted degree day losses.”

Analysts with Tudor Pickering Holt & Co. (TPH) said in a note to clients Friday that based on the -33 Bcf figure “weather adjusted supply and demand looks to be relatively balanced, consistent with the previous week.” Noting the potential for noise in the data from the Thanksgiving holiday, analysts said there’s been “significant change in year-to-date trends in the supply/demand dynamic” for gas recently versus what looked to be an undersupplied market previously. This is likely because of “a combination of rapid growth in northeast supply over the last three months (about 2-3 Bcf/d based on flow data) and slowing sequential demand growth.”

Production has pushed above 76 Bcf/d as the market waits for colder weather to lift demand, according to PointLogic’s Jack Weixel, vice president of the analytics firm. With nationwide temperatures expected to fall from Dec. 6-Dec. 12, “the first two weeks of December could show significantly higher storage withdrawals than currently modeled, should the referenced cold troughs hold over the Midwest and Eastern regions longer than predicted,” he said in a note to clients Thursday.

“As of Thursday, total demand will average 72.6 Bcf/d for the week ending Dec. 7, with demand peaking on Dec. 7 at 81.2 Bcf/d, or over 11.6 Bcf/d higher than Thursday’s estimated demand of 69.6 Bcf/d,” he said. “The week ending Dec. 14 will likely come in even higher at an average near 83.4 Bcf/d. For reference, winter 2016/2017 saw only six weeks when domestic demand averaged over 82 Bcf/d and only one of those weeks was in December.”

As for production, Thursday’s “evening cycle nominations mark the ninth straight day that Lower 48 dry gas production has exceed the 76 Bcf/d mark,” he said.

Genscape Inc. has also recorded estimated production levels exceeding 76 Bcf/d. Genscape’s estimates from Tuesday and Wednesday came in “more than 2.1 Bcf/d higher than the start of the month,” it said in a note to clients Thursday. “In that span, Northeast production is close to 1.3 Bcf/d higher, led primarily by Northeast Pennsylvania gains in excess of 0.65 Bcf/d. Within the Northeast, pipe samples show the systems with the largest gains include” Tennessee Gas Pipeline, Dominion, Stagecoach and Transco.

“Southwest Pennsylvania is showing more than 0.35 Bcf/d of growth along with about 0.15 Bcf/d of growth in Ohio and West Virginia,” Genscape said.

Rafferty Commodities Group’s Steve Blair, vice president, told NGI he thinks the rise in production may be serving to offset concerns about additional tightness because of Mexico and LNG exports.

“That may be one of the reasons the market is looking more toward weather,” he said.

Said Powerhouse’s Levin, “It seems to me like the market’s feeling that we’re closer to an equilibrium than not.” Hence the range. “One day, something will happen, and we’ll break out of that range. What it will be, your guess is as good as mine.”

Then there’s SoCal Citygate.

Sempra Energy’s gas utility Southern California Gas (SoCalGas) continues to report zero scheduled volumes through key import points at Topock, AZ, and Needles, CA, and more recently imports across the Mexico border at Otay Mesa have also been restricted. This is on top of limited availability of storage withdrawals from Aliso Canyon in the aftermath of the leak discovered in 2015.

Anxiety over potential supply shortages manifested during bidweek, with potential supply shortages in play as December demand increases loom on the horizon.

December bidweek prices at SoCal Citygate surged as high as $7.59 and averaged $6.38, up $2.77 month/month. That means SoCal Citygate bidweek prices for December surpassed the winter-constrained Algonquin Citygate ($5.81).

The restrictions on imports into the SoCalGas system have been severe enough that state regulators are concerned. A report issued last Tuesday by California energy agencies and the Los Angeles Department of Water and Power highlighted the uncertainty of gas supply availability this winter.

California officials predict that supplies from Aliso Canyon, the state’s largest gas storage facility, would be needed this winter. “Under extreme cold weather events, there may be insufficient gas supplies to meet demand even relying on withdrawals from all of the other storage fields,” the report noted.

A little bit of relief could soon be on the way to the Golden State, according to Genscape.

“SoCalGas posted a notice Thursday night announcing the limited removal of the capacity reduction at the Otay Mesa Mexican border point effective Friday,” Genscape said in a note to clients.

As Genscape has noted previously, Otay Mesa had seen increased use after the outages at Needles and Topock. “After being set at zero for 15 days due to gas quality issues, operational capacity will increase to 50 MMcf/d. SoCalGas expects operational capacity to return to the full, normal level of 400 MMcf/d” on Saturday, Genscape said.

“In the three weeks before that reduction took effect Nov. 16, Otay Mesa had posted an average receipt of 146 MMcf/d, with a single-day maximum of 191 MMcf/d. It was serving a crucial import point for SoCalGas since mid-October, following the multiple unplanned remediation events on SoCalGas’s typical import lines in eastern California.”

The largest recorded receipt through Otay Mesa is 291 MMcf/d, Genscape said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1258 | ISSN © 2577-9877 |