Shale Daily | E&P | Infrastructure | NGI All News Access

U.S. Rig Count Gets Another Bump on Haynesville, Permian Gains

The U.S. rig count climbed again for the week ending Friday, this time driven by units returning to the patch in the Permian Basin and the Haynesville Shale, according to updated data from Baker Hughes Inc. (BHI).

The United States added six rigs — four natural gas-directed and two oil-directed — to finish the week at 929 active units, versus 597 a year ago. The increase came entirely from horizontal units, the BHI data show. Eight rigs were added on land, while two units packed up in the Gulf of Mexico.

Canada added seven rigs week/week, including four oil and three gas, growing its tally to 222 (versus 200 a year ago). The combined North American rig count now stands at 1,151, up 354 from 797 active units in the year-ago period.

As New York Mercantile Exchange crude oil futures trade above $57/bbl, the domestic rig count has now gained four straight weeks to recover from a recent low of 898 rigs Nov. 3.

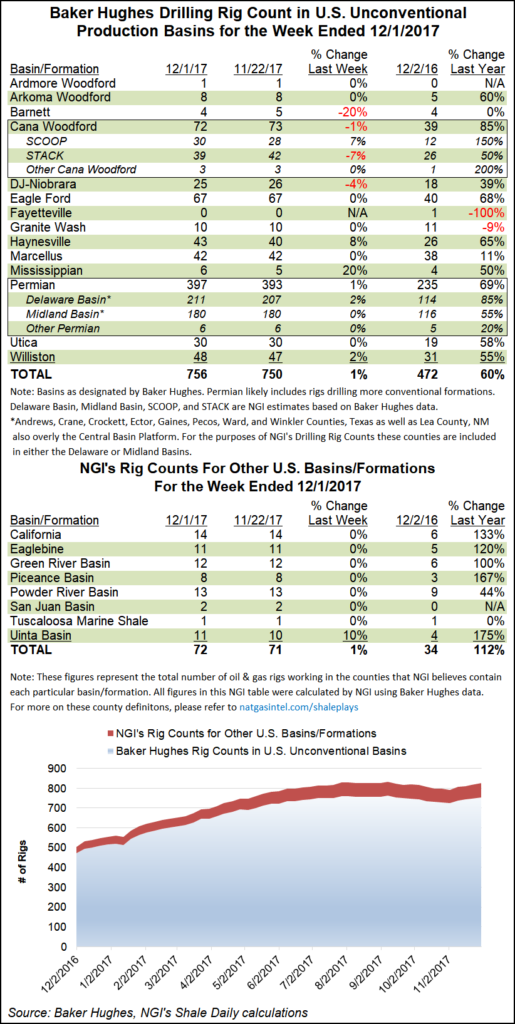

Among plays, the Permian in West Texas and southeastern New Mexico led the way, adding four rigs to end at 397, up from 235 units a year ago. The gains all came in the Permian’s Delaware sub-basin this week, according to NGI’sbreakdown of the BHI data.

The gassy Haynesville Shale wasn’t far behind, adding three units to finish at 43, up sharply from 26 units in the year-ago period. That puts the Haynesville above the Marcellus Shale (flat at 42 for the week) in terms of active rigs.

Other gainers for the week among plays included the Mississippian Lime in the Midcontinent and the Williston Basin in North Dakota, which each added a rig. The Barnett Shale, the Cana Woodford and the Denver Julesburg-Niobrara each dropped a rig for the week, according to BHI.

Looking more closely at the Cana Woodford, the SCOOP (South Central Oklahoma Oil Province) added two units to end at 30, while the STACK (Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties) dropped three to 39, NGI‘s analysis of the data shows.

Among states, Texas recorded a four-rig increase, while New Mexico, Utah and North Dakota also added a rig a piece. Colorado and Louisiana each saw one rig exit the patch.

The crude oil markets got some potentially bullish news this week on Thursday when the Organization of the Petroleum Exporting Countries (OPEC) and its Russian-led allies agreed in principle to extend their plan to keep 1.8 million b/d off the market possibly through 2018.

OPEC recently issued a bullish outlook for oil demand in 2018, forecasting demand should increase by around 400,000 b/d to 33.4 million b/d. However, on the heels of OPEC’s forecast, global energy watchdog, the International Energy Agency (IEA), reduced its 2018 oil demand forecast by 200,000 b/d.

“The reality is that even after some modest reductions to growth, non-OPEC production will follow this year’s 0.7 million b/d growth with 1.4 million b/d of additional production in 2018 and next year’s demand growth will struggle to match this,” IEA said. “This is why, absent any geopolitical premium, we may not have seen a ”new normal’ for oil prices…”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |