Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Producers Rushing to Lock in Oil Hedges, but for Natural Gas Not So Much

Natural gas hedging during the third quarter was a bit subdued, but oil hedging surged, as producers rushed to lock in rising crude prices for future production, according to an analysis by Wood Mackenzie.

Gas hedges fell 29% from the second quarter, with only 1.6 Bcf/d (annualized) added, researchers said. Most of the gas hedges were added at strike prices of $3.00-3.40/Mcf Henry Hub, with Range Resources Corp. accounting for 27% of quarterly volumes added.

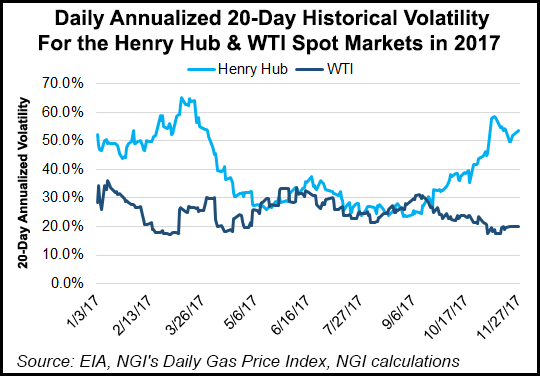

“Gas hedging activity has been much less volatile than oil during 2017, partially due to lower volatility in the underlying price of the commodity,” said Wood Mackenzie research analyst Andy McConn. “Producers have demonstrated that, similar to oil, inflections in gas price can trigger inflections in hedging behavior.”

Oil producers added hedges at a more frenzied pace.

The analysis, which looked at 33 of the largest upstream companies with active hedging programs, found 897,000 b/d (annualized) of oil hedges were added during 3Q2017, which was 147% higher than in 2Q2017. The volume was the highest of any single quarter since Wood Mackenzie began tracking hedging activity in 4Q2015.

“Many producers have been basing long-term growth targets on $50/bbl price scenarios,” said McConn. “When futures prices rose above that level, producers may have viewed it as an opportunity to lock in prices that will enable them to hit — or maybe outperform — targets.

“Recent pressure from investors for producers to live within cash flow is likely compelling producers to limit exposure to price risk.”

Most of the new oil derivatives added during 3Q2017 were at strike prices of S$50-60/bbl.

“The recent increase in oil price futures explains much of producers’ eagerness to lock in prices,” Wood Mackenzie reported.. “Since the downturn began producers have demonstrated more willingness to hedge while prices rise, but that only tells part of the story.”

Calgary-based Cenovus Energy Inc. and Hess Corp. added most of the oil hedges during the three-month period, together accounting for 35% of new volumes added.

However, many producers hedged significant oil volumes, with 14 companies each adding at least 25,000 b/d.

“Oil prices have continued to rise after the third quarter,” McConn said. “Producers that found $50-53/bbl WTI attractive may look to add more hedges at $53-59/bbl. But the recent surge in hedging leaves less room to add derivatives without exceeding historical levels.”

The peer group has 22% of 2018 liquids production hedged, versus the same period a year ago when only 17% of 2017 liquids production was hedged.

“Hedge positions significantly influence tight oil producers’ decisions about budgets and activity,” McConn said. “They are particularly pertinent at this stage of the year, when most companies are wrapping up the planning process for 2018.

“Producers that are able to lock in prices above previous expectations may feel more comfortable with increasing activity levels. Others may leave budgets unchanged and promote higher cash-flow guidance to an investment community anxious about profits.”

A separate analysis of North American oil hedging issued by ESAI Energy LLC mirrored some of Wood Mackenzie’s findings.

“Higher oil prices have encouraged hedging 2018 shale output, supporting production even as procyclical costs are lifting breakeven prices,” ESAI analysts said. “With a weighted average floor price of $50/bbl, roughly 1.5 million b/d of production has been hedged so far, about double the volume hedged at the end of the second quarter.

“U.S. shale is forecast to rise by about 660,000 b/d on average in 2018, but by 375,000 from start to finish during the year.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |