NGI The Weekly Gas Market Report | E&P | Markets | NGI All News Access

New Companies, Hurricanes Play Opposing Roles in NGI’s 3Q2017 NatGas Marketer Survey

A pair of first time entries with international ties spiced up NGI‘s 3Q2017 Top North American Gas Marketers Ranking, but the negative impacts of Hurricane Harvey helped drag the numbers lower among some of the survey’s heaviest hitters.

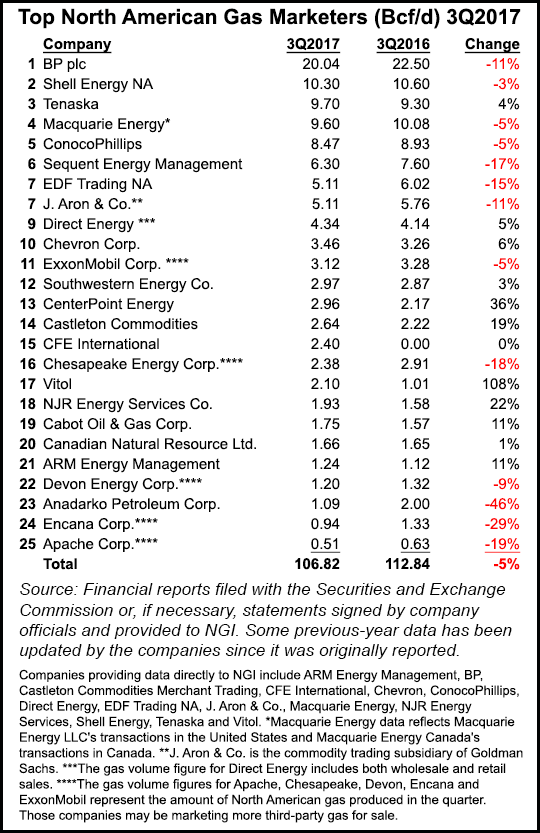

NGI’s quarterly snapshot of leading gas marketers reported combined sales transactions of 106.82 Bcf/d in 3Q2017, a 6.02 Bcf/d decline year/year from the 112.84 Bcf/d transacted during 3Q2016. Following two quarters of 7% increases in 2016, marketers have reported four consecutive quarters of declines.

BP plc reported 20.04 Bcf/d in 3Q2017, extending its perennial grip on the No. 1 position by another quarter despite a 2.46 Bcf/d (11%) decline, compared with 22.50 Bcf/d in 3Q2016. BP remains North America’s largest natural gas supplier, and late in the quarter was ramping up its natural gas service to industrial users, local distribution companies and independent producers in Mexico.

In the No. 2 spot, Shell Energy NA reported 10.30 Bcf/d, a 3% decline compared with 10.60 Bcf/d in 3Q2016.

It was better news from No. 3 Tenaska, with 9.70 Bcf/d in 3Q2017, a 4% increase compared with the year-ago period.

Rounding out the fourth and fifth spots, Macquarie Energy reported 9.60 Bcf/d, a 5% decline compared with 3Q2016, and ConocoPhillips reported 8.47 Bcf/d, also a 5% decline.

Nearly all of the companies that reported lower numbers in 3Q2017 compared with 3Q2016, including BP, Shell, Macquarie and ConocoPhillips, have marketing operations headquartered in Houston or its suburbs, which was slammed by Hurricane Harvey in late August. Harvey made landfall Aug. 25 in South Texas as a Category 4 storm, shuttering the energy breadbasket of the United States and, in concert with a broader cooling trend, prompting temporary natural gas demand reductions across the region. In September, Hurricane Irma, also a powerful Category 4 storm, made landfall in Florida, knocking out power to millions and delivering another major hit to natural gas demand.

Anadarko Petroleum Corp.’s average sales volumes in 3Q2017 fell to 626,000 boe/d, down 20% year/year, partly on asset sales, but also on shut-ins related to atrio of Gulf of Mexico hurricanes — Harvey, Irma and Nate — which made landfall on the central Gulf Coast in October and temporarily froze output from the deepwater. ExxonMobil Corp. said Harvey reduced its 3Q2017 earnings by an estimated $160 million (4 cents/share). ConocoPhillips reported increased earnings for 3Q2017 but production declined, due in large part to the effects of Harvey. And Devon Energy Corp.’s 3Q2017 production averaged 527,000 boe/d (44% oil), above the midpoint of its guidance after adjusting for impacts related to Harvey. The company reported storm-related curtailments of around 15,000 boe/d (65% oil) for the quarter, mostly attributable to reduced output from Eagle Ford Shale assets in South Texas.

“The next two quarters contain the winter heating season, so we know demand will increase those two months,” said NGI’s Patrick Rau, director of strategy and research. “Just how much it increases will of course depend on how cold a winter we get and projections of that have been all over the map so far.”

“However, what appears more clear is that production continues to increase, and that should lead to more volumes over the next two quarters, everything else being equal.”

U.S. dry gas production in 2Q2017 was up about 0.7 Bcf/d quarter-over-quarter, Rau said, and the 3Q2017 sequential increase should be at least 1.5 Bcf/d.

Moreover, Appalachia producers in particular should continue to increase production to fill the nearly 3.5 Bcf/d of incremental capacity in the near-term, from the completion of Rover,Leach and Rayne Xpress, and Texas Eastern Transmission LP’s Adair SW project. “Although operators have indicated it will take maybe a year to a year-and-a-half to fill that capacity, it should still contribute to higher marketing volumes over the next several quarters,” Rau said.

So too should more liquefied natural gas (LNG) export capacity from the United States, he added, since being better connected to the rest of the world should increase price volatility, and therefore marketed volumes, here at home. Overall, Rau expects another 1.2 Bcf/d of LNG export capacity from the United States to come online in 2018, followed by a sizable 5.8 Bcf/d increase in 2019.

“And that’s just for projects that are currently under construction,” he said. “A few other planned facilities could push our installed export capacity even higher in the 2020-22 timeframe.”

Among the highlights of the 3Q2017 survey were the additions of two new companies.

CFE International, which wasn’t trading natural gas a year ago, reported 2.40 Bcf/d in 3Q2017, enough for it to claim No. 15 in its first NGI survey. Mexico’s Comision Federal de Electricidad (CFE) has said much of its future lies in trading natural gas through marketing affiliates CFE International and CFEnergia.

Swiss trader Vitol reported 2.10 Bcf/d in 3Q2017, more than double the 1.01 Bcf/d it had in 3Q2016. Vitol has been on the advance this year, climbing 37 spots to No. 48 in NGI‘s June 2017 analysis of 2016 Form 552 buyer and seller filings with FERC.

Other highlights of the 3Q2017 survey include a 5% increase for Direct Energy (4.34 Bcf/d, compared with 4.14 Bcf/d in 3Q2016), a 6% increase for Chevron Corp. (3.46 Bcf/d, compared with 3.26 Bcf/d in 3Q2016) and a 3% increase for Southwestern Energy Co. (2.97 Bcf/d, compared with 2.87 Bcf/d in 3Q2016).

CenterPoint Energy reported 2.96 Bcf/d (up 36%), Castleton Commodities 2.64 Bcf/d (up 19%), and Cabot Oil & Gas Co. 1.75 Bcf/d (up 11%). Canadian Natural Resource Ltd. was up 1% compared with 3Q2016 at 1.66 Bcf/d, and ARM Energy Management was up 11% at 1.24 Bcf/d.

The NGI survey ranks marketers on sales transactions only. The Federal Energy Regulatory Commission’s Form 552 tallies both purchases and sales.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |