January NatGas Gains for Third Straight Day Amid Confidence in December Cold; Cash Follows

Natural gas futures gained for the third day in a row, continuing to gain momentum on a bullish outlook for December cold even as an early morning surge prompted some profit-taking.

The spot market followed the futures higher despite near-term forecasts showing above-normal temperatures across much of the country, and the NGI National Spot Gas Average climbed 15 cents to $2.96.

In its first day as the prompt-month, the January contract gained for the third straight day, trading as high as $3.218 and as low as $3.127 before settling at $3.179, 5.1 cents higher. February natural gas settled 4.8 cents higher to also finish at $3.179.

This week, forecasters have keyed in on a cold pattern set to move through next week, and prices have surged in anticipation of December providing a real test of the market’s underlying fundamentals after two consecutive warm winters.

NatGasWeather.com, in a midday update to clients, reported some “slight changes” in the weather data but emphasized that “a frigid U.S. pattern remains on track to sweep across the country from west to east during the middle of next week, arriving into the Midwest a full day quicker and also colder.

“The data is also colder on the overall pattern Dec. 10-14 and, most importantly, has become more convincing that strong demand for heating should be expected to continue well through mid-December.”

The firm said if the current cold pattern in the forecast “holds through the third week of December, we expect” the current storage deficit “to rapidly increase towards -200 Bcf, but only after the next two builds come in lighter than normal and drop deficits back under -80 Bcf.”

Bespoke Weather Services observed that the prompt-month, responding to overnight guidance in the European weather models, pushed up against resistance early in the day at $3.20-$3.22 before pulling back.

“This pullback was a bit more impressive than expected, but given the large premium the contract was trading at to cash prices and relative weakness we have seen over the past year on post-expiry trading days, the pullback still fits within our broader bullish narrative.”

The potential for a bearish storage report Thursday from the Energy Information Administration (EIA) could offer “a buying opportunity in the face of continued very impressive medium- and long-range bullish weather risks,” Bespoke said.

“Though the natural gas market has seemingly priced in cold within the 15-day forecast, leading to this round of profit-taking today, we feel the market is still discounting the risk of more continued cold into the second half of December that most guidance continues to show.”

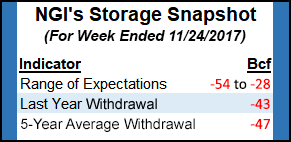

Predictions for Thursday’s 10:30 a.m. natural gas inventory report from EIA show the market anticipating another withdrawal, albeit a potentially bearish pull versus the year-ago and five-year figures.

A Reuters survey of traders and analysts shows on average a 37 Bcf withdrawal for the week, with responses ranging from -28 Bcf to -54 Bcf. Last year 43 Bcf was withdrawn, and the five-year average for the period is a withdrawal of 47 Bcf.

Kyle Cooper of ION Energy expects a 33 Bcf withdrawal, while Stephen Smith Energy Associates is calling for a withdrawal of 41 Bcf, lower than an original estimate for a 45 Bcf withdrawal.

PointLogic Energy models are predicting a 35 Bcf withdrawal. The firm said its estimate is based on a 2.9 Bcf/d week/week decline in demand driven by the residential/commercial sector in the Northeast.

“Low-side risk this week could come from the South-Central region, where local demand increased by nearly 1 Bcf/d,” PointLogic analysts said.

Steve Blair, vice president of Rafferty Commodities Group, said the year-on-year and year-on-five-year storage deficits that have developed to this point in the season are helping the bulls make their case.

“You’ve had two mild winters in a row, and the year-on-year storage differential continues to widen. Of course, we haven’t really truly started winter, so how that plays out remains to be seen,” Blair told NGI.

With the cold temperatures developing with some level of confidence in the longer-range forecast, “the market’s finally focusing on the fact that we’re going to get some winter weather, some winter demand, and it’s putting aside the near-term weather and the production,” he said. “From a technical perspective, we got down very close to the near-term supports last week, so I think a lot of people, both speculators and utilities, were thinking that those sub-$3 levels were a pretty good place to buy.”

In the spot market Wednesday, points across the country strengthened by a dime or more, helping day-ahead prices keep pace with the surging futures. Henry Hub added 15 cents to average $3.06, bringing it in line with Tuesday’s $3.074 settlement for the expired December contract.

MDA Weather Services in its one- to five-day outlook was calling for above-normal temperatures across most of the country, including at- or above-normal temperatures at a number of major U.S. cities until next week.

The Northeast Regional Average tacked on 30 cents to $3.60, though the volatile Algonquin Citygate shed 7 cents to average $3.07. Transco Zone 6 New York added 7 cents to $3.04.

Farther south, Transco Zone 5 jumped 15 cents to $3.12, while Transco Zone 4 added 16 cents to $3.05. Appalachian prices firmed, including Dominion South (up 15 cents to $2.56) and Columbia Gas (up 15 cents to $2.91).

Elsewhere, Chicago Citygate added 14 cents to $2.99, while Northern Natural Demarcation added 16 cents to $2.91.

Farther west, Kern River gained 11 cents to $2.73, and Opal gained 12 cents to $2.74. El Paso S. Mainline/N. Baja added 17 cents to $2.86, and Kern Delivery tacked on 12 cents to $2.86.

In California, the ongoing supply constraints at SoCal Citygate pushed prices 23 cents higher to $5.26 Wednesday.

Key restrictions on import and storage capacity for the Southern California Gas (SoCalGas) system have regulators concerned about supply availability this winter. Traders are concerned too, based on the latest Bidweek and Forward Look prices.

December fixed price forwards at SoCal Citygate gained again Tuesday to average $6.374, NGI’s Forward Look data show. Through Day 4, December Bidweek prices at SoCal Citygate are averaging $6.30 and have traded as high as $7.55, according to NGI‘s Bidweek Alert.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |