NGI Weekly Gas Price Index | Markets | NGI All News Access

During Holiday Week, Lack of Consistent Cold Brings NatGas Bears Out to Play

A lack of consistent cold weather heading into the Thanksgiving holiday had spot prices trending downward for the second week in a row, and the NGI Weekly Spot Gas Average during the three-day trading week for Nov. 21-27 flow dropped 14 cents to $2.85/MMBtu.

Declines were largest in the Northeast and in the west, where some above-normal temperatures verged on cooling degree day territory in some places and led to moderate overall regional demand during the week. Other regional averages generally fell between a nickel and a dime.

The California regional average tumbled 15 cents to $3.02, with the constrained SoCal Citygate giving up 19 cents for the week to average $3.87. Malin fell 17 cents to $2.69.

In the Arizona/Nevada region, El Paso South Mainline/North Baja dove 21 cents to $2.82, while Kern Delivery fell 19 cents to end at $2.81. Rockies points saw similar declines, with Kern River falling 18 cents to $2.65 and Opal giving up 16 cents to $2.66.

The Northeast was expected to see some cold to start the holiday weekend, but it wasn’t expected to last long. Algonquin Citygate tumbled 46 cents to $3.19, and Iroquois Waddington fell 19 cents to $3.14. Tennessee Zone 6 200L fell 23 cents to $3.40, while further south Transco Zone 6 New York dropped 13 cents to $3.01.

Natural gas futures continued to slump ahead of the holiday as a bearish medium-range weather outlook overshadowed another weekly storage withdrawal.

After ending the previous week at $3.097, December natural gas had dipped below $3 by Wednesday, settling 4.9 cents lower day/day at $2.968. January settled 5.1 cents lower at $3.059.

A second consecutive storage withdrawal reported by the Energy Information Administration (EIA) Wednesday failed to move the needle.

“To our view, prices started selling off once Tuesday’s midday data started showing milder trends in regards to a cold shot late this weekend, and then also due to a milder trending pattern across most of the country Dec. 1-5,” NatGasWeather.com said.

“The latest data maintained this, with a not-nearly-cold-enough overall pattern through Dec. 5, even with several cold shots impacting the northern and eastern U.S., just not widespread enough when considering most of the western, central and southern U.S. will be unseasonably mild for this time of year with highs in the 60s to 80s.”

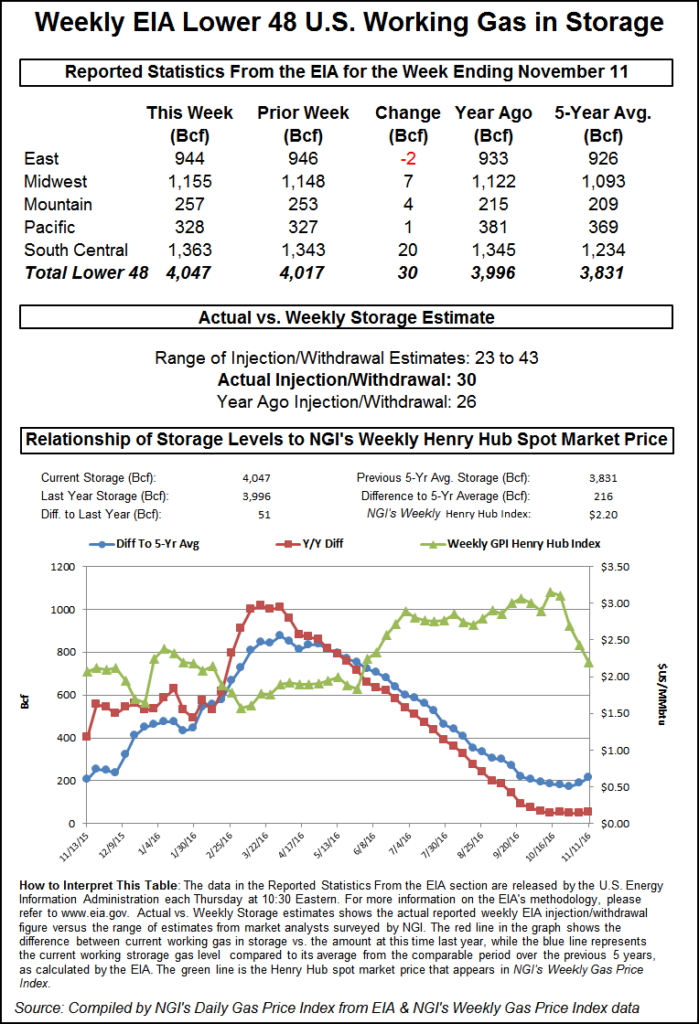

EIA reported a net 46 Bcf withdrawal from U.S. gas stocks for the week ended Nov. 17, a slightly smaller decline than what the market had been expecting.

The number came out a day early because of the Thanksgiving holiday, and in the minutes immediately following the noon EDT release on Wednesday, the prompt-month traded as low as $2.959 and as high as $2.976. By 12:30 p.m. eastern, December had climbed above $2.980, down about 3 cents from Tuesday’s settle.

The December contract had been trading lower prior to EIA’s report, with some warming in the medium-range forecast pushing the market below the gap in the chart that formed when prices surged on the first arrival of winter weather earlier in the month.

The market had been looking for a withdrawal somewhat larger than the actual figure.

A Reuters survey of 23 traders and analysts had predicted on average a 51 Bcf withdrawal for the week ended Nov. 17. Responses to the Reuters survey ranged from -63 Bcf to -22 Bcf. Last year, 2 Bcf was injected, and the five-year average stands at -26 Bcf.

Stephen Smith Energy Associates was calling for a withdrawal of 48 Bcf. ION Energy’s Kyle Cooper was calling for a 51 Bcf withdrawal, while PointLogic Energy was forecasting a net 54 Bcf decline in inventories.

“This print will likely not provide a catalyst to break prices higher in the face of bearish weather risks in the medium-range that will hold out into the first week of December as well,” said Bespoke Weather Services, which had counted some gas-weighted degree day (GWDD) losses in the overnight weather data. “If anything, a slightly smaller withdrawal than some were expecting (and less impressive expectations for the next two weeks) could put a bit more pressure on prices until long-range GWDD additions arrive.

“We see this number as marginally increasing the odds of a test of $2.92-2.93 support, but do not see it shifting our underlying understanding of the current market balance.”

Inventories now stand at 3,726 Bcf, versus 4,045 Bcf a year ago and a five-year average of 3,847 Bcf. The year-on-five-year deficit increased for the week to 121 Bcf from 101 Bcf.

Analysts with Wells Fargo Securities LLC said based on their models and current weather forecasts they project “a cumulative withdrawal of 78 Bcf for the next two weeks, which would move the deficit versus the five-year average to 140 Bcf.”

By region, EIA reported a 24 Bcf withdrawal in the East and an 18 Bcf withdrawal in the Midwest. The Mountain region was unchanged week/week, while the Pacific saw a 1 Bcf withdrawal. In the South Central region, 3 Bcf was withdrawn for the week, including 1 Bcf from salt and 2 Bcf from nonsalt.

Meanwhile, Wednesday’s spot market was dripping in red ink, with forecast weak demand following the Thanksgiving holiday not offering much incentive for buyers to lock in deals through the long weekend. The NGI National Spot Gas Average tumbled 17 cents to $2.74.

Day-ahead trading featured double-digit losses from coast-to-coast as forecasts showed a lack of sustained heating demand.

In its six- to 10-day outlook Wednesday, MDA Weather Services said the forecast “features a larger warm change in this period, with these adjustments being largest from the Midwest to the East. This comes in what is expected to remain a progressive pattern, but with rounds of high pressure lacking colder source regions.

“The result is a period which averages above normal from the West to the Midwest and including much-aboves in parts of the Southwest and Rockies. Farther east, a variable regime has temperatures being near normal overall, but with early period belows being replaced by aboves in the mid-period.” The European models “remain warmer in the East.”

Genscape Inc. said Wednesday that its models “through the end of the month show brief spikes in heating degree days (HDD) lasting for a day or two, followed by warming periods before the next cold air surge. This trend is shown by a slight increase in population-weighted HDDs through Thanksgiving Day, followed by a substantial decrease after the holiday, with another spike through Monday. The Midwest, East and South Central regions are expected to contribute heavily to this trend, while the Pacific and Mountain regions show milder forecasts.”

Every region followed by NGI finished firmly in the red Wednesday. Day-ahead and weekend deliveries at Henry Hub dropped 12 cents to average $2.93.

In the Northeast, Iroquois Waddington fell 18 cents to $3.04, while Transco Zone 6 New York dropped 6 cents to $3.

In Appalachia, Dominion South dropped 9 cents to $2.42, and Columbia Gas fell 11 cents to $2.79.

Several Midwest and Midcontinent points posted losses of 20 cents or more, including Chicago Citygate (down 22 cents to $2.83) and Northern Natural Demarcation (down 25 cents to $2.73).

Out West, the constraint-driven volatility at SoCal Citygate led prices there to tumble $1.28 to $3.03 Wednesday. Surrounding points also fell. SoCal Border Average gave up 23 cents to $2.63. Kern Delivery dropped 29 cents to $2.57.

Points in the Rockies and West Texas were also hit hard. Kern River fell 25 cents to $2.46, while El Paso Permian dove 27 cents to $2.28.

While the gas markets seemed to be reacting to medium-term weather concerns Wednesday, the underlying fundamentals for natural gas continue to look bullish, according to analysts.

“Winter weather is off to a strong start” after two consecutive weekly storage withdrawals, a team of analysts with Jefferies LLC wrote in a note to clients Wednesday. “Last week’s 18 Bcf withdrawal marked the earliest storage withdrawal since 2012 and marked only the third withdrawal from storage in the second week of November over the last decade.

“Through the first three weeks of November, gas storage has been drawn down by an aggregate 49 Bcf, which compares to an average aggregate injection of 132 Bcf over the past two years.”

Colder weather year/year and growth in exports — including an average of roughly 2.9 Bcf/d in liquefied natural gas exports month to date — have helped boost demand to offset higher production averaging 75.8 Bcf/d month-to-date, the Jefferies analysts said.

“While we do not consider ourselves meteorologists, the winter is clearly off to a stronger start and conditions for La Nina are currently developing, meaning colder weather across the northern part of the U.S. may be more likely. Using five-year average winter withdrawals, storage would exit the winter at around 1.5 Tcf, roughly 12% below the five-year average and 23% below the prior year average,” though the extent of winter cold may alter the final outcome considerably.

Analysts with Societe Generale said Wednesday they “see significant upside potential on short-term U.S. natural gas prices, and forecast 1Q2018 prices to average $3.40/MMBtu (versus March 2018 currently trading at $3.12/MMBtu). Fundamentals have tightened over the past year; however, two sequential weak-weather winters have succeeded in camouflaging underlying fundamentals. Winter 2017-2018, which started Nov. 1, is in a position to finally expose the underlying tightness” in the market.

As for production, the U.S. rig count continued to rebound for the week ended Wednesday, according to Baker Hughes Inc., which released its drilling data for the short week ahead of the holiday.

The United States added eight rigs to end the week at 923, with the return of nine oil-directed rigs offsetting the loss of one gas-directed unit. Canada added nine gas-directed rigs to offset two oil-directed units exiting the patch. That left the combined North American rig count at 1,138, up 15 week/week and 371 higher than a year ago.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |