NGI Data | Markets | NGI All News Access

Storage Withdrawal Not Enough to Lift December NatGas Ahead of Holiday

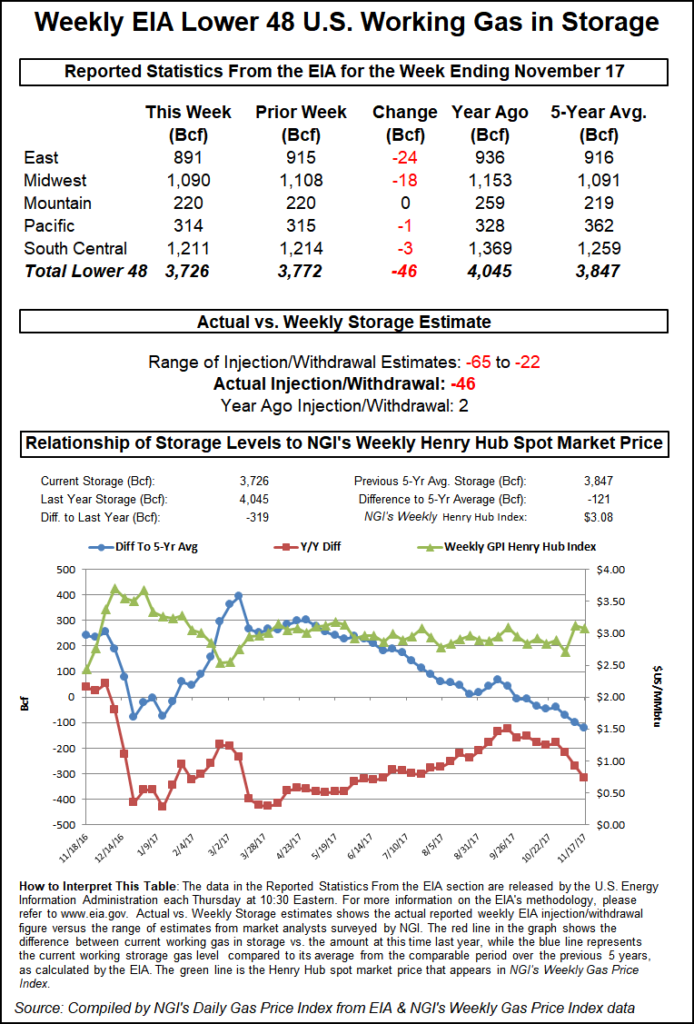

The Energy Information Administration (EIA) reported a net 46 Bcf withdrawal from U.S. natural gas stocks for the week ended Nov. 17, a slightly smaller decline than what the market had been expecting.

The number came out a day early due to the Thanksgiving holiday, and in the minutes immediately following the noon eastern release on Wednesday the prompt-month traded as low as $2.959 and as high as $2.976. By 12:30 p.m. eastern, December had climbed above $2.980, down about 3 cents from Tuesday’s settle.

The December contract had been trading lower prior to EIA’s report, with some warming in the medium-range forecast pushing the market below the gap in the chart that formed when prices surged on the first arrival of winter weather earlier in the month.

The market had been looking for a withdrawal somewhat larger than the actual figure.

A Reuters survey of 23 traders and analysts had predicted on average a 51 Bcf withdrawal for the week ended Nov. 17. Responses to the Reuters survey ranged from -63 Bcf to -22 Bcf. Last year, 2 Bcf was injected, and the five-year average stands at -26 Bcf.

Stephen Smith Energy Associates was calling for a withdrawal of 48 Bcf. ION Energy’s Kyle Cooper was calling for a 51 Bcf withdrawal, while PointLogic Energy was forecasting a net 54 Bcf decline in inventories.

“This print will likely not provide a catalyst to break prices higher in the face of bearish weather risks in the medium-range that will hold out into the first week of December as well,” said Bespoke Weather Services, which had counted some gas-weighted degree day (GWDD) losses in the overnight weather data. “If anything, a slightly smaller withdrawal than some were expecting (and less impressive expectations for the next two weeks) could put a bit more pressure on prices until long-range GWDD additions arrive.

“We see this number as marginally increasing the odds of a test of $2.92-$2.93 support, but do not see it shifting our underlying understanding of the current market balance.”

Inventories now stand at 3,726 Bcf, versus 4,045 Bcf a year ago and a five-year average of 3,847 Bcf. The year-on-five-year deficit increased for the week to 121 Bcf from 101 Bcf.

Analysts with Wells Fargo Securities said based on their models and current weather forecasts they’re projecting “a cumulative withdrawal of 78 Bcf for the next two weeks, which would move the deficit versus the five-year average to 140 Bcf.”

By region, EIA reported a 24 Bcf withdrawal in the East and an 18 Bcf withdrawal in the Midwest. The Mountain region was unchanged week/week, while the Pacific saw a 1 Bcf withdrawal. In the South Central region, 3 Bcf was withdrawn for the week, including 1 Bcf from salt and 2 Bcf from nonsalt.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |