Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

North American E&Ps Preaching Austerity, But History Indicates Otherwise, Say Analysts

North American oil and gas producers during third quarter conference calls repeated a mantra of capital discipline and living within cash flow heading into 2018, as they navigate a surfeit of output and insufficient infrastructure.

Exploration and production (E&P) management teams pledged allegiance to their bottom lines, while top executives of oilfield services (OFS) operators said they’re finally capturing higher prices following the devastating downturn.

“To listen to producers during 3Q2017 earnings season was to hear actors auditioning for the same part, reading the same lines from the same script,” said BMO Capital Markets analyst Dan McSpirit.

“The story was about capital discipline or growth within cash flow or some variation of it. We’ll

call it a work of fiction for now, pointing to the industry’s past that doesn’t provide much evidence to support a change in behavior.”

McSpirit said some E&Ps told “tall tales” during the quarterly earnings calls regarding capital discipline, with only a few acknowledging that overspending is to be “expected and accepted” if returns in the field exceed the cost of capital and depending on where an operator is in its lifecycle.

Evercore ISI’s James West said the word “austerity” has been added to the E&P lexicon, while “oil prices and E&P gluttony appear to be on diverging paths.” Producers stressed during the quarterly calls that growth would become an “output, rather than an input,” for their capital allocation strategy.

What He Said

A few of the top onshore operators led the charge for living within cash flow.

For example, Devon Energy Corp. is tieing its 2018 capex to operating cash flow based on average prices of $50/bbl West Texas Intermediate (WTI) and $3.00/Mcf Henry Hub.

Devon CEO Dave Hager said during the third quarter conference call that the “top objective” was to deliver returns on invested capital.

“This balanced operating model is in contrast to the industry’s historical behavior of aggressively chasing top line growth at the ultimate expense of shareholders,” Hager said. “This is not a populist philosophy that we are paying lip service to; we are absolutely committed to doing business differently in the E&P space, and we are taking the appropriate steps to become an industry leader with our disciplined approach to capital allocation.”

Anadarko Petroleum Corp. CEO Al Walker, who noted that the E&P is gearing 85% of its 2018 capex plan to the United States, said the company has been stressing discretion since early 2015.

“We made it very clear that we were going to focus on, and I quote, ”preserving value and flexibility rather than chasing growth in a lower return environment,’” Walker said of a commitment made almost three years ago. “We significantly pulled back our activity, reduced our cash costs and began the process of refocusing our portfolio on higher-margin scalable oil assets, with growth as an output, not an objective.”

Said Walker, “I don’t think at this juncture talking about the compounded annual growth is as important as making sure that we give you the type of returns in a $50 world that this budget we believe, if ratified, will provide. So, growth at this point is really going to be, as I said earlier, an output, not an input.”

Marathon Oil Corp. CEO Lee Tillman also stressed during the quarterly call that production growth would be “an outcome of our capital allocation to the highest risk-adjusted returns,” with about 95% allocated to U.S. resource plays.

“As we sit here today, if you think about what investors are calling for today, it’s somewhat different than it was a one-and-a-half to two years ago to some degree, maybe not totally, but to some degree,” Tillman said. “And so, I think what we’ll do is we’re trying to get this message out there. Our plan is to be generating free cash. And we’ll look at, at what investors really are calling for. And that optionality is the key for us.”

EOG Resources Inc. CEO Bill Thomas also claimed during the quarterly conference call that the Houston E&P was “committed to returns, living within our means and maintaining a strong balance sheet.” Production growth “should be the result of investing in high-return drilling and we have never been fans of outspending cash flow to pursue growth for growth’s sake,” Thomas said.

Lip Service Or Fact?

“Assuming these companies aren’t just paying lip service to a malcontent shareholder base, the OFS industry can no longer bank on E&Ps inevitably outspending cash flow by 20%/annum,” West said.

“However, we believe a more disciplined E&P industry, particularly in North American shale, is a constructive development for commodity prices, and higher oil prices and associated cash flow soften the impact of austerity.”

The analyst team at Tudor, Pickering, Holt & Co. (TPH) said corporate messaging on the quarterly conference calls was generally aligned with the push for more capital discipline. However, on average, many E&Ps raised their full-year 2017 budgets ahead of the updates while production guidance was static.

Producers covered by TPH are forecasting a ramp in oil production through the end of this year, averaging about 9% higher than in 3Q2017.

“Execution will be key for operators to hit guidance numbers,” the TPH team said. “Budget increases are mostly attributed to a few quarters impacted by service inefficiencies and cost inflation, with a few operators citing a bring-forward of infrastructure projects as a bump to capital spend.

“We expect some of these pressures to continue into the first half of 2018, and we’ll be watching for commentary as operators release 2018 budgets.”

The Sanford Bernstein team led by Bob Brackett did a deep dive on the financial and operational performance metrics for 60 North American E&Ps based on 3Q2017 data. It discovered that overall, capital expenditures are inching higher, with no production gains.

“In 2016, the theme was survive,” Brackett said. “Someday the theme will be thrive. We are somewhere in between — either strive (definition: to devote serious energy) or jive (definition: glib, deceptive, or foolish talk).”

E&Ps remained “sheepishly profitable” during the third quarter, even with sequentially flat West Texas Intermediate oil prices that averaged $48/bbl and a sequential decline in average natural gas prices of about 4% to $2.90/Mcf.

On average, Bernstein found that U.S./Canadian E&Ps returned only a small profit of 50 cents//boe in the quarter on $15/boe of organic capital expenditures (capex). Production for the 60 E&Ps reviewed increased by 3.4%.

“However, U.S.-only production was down by -0.45%, and most of the increase was by Canadian E&Ps,” Brackett said. Production included the impacts of acquisitions and divestitures.

Meanwhile, overall North American E&P cash costs per barrel rose 5.5% in 3Q2017 on the back of a 53% increase in exploration expenses. Production costs also were 3% higher.

Don’t Count On Deflation

“Said another way, don’t count on deflation going forward,” Brackett said. “After four consecutive quarters of underspend, E&Ps returned to overspending. Organic capex only increased by 12% while operating cash flow increased by 2%. As a result, E&Ps spent 106% of cash flow on organic capex in 3Q2017.”

It’s “not a terrible misstep,” he said as the North American E&P business model overall is tied to keeping organic capex in check with operational cash flow.

Capital restraint by E&Ps would “undeniably” diminish the near-term growth prospects for OFS companies, as a shallower capex ramp would compress industry-wide revenue growth, Evercore’s West said.

“Moderated E&P production growth will accelerate and exacerbate the inevitable supply crunch sown by several years of dramatic underinvestment and reserve replacement, in our view.”

The North American OFS results in the third quarter “reignited investor vigor,” West said. The “OFS narrative…is steadily gaining traction heading into year-end — and with crude breaking out above multi-year highs, a long-overlooked international/offshore beast has reawoken.”

Leading-edge pricing is moving higher for North America’s land-based OFS operators, but the speed at which they push pricing may be an important differentiator.

While OFS shareholders may push operators to raise pricing in what has become an under-supplied market, the more “cerebral” operators, which “take a full-cycle view on service quality and customer relationships,” have become more selective about their customers.

“In our view, those OFS providers that can maintain a healthy pricing dialogue with E&Ps, and make up for the more methodical pricing ramp with execution and throughput, will ultimately dominate in the longer term,” West said.

A combination of improving crude prices, “leaner and meaner” E&Ps post-downturn and a clean slate going into 2018 “all culminate in an energy setup that is poised to shatter even the most bullish of expectations.”

During the tumultuous energy downturn, the “scavengers and vultures subsisted on short-term moves and false rallies,” and “it’s time for the big game predators to get back in the hunt,” West said.

Shale Booming, Values Not So Much

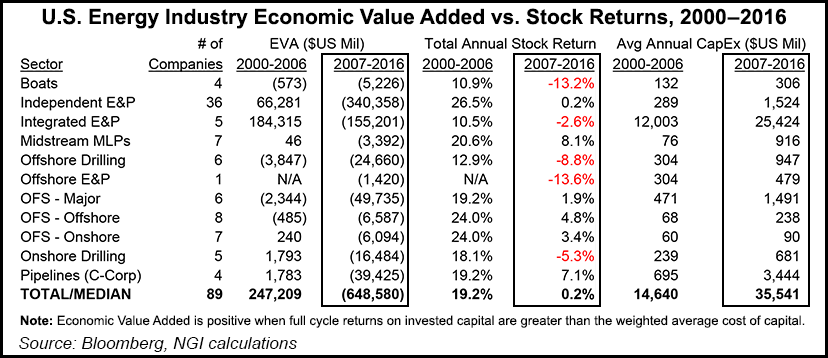

NGI’s Patrick Rau, who directs strategy and research, last summer compared the economic value added for the U.S. oil and gas industry before and after unconventional exploration exploded.

“Many industry executives have extolled the virtues of the shale revolution, and how it has created enormous value in the form of things like lower prices for consumers, greater employment and a large increase in tax revenue,” Rau said. “This is all true, but so far, the shale industry has failed to create much value for energy companies.

“Stock price movements can a terrible way to measure value added, especially over the short-run, when stock prices can be driven to unsubstantiated heights by bubble-crazed momentum investors.”

The “true test of value over time,” he said, is whether a company creates positive economic value added (EVA), which is a function of how much a capital is invested, and more important, whether return on invested capital is more than the weighted average cost of capital.

“Since the U.S. shale boom really took off in 2007, EVA in the U.S. energy patch has been decidedly negative,” Rau noted.

From 2000-2006, a group of 89 publicly traded U.S. E&P, OFS and midstream companies generated a combined EVA of $247 billion, “and were rewarded with a median annual stock return of 19.2% during that period,” Rau said. “However, that same group of firms generated nearly $650 billion of negative EVA from 2007-2016, and their median annual stock returns during that time were basically nil.”

Since 2007, he said, no industry sector has been immune from generating negative EVA.

“There is no question a big driver for the poor returns has been a massive overspend of cash flows,” Rau said. For the 89 operators he reviewed, the average annual capex increased to $35.5 billion from 2007-2016 from $14.6 billion from 2000-2006.

For E&Ps in particular, it may be difficult to contain themselves if WTI prices remain above $55/bbl for any significant length of time, but the massive overspend by the industry has set it up to generate better returns going forward, if it so chooses, Rau said.

“The huge returns from 2000-2006 will be tough to achieve again, particularly for U.S. E&P companies, since that was marked by a period of production declines that stemmed from a lack of exploration spending,” he said.

“Producers were more in a harvest mode in those days, which helped generate nice returns on capital. But obviously, at some point, they have to invest to replace reserves and that is something U.S. independents in particular have done in droves in recent years.

“The result is many now have many years of drilling inventories they can focus on, without having to incur as much spending on things like land acquisition, geoscience, and in more mature areas, infrastructure spending. All that should help increase returns on invested capital going forward, everything else being equal.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |