Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Bill Barrett Exits Uinta with Full Focus on DJ

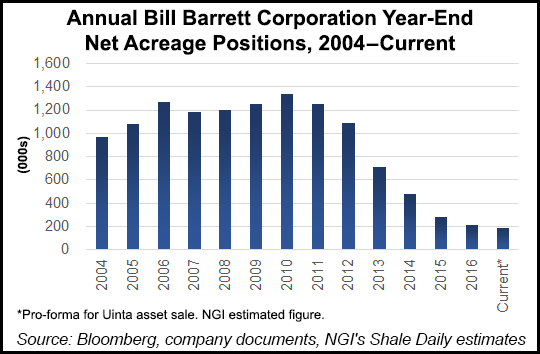

Bill Barrett Corp. on Monday agreed to sell its remaining assets in Utah’s Uinta Basin for $110 million.

The assets, which were sold to undisclosed parties, produced 2,300 boe/d during the third quarter, 91% weighted to oil. Estimated proved reserves, 100% proved developed, totaled 12 million boe at the end of 2016.

“This sale transitions us into a pure-play Denver-Julesburg (DJ) Basin company, further streamlines our operational cost structure and strengthens our balance sheet and liquidity,” said CEO Scot Woodall.

The Rockies long have been Bill Barrett’s primary focus. Increasingly, however, the independent has sharpened its skills in the DJ, and specifically extended laterals within the Wattenberg field of Colorado.

“We have a top-tier oil position in the DJ Basin, with our 2017 capital program underpinning a strong growth profile in 2018 as we expect to generate greater than 30% growth from our northeast Wattenberg assets,” Woodall said.

The 2018 capital program is expected to be “fully funded as we exit 2017, with a significant cash position and an improved leverage ratio.”

During the third quarter, the producer surpassed guidance of 1.75 million boe by 10%, with volumes 23% higher year/year and 26% higher sequentially to 1.92 million boe.

Natural gas volumes during the third quarter were 18% higher from a year ago and 31% higher sequentially at 2.274 MMcf. Oil volumes jumped 18% year/year and 33% sequentially to 1.2 million bbl. Lease operating expenses were down by 18% from a year ago and fell 15% sequentially.

“We now anticipate 2017 production growing over 20% relative to 2016 and expect to generate greater than 30% growth in 2018,” Woodall said during the third quarter call.

The Uinta sale is expected to be completed by the end of the year. Tudor, Pickering, Holt & Co. advised the company in the sale process.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |