NGI Weekly Gas Price Index | Markets | NGI All News Access | NGI Data

Winter Arrives to Find NatGas Bulls Ready to Shake Off Shoulder Season Lull

Winter started during the week ended Nov. 10, at least as far as natural gas markets were concerned.

Broad-based gains of 30 cents or more at points from Texas to California to the Northeast propelled the NGI Weekly Spot Gas Average 67 cents to $3.09/MMBtu, eclipsing the $3 mark for the first time since May.

The big story was a cold blast that moved through the Northeast and Midwest late in the week. Forecasts of lows in the 20s in cities like Boston, New York and Chicago came in like a rush of chilly winter air and jolted the natural gas market out of its shoulder season doldrums.

In the spot market, the Northeast Regional Average jumped $2.17 week/week to $4.02. Algonquin Citygate, known to be volatile during cold weather, gained $3.10 this week to $4.50. Tennessee Zone 6 200L similarly added $3.61 to $5.07.

Further south, Transco Zone 6 New York climbed $1.82 to $3.68, while Transco Zone 5 North gained $1.19 to $3.26 as the late-week cold blast hit parts of the Mid-Atlantic.

Appalachian points were lifted by the winter demand. Dominion South posted strong gains early in the week and finished $1.37 higher at $2.28. Tetco M3 Delivery tacked on $1.57 to $2.60.

In the Midwest, Chicago Citygate finished up 43 cents on the week at $3.19, while Joliet gained 39 cents to $3.13.

Out West, the standout was SoCal Citygate, which continues to experience volatility amid limited import and storage capacity. SoCal Citygate finished the week $1.07 higher at $4.17.

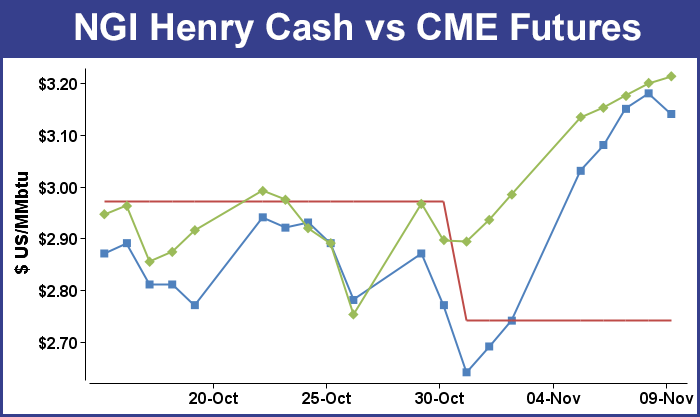

In the futures market, after testing the $3.17 area earlier in the day Friday, the December contract settled 1.3 cents higher at $3.213, while January added 0.9 cents to settle at $3.306. Friday’s gains capped off a strong week for gas; after surging last Monday on the market’s first glimpse of winter cold, the prompt-month never looked back, ending the week more than 20 cents above last Friday’s settle of $2.984.

An on-the-nose natural gas storage figure from the Energy Information Administration (EIA) Thursday triggered some selling in the December contract, with the market showing some disappointment that the actual injection — while lean — didn’t come in lower than consensus.

The EIA reported a 15 Bcf injection for the week ended Nov. 3, right in line with market expectations. In the minutes following EIA’s 10:30 a.m. EDT publication, the December contract dipped into the $3.180 range after taking out technical resistance earlier in the morning and climbing as high as $3.216. By 11 a.m. EDT December was trading around $3.190.

“This print once again fell right within market expectations and has resulted in only gradual selling since its release. It was slightly larger than expected, which may put a temporary halt on the rally we have seen as of late and may encourage longs to take profits,” said Bespoke Weather Services in a post-release note to clients.

“However, we do not think the number reflects any material week/week loosening, as it is about on par with last week. Accordingly, we have not adjusted our expected prints over the next three weeks, and see any profit-taking off this print as temporary in the face of broader bullish weather expectations.”

Steve Blair, vice president of Rafferty Commodities Group, said the market seemed a little disappointed in the 15 Bcf figure given talk that the number could come in even lower than the consensus.

“That was a very wide range of estimates…and so sometimes you’ve got to take with a grain of salt the average. It could be that the market was actually looking for a little bit less than that, or it could be that the market got what it expected, is disappointed it wasn’t a smaller injection, and now we’re back to the whole weather scenario,” Blair said.

This could be a case of “buy the rumor, sell the fact, with the market still not believing that we’re heading into winter yet,” he said.

Prior to the storage figure release, consensus was for a build in the teens. A Reuters survey of traders and analysts called for a build of 15 Bcf, with a range of -3 Bcf to +32 Bcf. Kyle Cooper of IAF Advisors predicted a 14 Bcf injection, and Stephen Smith of Stephen Smith Energy also estimated a build of 14 Bcf.

Last year 54 Bcf were injected, and the five-year average stands at +45 Bcf.

Total working gas in underground storage now stands at 3,790 Bcf. That’s below the five-year average of 3,861 and well below year-ago inventories of 4,009 Bcf.

The East (-1 Bcf) and Mountain (-2 Bcf) regions saw net withdrawals for the week. The Midwest injected 5 Bcf, while the South Central region injected 13 Bcf.

Natural gas for weekend and Monday delivery traded in the red from coast-to-coast Friday amid a let-off in expected demand following the cold blast sweeping through the Northeast and Midwest. Northeast prices moderated from Thursday’s weather-driven spikes as Midwest points fell by double digits, and the NGI National Spot Gas Average notched a 24-cent decline to end the week at $3.16.

Having posted gains for five consecutive days, natural gas has shown that it’s “a very strong market for the first time in months,” said Powerhouse CEO Alan Levine, whose risk management firm is based in Washington, DC. “There was an effort to bring it down to $3.17, but it couldn’t hold it…the market continued to show strength,” he told NGI.

Levine said he would expect to see support hold in the $3.15 area, with targets to the upside in the $3.32 to $3.43 range.

“You may have some profit-taking early in the week,” he said. “I think that’s the real next big test. If you can hold that sell-off, wherever it goes to, then you may have the beginning of a new wave that brings us higher. But overall, I think the market has demonstrated that it has some legs.

“This wasn’t just a knee-jerk reaction,” Levine added. “That gap is still staring at us and nobody’s selling it. I have to think that even if you see a setback at this point, you may see that as a buying opportunity.”

The December contract traded as high as $3.224 Friday. The last time the prompt month traded above $3.20 was in May. The high that month was $3.431.

Forecasters see some questions surrounding which way temperatures may go late in the month.

“The latest mid-day data maintained a weather system and cold blast arriving into the eastern U.S. Nov. 18-20, with a second one quick to follow Nov. 22-23,” said NatGasWeather.com in a note to clients. “The focus will then turn to if additional systems can continue to close out November, which the data is mixed on.

“…If additional weather systems gain momentum in the weekend data to close out November, weather sentiment will likely be considered bullish when the markets re-open. Although the latest datasets are mixed on if that will occur, as some solutions suggest a milder ridge will build back toward the east-central U.S.”

Bespoke Weather Services also pointed to some risks for a warmer pattern developing in the Midwest in late November.

“After slightly bullish sentiment through the entire week…our sentiment has turned back to neutral heading into the weekend as we have begun to see some bearish risks increase in long-range forecasts,” Bespoke said. “We are not yet confident enough in them to turn slightly bearish at these levels, but should we see a warmup across the center of the country into week three we would likely see prices pull back next week.”

In the spot market, there was red ink spilled everywhere, with forecasts calling for warming to occur through the weekend and into next week in places like Chicago, Boston and New York. Projections from natural gas analytics firm Genscape Inc. showed demand expected to fall Saturday through Monday in key regions such as the Midwest, Northeast, Appalachia and California.

In New England, where Genscape forecast demand to fall from 3.76 Bcf/d Friday to 2.73 Bcf/d by Monday, Algonquin Citygate dropped $2.60 to end at $5.59. Iroquois Waddington fell 77 cents to $3.81.

Appalachia demand, including New York and New Jersey, was expected to drop from 16.09 Bcf/d Friday to 12.72 Bcf/d Monday, according to Genscape. Midwest demand was expected to drop from 17.17 Bcf/d to 13.45 Bcf/d by the start of next week.

Transco Zone 6 New York fell $2.24 to $3.43, and Chicago Citygate dropped 17 cents to $3.17.

Out West, the recently volatile and constrained SoCal Citygate dropped $1.07 to $3.77. In California, Genscape was forecasting regional demand to fall by around 1 Bcf/d over the weekend.

Price points in producing regions also saw declines Friday. Dominion South retreated 8 cents to $2.40, while NGPL Midcontinent dropped 10 cents to $2.82. The West Texas regional average dropped 18 cents, including El Paso Permian, which gave up 20 cents to finish at $2.66.

With winter here at last, natural gas had a good week, but it isn’t the only commodity looking bullish lately.

Oil prices have surged recently, with the December Nymex contract trading above $57/bbl Friday, pointing to a potential recovery in U.S. onshore activity following a pullback in the rig count observed since the summer.

After more than a month of retrenchment, the domestic rig count bounced back for the week ended Friday on growth in oil-focused activity in the U.S. onshore, according to data from Baker Hughes Inc.

The United States added nine rigs — all land units and all oil-directed — to grow its tally to 907, versus 568 in the year-ago period. The gains break a five-week losing streak that saw the domestic rig count fall by 42 units going back to early October. The nine-rig increase is also the highest weekly increase since U.S. drillers added 12 rigs for the week ended July 7.

December crude oil settled Friday at $56.74, down 43 cents on the day but from about $52/bbl in late October.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |