NatGas Rig Count Flat as Oil Drives Bounce-Back Week for U.S.

After more than a month of retrenchment, the domestic rig count bounced back for the week ended Friday on growth in oil-focused activity in the U.S. onshore, according to data from Baker Hughes Inc. (BHI).

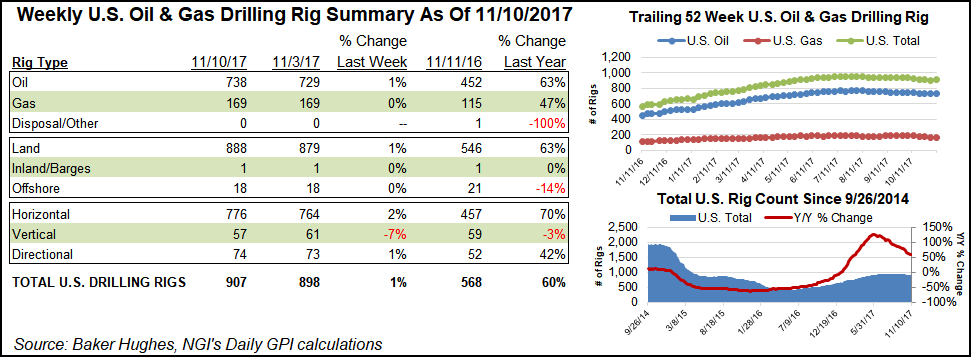

The United States added nine rigs — all land units and all oil-directed — to grow its tally to 907, versus 568 in the year-ago period.

The gains break a five-week losing streak that saw the domestic rig count fall by 42 units going back to early October. The nine-rig increase is also the highest weekly increase since U.S. drillers added 12 rigs for the week ended July 7.

Oil prices have surged recently, with the December Nymex contract trading above $57/bbl Friday, pointing to a potential recovery in U.S. onshore activity following the pullback observed earlier in the year.

The United States added 12 horizontal units for the week along with one directional unit. Four vertical units left the patch.

Canada also gained, adding eight oil-directed rigs and four gas-directed to exit the week at 203 rigs, versus 176 a year ago.

That leaves the combined North American rig count at 1,110, up from 1090 a week ago and 744 in the year-ago period.

Among plays, BHI reported big gains for the week in the Permian Basin and the Cana Woodford — aka the SCOOP (South Central Oklahoma Oil Province) and STACK (Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties).

The Permian — located in West Texas and southeastern New Mexico — added six rigs for the week to finish at 386, while the Cana Woodford added seven rigs to end at 73. That includes a gain of three rigs in the SCOOP and three in the STACK.

The Eagle Ford Shale in South Texas also gained this week, adding two rigs to finish at 67, while the Utica Shale gave up one rig to end at 29.

The rig exiting the Utica appears to have been running in West Virginia, which dropped a rig to fall to 12, while Ohio and Pennsylvania held flat week/week at 29 and 31 rigs, respectively.

Also among states, reflecting the growth in the Permian and SCOOP/STACK, New Mexico added four rigs, while Oklahoma tacked on six. Utah and Alaska each added a rig, while Texas dropped by two to exit the week at 442 active units.

How higher oil prices will influence exploration and production (E&P) capital expenditures heading into 2018 remains to be seen.

With West Texas Intermediate prices above $55/bbl, “bullish conviction could not be higher,” Evercore ISI analysts said in note to clients earlier in the week.

Looking at the latest round of third quarter earnings results, a team led by Evercore analyst James West observed that “oil prices and E&P gluttony appear to be on diverging paths as E&P conference calls have overwhelmingly emphasized a commitment to spending within cash flow and maximizing shareholder returns…Moderated E&P production growth will accelerate and exacerbate the inevitable supply crunch, in our view.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |