NGI Data | Markets | NGI All News Access

On-Target NatGas Storage Figure Triggers Some Profit-Taking

An on-the-nose natural gas storage figure from the Energy Information Administration (EIA) Thursday triggered some selling in the December contract, with the market showing some disappointment that the actual number didn’t come in lower than consensus.

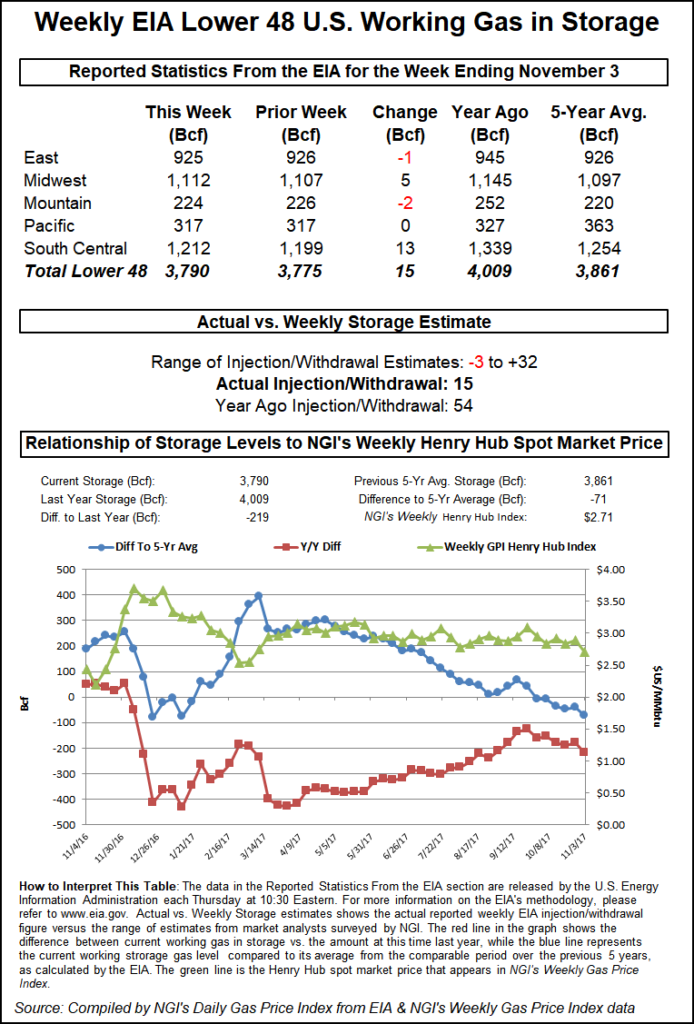

The EIA reported a 15 Bcf injection for the week ended Nov. 3, right in line with market expectations. In the minutes following EIA’s 10:30 a.m. EDT publication, the December contract dipped into the $3.180 range after taking out technical resistance earlier in the morning and climbing as high as $3.216. By 11 a.m. EDT December was trading around $3.190.

“This print once again fell right within market expectations and has resulted in only gradual selling since its release. It was slightly larger than expected, which may put a temporary halt on the rally we have seen as of late and may encourage longs to take profits,” said Bespoke Weather Services in a post-release note to clients.

“However, we do not think the number reflects any material week/week loosening, as it is about on par with last week. Accordingly, we have not adjusted our expected prints over the next three weeks, and see any profit-taking off this print as temporary in the face of broader bullish weather expectations.”

Steve Blair, vice president of Rafferty Commodities Group, said the market seemed a little disappointed in the 15 Bcf figure given talk that the number could come in even lower than the consensus.

“That was a very wide range of estimates…and so sometimes you’ve got to take with a grain of salt the average. It could be that the market was actually looking for a little bit less than that, or it could be that the market got what it expected, is disappointed it wasn’t a smaller injection, and now we’re back to the whole weather scenario,” Blair said.

This could be a case of “buy the rumor, sell the fact, with the market still not believing that we’re heading into winter yet,” he said.

Prior to the storage figure release, consensus was for a build in the teens. A Reuters survey of traders and analysts called for a build of 15 Bcf, with a range of -3 Bcf to +32 Bcf. Kyle Cooper of IAF Advisors predicted a 14 Bcf injection, and Stephen Smith of Stephen Smith Energy also estimated a build of 14 Bcf.

Last year 54 Bcf were injected, and the five-year average stands at +45 Bcf.

Total working gas in underground storage now stands at 3,790 Bcf. That’s below the five-year average of 3,861 and well below year-ago inventories of 4,009 Bcf.

The East (-1 Bcf) and Mountain (-2 Bcf) regions saw net withdrawals for the week. The Midwest injected 5 Bcf, while the South Central region injected 13 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |