NGI Data | Markets | NGI All News Access

Whispers of Lean NatGas Storage Help Prop Up December; Cash Bulls Out En Masse

Natural gas futures settled higher Wednesday, but some choppy action showed a skeptical market weighing expectations of a slim storage figure against a potential pullback following a late-week cold snap in the northern states that’s expected to come and go.

Meanwhile, that cold snap, with lows in the 20s expected Thursday and Friday in Boston, Chicago and New York, had the bulls out en masse in Wednesday’s cash market. Led by double-digit gains in the Midwest, Midcontinent, Northeast and Appalachia, the NGI National Spot Gas Average added 14 cents to finish at $3.09/MMBtu, eclipsing $3 for the first time since May.

In the futures market, predictions of a well-below-five-year storage figure Thursday from the Energy Information Administration (EIA) helped the December contract recover after trading lower prior to the open. December settled up 2.3 cents to 3.175, while January added 2.1 cents to 3.272. December crude oil gave up 39 cents to settle at $56.81/bbl.

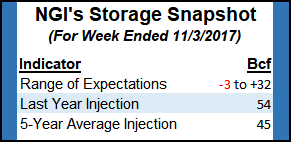

A Reuters survey showed traders and analysts expecting EIA to report a build of 15 Bcf for the week ended Nov. 3, with a range of -3 Bcf to +54 Bcf. The five-year average build for the period is 45 Bcf.

The market could get “a wake-up call” Thursday given the underlying tightness in the supply/demand balance, according to senior market analyst Phil Flynn of The Price Futures Group.

“It is a little choppy. I think there’s a little bit of discussion on where this is going to come in. We really seem to be in the area where this is either a breakaway bottom gap where you’re just going to go higher all winter,” or there could be a pullback down to $3, Flynn told NGI.

A storage figure in the teens “would be good, but the whisper number we’re hearing is 7 or 8 Bcf. We know there’s been an incredible amount of demand. The weather has been bullish. I think this could be a wakeup call,” he said.

On the underlying tightness in the market, Flynn pointed to pipeline delays, including this week’s announcement that the 1.5 Bcf/d Leach XPress expansion won’t be online until January instead of this month, as originally planned.

“I think there’s a concern this winter that we’re going to get some prices spikes,” Flynn said. “Without that pipeline, it’s going to be difficult to get gas to where it needs to be, and that’s going to keep supplies tight during a high demand period.”

Forecasts continue to point to risks of a short-term pullback.

“We do continue to see further upside toward the $3.30 level over the next couple of weeks…yet in the short-term we continue to see room for a pullback that could be potentially larger than the small pullbacks we have seen each of the last two overnight sessions,” said Bespoke Weather Services in an afternoon note to clients. The European ensembles “came out warmer in the medium-range and showed more warmth lingering into the long-range, pulling natural gas prices back a few cents.”

Rafferty Commodities Group’s Steve Blair, vice president, said the market seems skeptical of the current weather, noting that the cold snap hitting the northern states later this week isn’t expected to stick around.

“I think the market is taking some of this with a grain of salt, because if the market really believed that we finally have cold weather and it’s here to stay, and storage numbers are dramatically lower” than the five-year average, “then this market would have gone a lot higher,” Blair told NGI. “I think traders are guarded, because the mid- to long-term forecast is not showing that we’re going to blast into winter. I don’t think traders are convinced it’s going to happen yet.”

On the technical side of things, Powerhouse CEO Al Levine said he would look for this market to climb to the 3.26-3.32 range.

Day-ahead traders weren’t dwelling on the long-range forecasts Wednesday, as there was plenty of buying to be done ahead of the colder temperatures moving into the northern portion of the country.

Weather Underground was calling for a low of 20 degrees Thursday in Chicago, and Chicago Citygate enjoyed a 23-cent bump to $3.31. Joliet added 19 cents to $3.23. Prices in the Midcontinent also saw significant strength Wednesday, with Northern Natural Demarcation surging 18 cents to $3.22.

With the first real blast of winter looming, points in the Northeast and Appalachia have surged this week, and yet both regional averages managed to climb even higher Wednesday. Algonquin Citygate tacked on 46 cents to $3.47, while Transco Zone 6 New York gained 11 cents to $3.19.

Too busy riding the weather-driven wave to worry about the Leach XPress delay, Appalachian prices generally gained by double digits. Dominion South added 31 cents to $2.58, surpassing its prior 30-day average by rural Pennsylvania mile. Tetco M-3 Delivery jumped 40 cents to $2.90, while Tetco M-2 30 Receipt climbed 16 cents to $2.44.

Out west, prices in the Rockies and California bounced back following declines Tuesday. The California regional average jumped 19 cents to $3.38. Still dogged by storage and import constraints, SoCal Citygate threw off the curve, adding 55 cents to $4.41.

Genscape Inc. analyst Joseph Bernardi told NGI that there are “two main potential culprits” for the increase at SoCal Wednesday given that demand levels, while higher, were not outside of the prior 30-day range.

PG&E began maintenance on Tuesday “that was supposed to limit their delivery capacity to SoCal to 0,” Bernardi said. “We’ve still seen some flows coming in” for Tuesday and Wednesday of 65 MMcf/d, “but volumes are still down by around 175 MMcf/d from the prior two-week average.”

Maintenance is expected to last through Friday, he said.

“SoCal has also been importing a significant amount of gas from Mexico at the Otay Mesa point. Normally flows are zero or negligible, but since mid-October they’ve been on the rise and have reached nearly 200 MMcf/d some days. These are essentially Permian molecules, which SoCal would normally be able to receive directly from El Paso Natural Gas (EPNG),” Bernardi said.

“However, with SoCal’s import capacity limited, this gas is flowing from EPNG to North Baja, then into Mexico at Ogilby and back to the U.S. at Otay Mesa.” With flows maxing out at Ogilby “we’d expect to see some price strength at SoCal Citygate in order to continue to incentivize imports.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |