NGI All News Access | Infrastructure | Markets

New Northeast Pipes Unlikely to Relieve DomSouth NatGas Prices

Even with nearly 11 Bcf/d of new takeaway capacity coming online to move more Appalachian natural gas supply to market, prices at the regional pricing hub Dominion South (DomSouth) will remain depressed until more infrastructure in northeast Pennsylvania and the Permian Basin in West Texas goes online, according to BTU Analytics senior energy analyst Matthew Hoza.

One of the largest — and perhaps most well-known — pipeline projects out of Appalachia is Energy Transfer Partners LP’s Rover Pipeline, a 3.25 Bcf/d system that, once completed, will move gas to markets as far south as the Gulf Coast and as far north as Ontario. Already, about 1.2 Bcf/d of gas is flowing on Rover, taking gas east-to-west out of the basin and opening up avenues to reach Gulf Coast markets.

Phase 1B, which BTU expects to be online by December, will add another 800,000 Mcf/d of capacity and open up another receipt point on the mega pipe. Phase 2, the final stage that will bring the pipe to its full 3.25 Bcf/d capacity, is expected to be in service next March.

But even a mammoth pipeline like Rover won’t be enough to provide DomSouth price relief, Hoza said. While Rover is expected to see high utilization rates on the portion of its line going to the Southeast, it is the Midwest-focused part of the line that Hoza has trouble seeing high utilization, except during the winter when demand is stronger.

“It’s when we get into the shoulder season, next spring, where we get into trouble,” Hoza said.

As demand dries up because of milder weather, the Midwest will also have to contend with the shuffling of gas flows resulting from increasing associated gas from the oil-focused Permian. BTU is projecting 367 MMcf/d of incremental gas growth in the Permian by the end of 2017. The Lakewood, CO-based company expects 3.3 Bcf/d of incremental gas growth by the end of 2019.

The Rockies and Midcontinent are all going to be targeting the Midwest area during shoulder season, and the demand won’t be there, Hoza said. “If Appalachia is going to compete with depressed Rockies and Midcontinent gas, then it’s going to have to price itself down as well. We don’t expect to see basis relief with Rover coming online.”

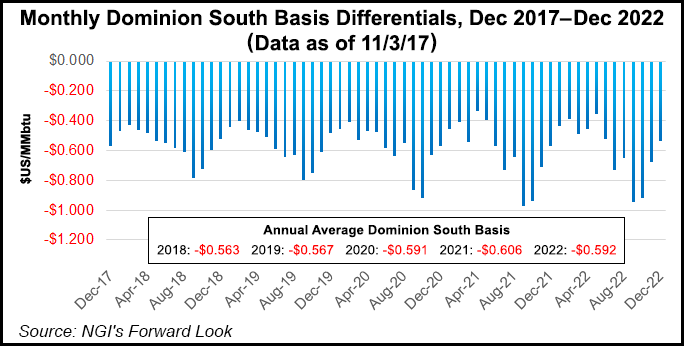

Indeed, NGI’s Forward Look shows DomSouth remaining at a steep discount to the benchmark Henry Hub throughout the forward curve, with the discount worsening as the years progress. Data for Nov. 2 shows DomSouth averaging 56.3 cents below Henry Hub in 2018, 56.7 cents below Henry in 2019, 59.1 cents below Henry in 2020 and 60.6 cents below Henry in 2021. The spread contracts ever so slightly in 2022, with DomSouth averaging at a 59.2-cent discount to Henry.

Even the slew of other projects aimed at delivering Appalachia gas supplies to market won’t offer much basis relief at DomSouth, Hoza said. What will occur as the new takeaway capacity comes online is that DomSouth will emerge as the marginal supplier of gas.

“If there is incremental demand in the Gulf, that will most likely be filled with incremental molecules from DomSouth,” Hoza said.

Still, it will not be until new infrastructure is built to serve northeast Pennsylvania and the Permian, likely around 2019-2020, that DomSouth will begin to see some price uplift.

Among the projects in northeast Pennsylvania is Williams Partners LP’s Atlantic Sunrise, a 1.7 Bcf/d pipeline that should be in service by mid-2018. The roughly $3 billion project would open a path for constrained Marcellus gas to reach markets in the Southeast through the Transcontinental Gas Pipe Line (Transco) system running along the Atlantic seaboard.

The expansion would include 197.7 miles of pipeline composed of about 184 miles of 30- and 42-inch diameter pipeline for the greenfield CPL North and CPL South segments in Pennsylvania; about 12 miles of 36- and 42-inch diameter pipeline looping known as Chapman and Unity Loops in Pennsylvania; about three miles of 30-inch diameter replacements in Virginia, and associated compressor stations, equipment and facilities.

FERC granted approval of Atlantic Sunrise in February, just hours before the Commission was left without a quorum amid then-Chairman Norman Bay’s resignation.

In the Permian, NAmerico, a joint venture partnership with Cresta Energy and backed by privately held NAmerico Energy Holdings LLC, began marketing their proposed Pecos Trail pipeline last winter. NAmerico continues to hold bilateral discussions with prospective shippers to gauge interest in the proposed 461-mile, 1.85 Bcf/d pipeline, and a final investment decision is expected by the end of the year.

Meanwhile, Kinder Morgan Inc. (KMI), is proposing the 1.92 Bcf/d Gulf Coast Express Pipeline (GCX), a 430-mile, 42-inch pipeline that would connect Permian gas to KMI’s Texas intrastate pipelines. Targa Resources Corp. has joined KMI and DCP Midstream LP as a third partner to develop the system. And during a conference call in October to discuss 3Q2017 results, KMI CEO Steve Kean said contracting talks are moving quickly for GCX, which would carry volumes produced by Pioneer Natural Resources Co. through its joint ownership in Targa’s West TX Permian Basin gas system.

While DomSouth will eventually see some price relief in the coming years, the same cannot be said for prices in northeast Pennsylvania. Hoza said he expects to see a greater divergence after 2020 between DomSouth and Tennessee Gas Pipeline (TGP) Zone 4 as limited infrastructure and extremely good well economics in northeast Pennsylvania essentially force producers to adopt what he called “shut-in economics,” as producers ask themselves what price they need to shut in the next molecule of gas.

“High utilizations out of northeast Pennsylvania will cause a divergence in TGP zone 4 and DomSouth pricing, as open capacity emerges out of western Appalachia while eastern Appalachia remains constrained,” Hoza said.

Drilling To Fill Pipes

Between January 2015 and mid-2016, a large decline in drilling activity did not coincide with a huge drop in production as it had historically. Instead, a backlog of drilled but uncompleted wells (DUCs) helped to keep Lower 48 supply relatively supported.

By the winter of 2016-2017, much of that backlog was essentially exhausted. With little to no backlog of DUCs ready to come online when new capacity enters service this winter, incremental production will depend on turning recently drilled wells to sales, Hoza said.

“Producers will have to drill to fill new capacity, but there is a six- to nine-month spud to sales time lag. That lends itself to normal working inventory that you’re going to have no matter what,” Hoza said.

But the current low price environment may not be able to support the kind of producer ramp-up needed to fill all the new capacity, management for Range Resources Corp. said during the recent 3Q2017 conference call.

“We believe the industry cannot support the production increases equivalent to the capacity added from these projects in southwest Pennsylvania, especially given where the strip is today and with sweet spot exhaustion,” Range COO Ray Walker said. “Unless we see a significant uptick in rig additions, we think the basin will see significant displacement of gas from local markets over the next few quarters as production is simply moved to better markets.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |