Eastern Pipeline Expansions Pound Eastern NatGas Cash; Futures Drift Lower

Physical natural gas for Thursday delivery took another step lower in Wednesday trading as steep declines in New England and Mid-Atlantic prices tugged the market lower.

Titanic losses in the Northeast prompted by increased pipeline capacity and moderate weather easily dominated more moderate losses in Texas, Louisiana, the Midcontinent and Midwest. The NGI National Spot Gas Average slumped 18 cents to $2.33.

Futures trading was hardly more inspired, and the December contract was held to an 8 cent range as traders continued to scour weather forecasts for any market-moving cold. At the end of the day December had fallen three-tenths to $2.893 and January lost nine-tenths to $3.017. December crude oil eased 8 cents to $54.30/bbl.

New England quotes suffered a double-digit drubbing as increased capacity on Algonquin Gas Transmission swamped the market. “The floodgates are open as the maintenance season started just before the summer, in June, and the most debilitating de-rate was for the last week in October,” said Stefan Baden, analyst with Energy GPS, a Portland, OR-based gas and power trading and risk management firm.

“The return of capacity was the most pronounced at the Stony Point compressor station where capacity more than doubled. In addition we saw .04 Bcf/d increase and that is the first incremental expansion from the Atlantic Bridge pipeline project. When it’s all said and done it should be an addition of .13 Bcf/d.”

Baden also noted that Texas Eastern Transmission started up the Access South and Adair Southwest expansions. “That flows to the Gulf, and in theory it should cause a convergence to the Henry Hub but for now it’s just an increase in capacity on the pipeline in that area. Week on week Tetco M-3 is about where it was before the expansion,” he said.

Gas at the Algonquin Citygate plunged 89 cents to $1.18 and deliveries to Tennessee Zone 6 200 L fell $1.00 to $1.06. Gas on Tetco M-3 Delivery was quoted at 87 cents, down 39 cents and gas on Transco Zone 6 New York skidded $1.30 to $1.34.

Other market hubs had a hard time matching the imploding eastern hubs. Gas at the Chicago Citygate eased 11 cents to $2.67 and deliveries to the Henry Hub were seen at $2.64, down 13 cents. Gas on El Paso Permian shed 8 cents to $2.34 and gas priced at the NGPL Midcontinent fell 12 cents to $2.43.

Gas at Opal registered an 8 cent loss to $2.51 and gas at Malin changed hands 6 cents lower at $2.56. Gas on El Paso S Mainline was quoted 16 cents lower at $2.65 and deliveries to SoCal Citygate rose 19 cents to $3.23.

If increased pipeline capacity were not enough, production is expected to mushroom as well. “Natural gas production enters winter 2017-18 averaging near 75.5 Bcf/d with expectations to reach even higher heights as the season progresses,” said PointLogic Energy in a Wednesday note to clients. “Meanwhile, total demand this winter is forecast to hit record highs, assuming normal weather and a surge in export activity.”

Forecasters near-term are calling for nominal cooling. “Forecast changes were in the colder direction from the Midwest to the East, where rounds of high pressure are forecast,” said MDA Weather Services in its morning six- to 10-day outlook for clients. “These highs originate from an established cold source region out of western Canada and lends additional cold concerns versus the forecast and models.

“This cold source region has temperatures in the much and strong below normal categories in central and western Canada while offering a period with belows in parts of the Midwest as well. The East Coast has much above normal readings at the start of the period before belows arrive late. A’s are most steady along the Southern Tier.”

A week from now MDA’s forecasts places the average temperature in Chicago at 40, 5 degrees less than normal and New York City’s average is 49, 2 degrees below normal.

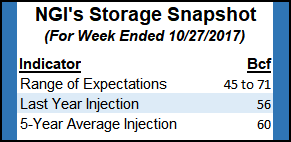

Traders Thursday will get a look at inventory levels now expected to approach 3,800 Bcf. Currently supplies stand at 3,710 Bcf and last year 56 Bcf were injected; the five-year pace is 60 Bcf.

Citi Futures Perspective predicts a build of 52 Bcf and Raymond James is looking for a 70 Bcf increase. A Reuters survey of 26 traders and analysts showed an average 62 Bcf build with a range of +45 Bcf to +71 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |