Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Hurricanes Mar Anadarko Output, but ‘Three D’ Onshore Strategy Shines

An unusually active hurricane season and volatile commodity prices bit into Anadarko Petroleum Corp.’s oil and gas sales volumes during the third quarter, but double-digit production gains from its three Ds — deepwater Gulf of Mexico (GOM), Denver-Julesburg (DJ) Basin and the Permian Basin’s Delaware — proved their mettle, CEO Al Walker said Wednesday.

Average sales volumes in 3Q2017 fell to 626,000 boe/d, down 20% year/year, partly on asset sales but also on shut-ins related to a trio of GOM hurricanes — Harvey, Irma and Nate — that temporarily froze output from the deepwater.

Still, the short-term setback was not enough to dull management’s enthusiasm about its U.S. strategy or long-term prospects, Walker said during a conference call to discuss results.

“You can expect we will continue to direct a high percentage of our capital investments toward the Delaware, DJ and deepwater Gulf of Mexico, due to the attractive economics they produce,” he said.

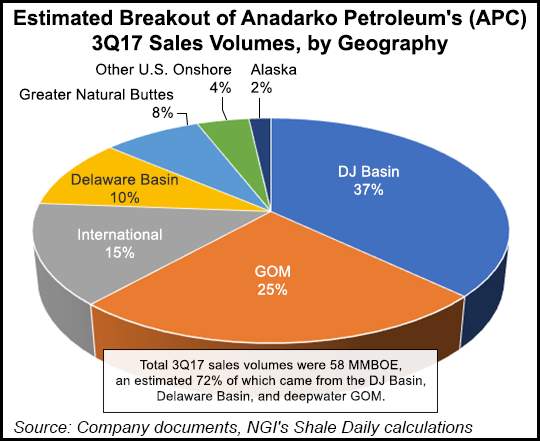

The super independent in 3Q2017 improved its oil production mix year/year to 57% from 42%, boosting margins/bbl by around 34%. While double-digit volume growth was seen in the three Ds, global volumes overall fell by 20% or 58 million boe, an average of 626,000 boe/d.

Full-year volume guidance was adjusted to reflect the impacts from the hurricanes and from selling the gassy Moxa Arch asset in Wyoming.

However, Anadarko still expects to exit 2017 producing 150,000 b/d of oil combined from the Delaware and DJ, with more than 130,000 b/d contributed from the deepwater GOM.

In the Delaware, the 2017 exit rate now is estimated at 50,000 b/d after hitting a record for oil volumes in 3Q2017 of 44,500 b/d. The Delaware assets averaged 37,000 b/d in the quarter, a 13% sequential increase. Anadarko averaged 16 rigs and six completions crews in the Delaware between July and September to capture operatorship over 70% of its gross acreage position.

Analysts continue to press management about when the Delaware will move to “full” production mode, like the DJ and the deepwater. Up to now, Anadarko has concentrated on building infrastructure and experimenting, using learnings from the legacy DJ.

Even though output from the Delaware climbed 37% year/year and operatorship increased to 70% in Reeves and Loving counties, the West Texas play is still in development mode.

Have patience, Walker advised. Anadarko prefers being the turtle rather than the hare, building out infrastructure ahead of increasing production.

“Frankly, in addition to focusing on joint activity on capturing operatorship, our investments have been directed toward building one of the broadest and most integrated infrastructure positions in the basin, which is an important and critical factor and successful long-term development program,” he said.

The comprehensive build-out plan for the Delaware is to include blocking up acreage to improve wellhead economics for longer laterals. It also is to include using Anadarko’s tankless battery design first implemented in the DJ.

“Going tankless is much more cost effective over the longer term, significantly reduces emissions and improves safety by reducing the number of trucks on the road,” Walker said. “Doing this network correctly requires material capital commitments in the short-term, which we are making in 2017 and 2018.” The idea is to enhance value and returns “rather than focusing on near-term growth.”

A clear line of sight in the DJ puts its exit rate this year at about 100,000 b/d. Record output of more than 90,000 b/d was achieved during the third quarter, with average output of 83,000 b/d, a 10% increase over 2Q2017. The company on average ran six rigs and four completions crews, with the number of wells turned to sales increasing by 70% from 2Q2017.

The company also is using a new completion design in the DJ, now applied to more than 70 wells, most of which have been producing at least 150 days. The wells are “demonstrating a cumulative oil uplift of more than 40% when compared to the previous design,” management said.

In the deepwater GOM, Anadarko boosted oil output sequentially by more than 10%, averaging 126,000 b/d, even though about 840,000 boe was deferred by hurricanes Harvey and Irma. The company’s hub-and-spoke infrastructure provided value to new tiebacks at Horn Mountain and Marlin, and Anadarko added more tieback opportunities as the apparent high bidder on 10 blocks in the most recent GOM lease sale.

A slow-and-steady approach should give Anadarko a competitive advantage in the years ahead, Walker said.

“Through the increased application of technology, we expect to further improve breakevens across the portfolio in order to manage over price volatility and improve profitability. To that end, even in the face of unprecedented hurricanes in the Gulf during the quarter, the ”three D’s’ delivered attractive growth.”

International and Alaska sales volumes in 3Q2017 averaged 102,000 b/d, slightly down sequentially. Anadarko also is continuing to generate “substantial momentum” with its Mozambique liquefied natural gas (LNG) project, having finalized marine concession agreements, marking completion of the foundational legal and contractual framework.

Anadarko also reached a 20-year sale and purchase agreement for 2.6 million metric tons/year of LNG with PTT Public Co. Ltd. of Thailand, which is pending approval by the Thai government.

Bad bets on hedging and impairment losses, including $565 million for drilling dry holes, led to net losses in 3Q2017 of $699 million (minus $1.27/share), which was down from a year-ago net loss of $830 million (minus $1.61). Excluding the one-time charges for 3Q2017, losses totaled 77 cents/share. Operating net cash at the end of September was $639 million.

Anadarko ended the third quarter of 2017 with $5.25 billion of cash on hand. In September, a $2.5 billion share-repurchase program was begun to extend to the end of 2018. Plans also are underway to repurchase $1 billion worth of shares before the end of this year.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |