Shale Daily | Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Anadarko Basin Deals Surpass Permian in Third Quarter, Says PwC

U.S. oil and natural gas dealmaking increased during the third quarter, but the total value fell substantially as operators sought smaller, bolt-on acquisitions and went hunting outside the Permian Basin for the first time in months, PwC said in a quarterly review.

Two notable trends emerged, researchers said in the latest U.S. Oil & Gas Deal Insights. Operators were focused on complementing rather than transforming their portfolios, and they were making deals beyond West Texas and southeastern New Mexico.

“We see deal activity moving away from Permian, where core acreage transactions appear to have run their course, and more toward other plays such as Eagle Ford and Bakken, which are supported by stabilizing oil prices,” said PwC’s Mile Milisavljevic, principal of U.S. Oil & Gas deals.

During the quarter, three transactions were completed in the Permian worth $1.48 billion. By comparison, the Anadarko Basin saw the most active unconventional dealmaking with six transactions worth $3.94 billion total. Five deals each were made in the Bakken Shale for $4.86 billion total, and in the Eagle Ford Shale, worth $698 million total.

“We see this shift not as a reflection of problems in the Permian, but rather of success, as significant dealmaking in the basin has pushed prices higher than they were prior to the commodity price crash,” PwC researchers noted.

The upstream segment, and particularly, unconventional dealmaking, remained a major contributor to activity, but it centered on “non-transformational asset deals intended to help the producer gain greater economies of scale on existing assets and infrastructure,” researchers said.

The “predominant strategy” for transactions was portfolio rationalization as upstream buyers pulled “more pieces of their asset jigsaw puzzles into place, acquiring acreage in basins where they believed they could gain greater economies of scale and divesting assets in basins they considered noncore.”

PwC compiled data using information from various sources including from IHS Markit and included deals for the U.S. companies within the upstream, midstream, downstream, oilfield services and integrated/diversified sectors. The analysis includes all individual deals with value exceeding $50 million; deals with undisclosed values were omitted.

Thirty-four of the 53 announced deals were asset transactions for a total of $13.16 billion, more than half the total value for the quarter.

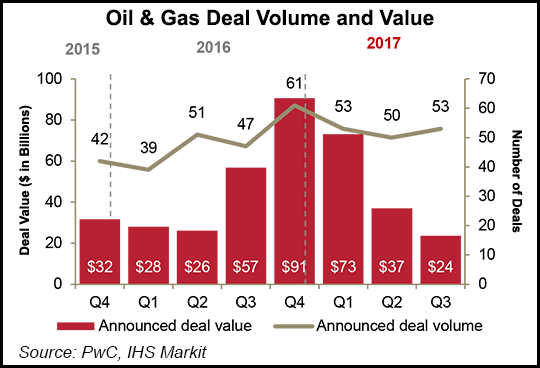

The 53 total deals announced indicated a 6% sequential increase and 13% year/year growth. However, total deal value fell 36% sequentially and 58% from a year ago to $23.61 billion.

“Strong deal activity in the Permian has pushed prices and valuations, making other, less active basins, such as the Bakken, more attractive to investors,” said researchers. “Mega-deals, or deals with value greater than $1 billion, continued the downward slide they began in the first quarter of 2017.”

Seven mega-deals announced in the quarter were worth $11.74 billion, the lowest share of total deal value and volume since the second quarter of 2016.

Despite the hurricane disruptions in the Gulf of Mexico during the period, “downstream deals made a comeback, driven by sustained interest of private equity investors.” Joint ventures and pipeline drop-downs also contributed to an increase in downstream activity.

“Stabilizing commodity prices, greater operational efficiency and ongoing efforts to divest noncore assets drove deal activity,” said PwC’s Joe Dunleavy. “Financial investors sitting on plenty of dry powder seem to have an appetite to do deals in the sector. However, few of these deals have been mega-deals or transformational.”

Looking ahead, PwC expects the final three months of this year to be similar to the third quarter, with M&A activity higher, as investors typically want to close deals by year’s end.

“The third quarter was a solid quarter from a volume perspective, but the lack of transformational deals indicates that companies are reining in their risk appetite and focusing on niche deals,” said PwC’s Doug Meier, Greater Texas deals leader.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |