NGI Weekly Gas Price Index | Markets | NGI All News Access

Physical NatGas Ends Wacky Week With Solid Weekly Gains

Weekly natural gas trading started off with a bang as a perfect storm of soaring temperatures, loss of electrical transmission,, and constrained pipeline transportation converged on the Los Angeles Basin and set prices early in the week rocketing by $9 to upwards of $12.

That along with steady gains of a nickel to a dime or more across all regions lifted the NGI Weekly Spot Gas Average 13 cents to $2.70. Not surprisingly SoCal Citygate posted the week’s greatest gain by rising $2.03 to average $6.34 and although losses were only seen at a handful of points, the week’s biggest loser was Tetco M-3 Delivery dropping 37 cents to average $1.23.

Regionally California rose to the top of the leader board with a gain of 53 cents to average $3.63, and South Texas proved to be the week’s laggard adding just 4 cents to $2.82.

Other locales posting double-digit gains included the Northeast up 23 cents to average $2.85, the Midwest with a 15 cent rise to $2.87, and the Midcontinent and Rocky Mountains both adding 14 cents to $2.69 and $2.61, respectively.

Other regions added anywhere from a nickel close to a dime with averages ranging from $1.36 in Appalachia to $2.86 in the Southeast.

The November futures contract expired Friday at $2.752, down 16.3 cents on the week and 22.2 cents less than the expiration of the October contract.

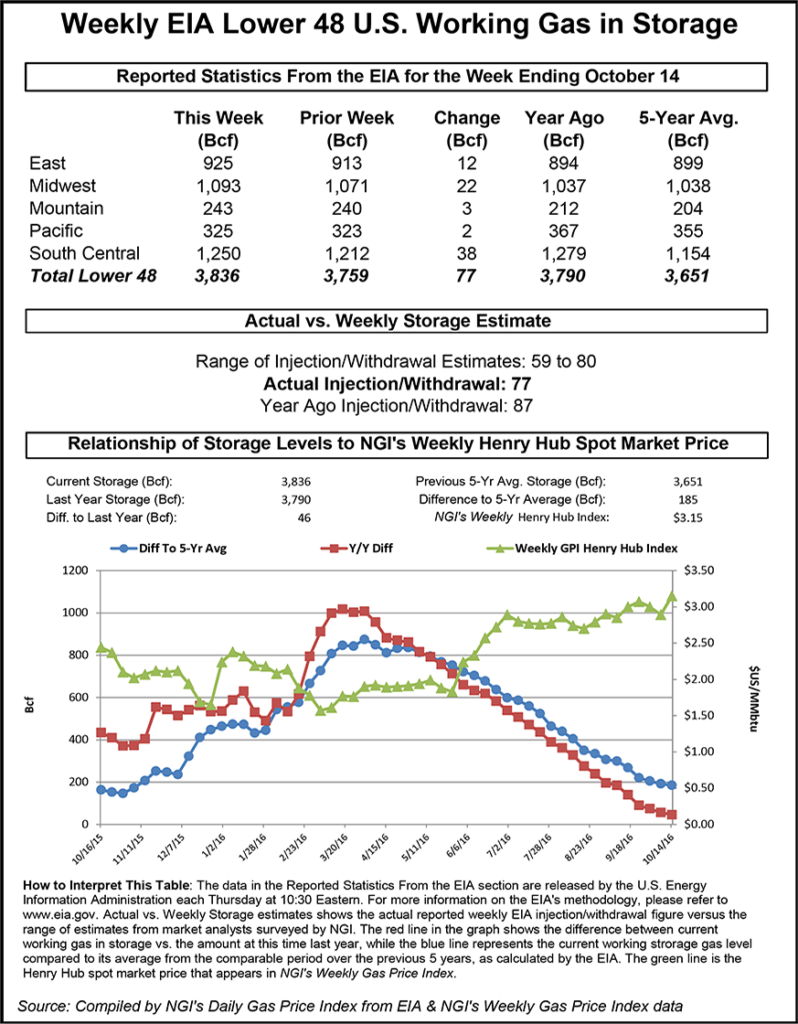

On Thursday the EIA reported a storage injection of 64 Bcf for the week ended Oct. 20, about even with market expectations, and prices registered nary a whimper once the figures were released. At the close on Thursday November had shed 2.9 cents to $2.890 and December had given up 3.1 cents to $3.051.

The 64 Bcf injection came in about 1 Bcf less than consensus estimates. Just before the 10:30 a.m. EDT report on Thursday the market was hovering around $2.894, and upon the release, the November contract edged lower. By 10:45 a.m. November was trading at $2.886, down 3.3 cents from Wednesday’s settlement.

Prior to the release of the data traders were looking for a storage build about equal to the actual figures. Last year 74 Bcf was injected and the five-year average stands at 75 Bcf. ION Energy’s Kyle Cooper calculated a 63 Bcf injection and Gelber and Associates was looking for a 68 Bcf build. A Reuters survey of 24 traders and analysts showed an average 65 Bcf build with a range of +60 Bcf to +70 Bcf.

“The high and low on the day remained the same after the number came out. It was trading about $2.89 before the figures were released, and we were hearing a 65 Bcf build. It was not a big deal,” said a New York floor trader.

Harrison NY-based Bespoke Weather Services said, “The print is rather tight still as it indicates that last week’s even tighter print was not entirely because of Nate, and we see this as helping to provide a bit of support for the market, though it will be relatively meaningless without any sustained cold weather.”

The analytical team at Wells Fargo saw the report as neutral. “The focus remains on weather forecasts for the remainder of shoulder season and recent projections from the NOAA (National Oceanic and Atmospheric Administration) have flipped, with cooler than normal temperatures now forecasted across much of the U.S. for the next one to two weeks.

“As we move into late October/November, cooler temperatures become bullish for demand and we forecast a cumulative build of just 83 Bcf for the next two weeks, well below the five-year average of 111 Bcf and last year’s cumulative build of 108 Bcf. Additionally, we now forecast end of injection season storage at approximately 3.81 Tcf, 70 Bcf below the five-year average and 237 Bcf below comparable 2016 levels.”

Inventories now stand at 3,710 Bcf and are 189 Bcf less than last year and 46 Bcf less than the five-year average. In the East Region 13 Bcf were injected, and the Midwest Region saw inventories rise by 28 Bcf. Stocks in the Mountain Region were unchanged and the Pacific Region fell by 1 Bcf. The South Central Region added 24 Bcf.

Physical natural gas for weekend and Monday delivery was in abundant supply on Friday, and with sellers outnumbering buyers and a weak settlement of the November futures contract, prices tumbled.

Heaviest losses were seen in California, the Northeast, and Appalachia, and more modest setbacks of about a dime in Texas, Louisiana, the Midwest and Midcontinent resulted in the NGI National Spot Gas Average falling 16 cents to $2.53.

The expired November contract skidded as weather forecasts moderated overnight, resulting in a lack of traders wishing to take delivery. November expired Friday down 13.8 cents at $2.752 and December dropped 8.7 cents to $2.964. December crude oil jumped $1.26 to $53.90/bbl.

The day’s big physical mover was the SoCal Citygate tumbling from its recent highs as temperatures were seen below seasonal norms by Monday and power prices moderated. AccuWeather.com forecast the high in Los Angeles Friday of 88 would hold Saturday before dropping to 74 by Monday, 3 degrees below normal. San Bernardino, CA was anticipated to see its Friday high of 94 hold for Saturday before falling to 76 Monday, 5 degrees below normal.

Gas at the SoCal Citygate for weekend and Monday delivery fell $1.72 to $2.79 and gas priced at the SoCal Border Average shed 53 cents to $2.59. Deliveries to El Paso S Mainline skidded $1.01 to $2.58, and parcels at the PG&E Citygate fell 11 cents to $3.06.

Intercontinental Exchange reported on-peak Monday power at SP-15 shed $4.25 to $32.75/MWh and power at COB [California Oregon Border] fell $1.88 to $26.30/MWh.

Eastern points had some hefty losses of their own. Gas at the Algonquin Citygate was quoted 19 cents lower at $2.85 and gas on Dominion South fell 37 cents to 92 cents. Gas on Tetco M-3 Delivery changed hands 20 cents lower at $1.18 and gas on its way to New York City via Transco Zone 6 fell 42 cents to $2.29.

Chicago Citygate deliveries gave up 8 cents to $2.85 and gas at the Henry Hub lost 11 cents to $2.78. Quotes for gas at Transco Zone 4 slid 6 cents to $2.74 and gas on Panhandle Eastern dropped 9 cents to $2.56.

Although a significant shift in weather patterns occurred in the overnight model runs, traders were reluctant to ascribe the day’s drop in November futures solely to any mega-shift in fundamentals. “Usually at expiration it’s a question of who wants to take delivery,” said Tom Saal, vice president at FCStone Latin America. “It’s more of a liquidation process relative to contract expiration with people offsetting positions ahead of expiration.

“Last week we had a little bit of a rally, so maybe that was the shorts getting out a little early and the longs sticking around a little too long. Expiration exaggerates things and you really can’t draw the conclusions you might otherwise if it were not expiration.”

There is no denying that market bulls suffered a significant setback with the overnight weather model runs.

“[Friday’s] six-to-10 day period forecast is notably warmer than yesterday’s forecast over the eastern two thirds of the” continental United States (CONUS), “aided by the day shift. The Northwest and No. Rockies are colder,” said WSI Corp. in its morning report to clients. “CONUS” gas-weighted heating degree days “are -9.3 to 61.1, which are now 12.2 below average.

“Even with the warmer changes, there is a warmer risk across the south-central and eastern U.S., especially day six across the south-central states. The Northwest, No.Rockies and western Canada could run even colder.”

Traders see the breach of $3 in the now spot December contract as auguring further weakness. “As we shift focus to the December contract, today’s violation of expected key support at the $3.00 mark strongly favors some downside price follow through,” said Jim Ritterbusch of Ritterbusch and Associates in comments Friday.

“While sub $3.00 levels would appear attractive given weather uncertainties during the coming month, we will await weekend temperature updates before considering a buy recommendation. The storage deficit, albeit small, would appear capable of driving a sizable price advance once the first sustainable cold weather forecast shows up on the horizon. But while we see more upside than downside price risk from current levels, we will defer on a purchase suggestion for now.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |