Shale Daily | E&P | NGI All News Access

NOV Sees Opportunities Even With Flattish Growth in Drilling Activity

Despite the recent pullback in the U.S. rig count and the uncertainty in the 2018 outlook, drilling technology expert National Oilwell Varco Inc. (NOV) sees opportunities to help the industry retool and innovate as it navigates a $50/bbl world.

Improving market conditions from 2016 have boosted NOV’s profitability this year, CEO Clay Williams said during a conference call Friday to discuss 3Q2017 results. But since the decline in oil prices that began in April, “rig reactivations have slowed and many of our drilling contractors are, once again, curtailing spending with our rig group.

“…Oil prices have moved back up above $50 lately, which is timely” as producers begin budgeting for 2018. “Nevertheless, the recovery narrative right now seems tepid and visibility in 2018 is limited. Customers seem to be waiting for sustained oil price improvement before ramping up land spending or pulling the trigger on long-awaited offshore” final investment decisions.

Even as customers continue to look to curtail spending given uncertainty around commodity prices, Williams said NOV expects to continue to see “pockets of demand emerging with three years of underinvestment and cannibalization, and lately, rising scarcity, fueling demand for certain areas like frack equipment. Other pockets of demand arise from technologies changing the landscape and providing opportunity, the closed-loop drilling, downhole tools and completion tools.”

NOV reported revenues of $693 million from its Wellbore Technologies segment during the third quarter, up 13% sequentially and 32% year/year, outperforming the Houston-based company’s other segments. Management said the “rising levels of scarcity for the critical products and services the segment provides combined with increased market adoption of the segment’s new technology introductions resulted in revenue growth that outpaced rig count growth” for the same period.

Williams said he expects the segment to continue to see opportunities for growth, even if drilling activity remains flat over the next several quarters.

“In Q3, we had globally 2,100 rigs running, and I would tell you I think they’re being run harder than they’ve ever been run. And that’s tough on drill pipe, that’s tough on downhole tools,” Williams said. “You’ve got rig operators that are pretty good at forestalling expenditures on spares for a quarter or two, but eventually the opportunity to cannibalize, to avoid buying spare parts, comes to an end.

“And so even in that world, where we all just move sideways, I think our prospects continue to improve as our customers burn through a lot of the things that we provide…as we’ve said many times, we are seeing returns of pockets, and that drives future demands for NOV, both within Wellbore Technologies but also Rig Aftermarket, Rig Systems and other businesses.”

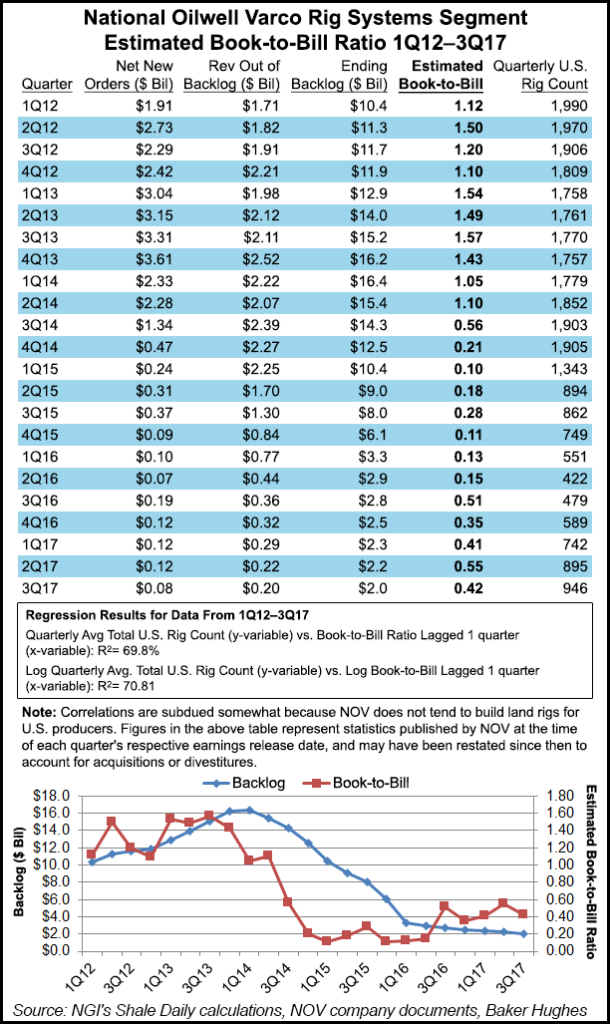

Rig Systems generated $330 million in revenues for the quarter, down 5% sequentially and 30% year/year, with management pointing to the commodity price pullback this year leading to limited orders for new equipment. The backlog for capital equipment orders for the segment as of the end of the quarter was $2.01 billion, with new orders during 3Q2017 totaling $84 million.

Rig Aftermarket generated $331 million in revenues, down 9% sequentially and 3% year/year.

Completion and Production Solutions generated $682 million in revenues, up 5% sequentially and 26% year/year, with rising North American onshore demand helping to boost the segment’s land-related business, according to management. The backlog for capital orders for the segment as of the end of the quarter was $974 million, with $463 million in new orders during the quarter.

“Nearly all of the segment’s business unit secured orders near or in excess of 100% book-to-bill,” management said.

NOV reported total revenues for the quarter of $1.835 billion versus $1.646 billion in the year-ago quarter.

The company reported a net loss of $26 million (7 cents/share). That’s compared with a net loss of $1.362 billion ($3.62/share) in the year-ago period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 2158-8023 |