Shale Daily | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Marcellus Down, SCOOP/STACK Up as U.S. Drops Four Rigs

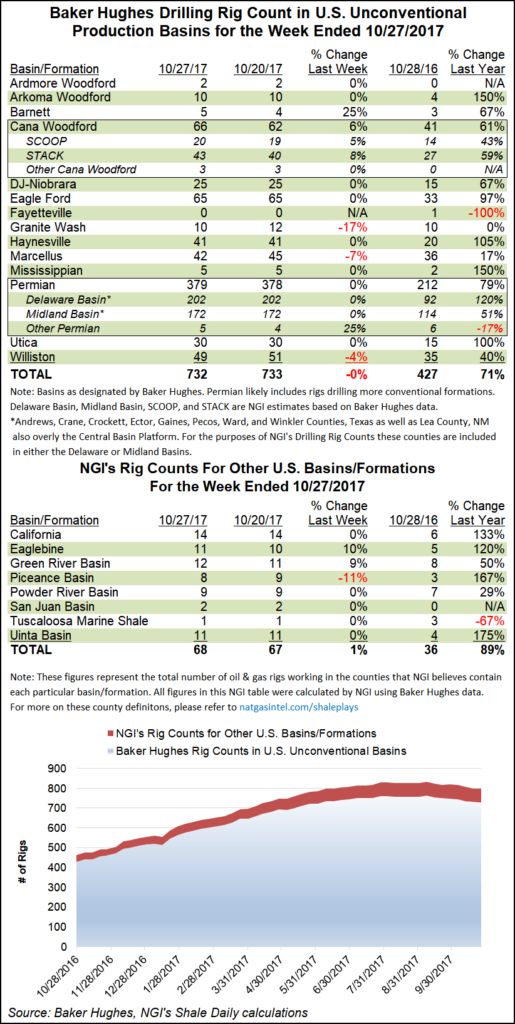

The U.S. rig count continued its slide for the week ended Friday, with the Marcellus Shale dropping three units to headline a down week for natural gas-directed drilling, according to data from Baker Hughes Inc. (BHI).

The United States dropped four rigs overall to fall to 909 rigs, continuing a pattern of retrenchment that began this summer. One oil-directed unit returned to the patch, while five gas-directed rigs packed up shop. The U.S. drilling declines included six directional rigs and two horizontal, while four vertical units were added for the week, according to BHI.

Canada saw 11 rigs leave the patch, including 11 oil-directed and one gas, with one “miscellaneous” rig added.

The combined North American rig count now stands at 1,100, down 15 week/week but up from 710 rigs running in the year-ago period, according to BHI.

Among plays, the Marcellus saw the largest week/week decline at three. The Marcellus now stands at 42 rigs, versus 36 in the year-ago period, allowing its nearest gas-focused competitor, the resurgent Haynesville Shale, to remain within striking distance at 41 rigs.

Other declines among plays included the Williston Basin (down two to 49) and the Granite Wash (down two to 10).

Meanwhile, the Midcontinent saw a bump in activity this week, with the SCOOP (South Central Oklahoma Oil Province) and STACK (Sooner Trend of the Anadarko Basin, mostly in Canadian and Kingfisher counties) adding a combined four rigs. The STACK exited the week at 43 rigs, versus 27 a year ago, with the SCOOP finishing at 20 from 14 a year ago.

Among the states, the Texas rig count climbed by a healthy five units for the week, with the Barnett Shale and Permian Basin adding one rig each.

Wyoming also added one rig for the week, but most other states tracked by BHI saw rigs exit the patch. Louisiana dropped three rigs, while Colorado, Kansas and New Mexico each dropped one. Reflecting the declines in the Marcellus for the week, West Virginia dropped two rigs to finish at 13, while Pennsylvania finished down a rig at 31.

Following several months of retrenchment in the U.S. rig count, the oilfield services players have begun rolling out their 3Q2017 results, providing insights on the current state of North American onshore exploration and production activity.

Superior Energy Services Inc. said during a conference call that there’s some uncertainty surrounding the 2018 outlook given a lack of direction for producer spending plans and “supply chain stress.” Schlumberger and BHI also pointed to a diminished 2018 outlook as exploration and production companies become wary of potential commodity price weakness.

Leading North American pressure pumping operator Halliburton Co., meanwhile, offered a more bullish outlook, reporting that it was “hitting on all cylinders” during the third quarter and that market conditions appear to be strengthening.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |