NGI Data | Markets | NGI All News Access

Cash NatGas, November Futures Both Off 3 Cents in Thursday Trading

Physical natural gas and futures each slipped lower Thursday as cash traders scurried to get their deals done ahead of the often volatility-inducing Energy Information Administration (EIA) storage report. Gains in California and steady pricing in Appalachia were unable to offset weakness in Texas, Louisiana, the Northeast and Southeast. The NGI National Spot Gas Average fell 3 cents to $2.69.

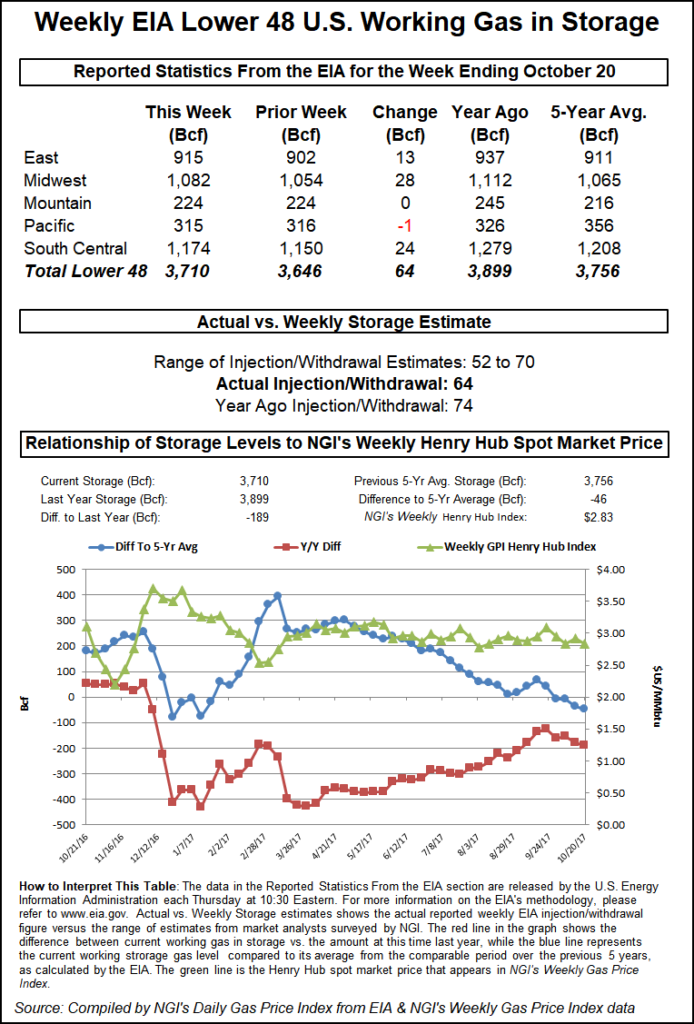

The EIA reported a storage injection of 64 Bcf, about even with market expectations and prices registered nary a whimper once the figures were released. At the close November had shed 2.9 cents to $2.890 and December had given up 3.1 cents to $3.051. December crude oil added 46 cents to $52.64/bbl.

Trading at the SoCal Citygate hasn’t quite shed all its volatility as temperatures in the area were forecast 15 degrees above normal, but next-day power prices did recede along with forecast power loads. Wunderground.com predicted that Los Angeles’ high Thursday of 92 would ease to 87 Friday before inching up to 88 Saturday, 11 degrees above normal. Riverside, CA was expected to see its high Thursday of 93 rise to 94 by Friday and Saturday, a stout 15 degrees above its seasonal norm.

Gas at the SoCal Citygate added 34 cents to $4.51 and gas priced at the SoCal Border Average came in 8 cents less at $3.12. Kern River was quoted a penny lower at $2.71 and Kern Delivery added 8 cents to $3.49.

CAISO forecast peak load Thursday of 34,502 MW would drop to 32,603 MW Friday.

Intercontinental Exchange reported that Friday peak power at SP-15 retreated $13.88 to $44.31/MWh.

Eastern points were mostly lower as next-day power prices softened. Intercontinental Exchange reported Friday on-peak power at the ISO New England’s Massachusetts Hub skidded $8.92 to $32.14/MWh, and power at the PJM West terminal fell $2.36 to $28.00/MWh.

Gas at the Algonquin Citygate fell 19 cents to $3.04 and gas bound for New York City on Transco Zone 6 dropped 22 cents to $2.71. Deliveries to Dominion South rose 6 cents to $1.29 and parcels on Tetco M-3 Delivery changed hands 10 cents higher at $1.38.

Gas at the Chicago Citygate fell 8 cents to $2.93 and gas priced at the Henry Hub fell 4 cents to $2.89. Deliveries to Transco Zone 4 retreated 9 cents to $2.80 and gas at Northern Natural Demarcation shed 2 cents to $2.83.

When the EIA reported the week’s storage figures prices fell even though they were right on what the market was expecting.

The 64 Bcf injection for the week ended October 20 came in about 1 Bcf less than consensus estimates. Just before the 10:30 a.m. EDT the market was hovering around $2.894 and following the release of the number November futures dropped to $2.883. By 10:45 a.m. November was trading at $2.886, down 3.3 cents from Wednesday’s settlement.

Prior to the release of the data traders were looking for a storage build about equal to the actual figures. Last year 74 Bcf was injected and the five-year average stands at 75 Bcf. ION Energy’s Kyle Cooper calculated a 63 Bcf injection and Gelber and Associates was looking for a 68 Bcf build. A Reuters survey of 24 traders and analysts showed an average 65 Bcf build with a range of +60 Bcf to +70 Bcf.

“The high and low on the day remained the same after the number came out. It was trading about $2.89 before the figures were released, and we were hearing a 65 Bcf build. It was not a big deal,” said a New York floor trader.

Harrison NY-based Bespoke Weather Services said, “The print is rather tight still as it indicates that last week’s even tighter print was not entirely because of Nate, and we see this as helping to provide a bit of support for the market, though it will be relatively meaningless without any sustained cold weather.”

The analytical team at Wells Fargo saw the report as neutral. “The focus remains on weather forecasts for the remainder of shoulder season and recent projections from the NOAA (National Oceanic and Atmospheric Administration) have flipped, with cooler than normal temperatures now forecasted across much of the U.S. for the next one to two weeks.

“As we move into late October/November, cooler temperatures become bullish for demand and we forecast a cumulative build of just 83 Bcf for the next two weeks, well below the five-year average of 111 Bcf and last year’s cumulative build of 108 Bcf. Additionally, we now forecast end of injection season storage at approximately 3.81 Tcf, 70 Bcf below the five-year average and 237 Bcf below comparable 2016 levels.”

Inventories now stand at 3,710 Bcf and are 189 Bcf less than last year and 46 Bcf less than the five-year average. In the East Region 13 Bcf were injected, and the Midwest Region saw inventories rise by 28 Bcf. Stocks in the Mountain Region were unchanged and the Pacific Region fell by 1 Bcf. The South Central Region added 24 Bcf.

When in doubt exit the market, and the contradicting weather patterns seen in morning weather reports gave some traders all the excuse they needed to step aside. “While again emphasizing that this pattern is nowhere near as super-warm as last year in early November, we are still dealing with conflicting influences on the pattern that offer both colder and warmer risks to the forecasts,” said Matt Rogers, president of Commodity Weather Group in a morning report to clients.

“Our outlook today is fairly flat in the one-to-five day, slightly warmer South to West and cooler Midwest to East in the six-to-10 day, while (again) going warmer East and cooler West in the 11-15 day. A powerful high pressure ridge over the Alaska area into the six-to-10 day offers colder risks to our outlook (as seen on the American/Canadian modeling), but it starts shifting westward (into the Bering Sea) for the 11-15 day, which opens the door for colder risks in the West by that point (as the East re-warms).”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |