Shale Daily | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Uncertainty on E&P Plans, Pricing Casting ‘Pall’ Over Industry, Says Superior CEO

Houston-based Superior Energy Services Inc., which makes its mark in the U.S. onshore with its pressure pumping services and specialized drilling, said a lack of direction regarding overall spending plans by producers and “supply chain stress” have created some uncertainty about the outlook for 2018.

During a conference call to discuss results, CEO Dave Dunlap said things are much better than they were a year ago, but uncertainty is lingering in the U.S. onshore, the Gulf of Mexico (GOM) and in the international business.

“As we enter the final quarter of 2017, we’re a much healthier company, and industry fundamentals have a greatly improved from last year,” Dunlap said. “With that said, we remain in a challenging environment.

“Uncertainty around oil prices, uncertainty around our customer spending plans for 2018 and uncertainty of long-term oil demand growth have cast a pall over our industry, despite the fundamental business improvements that we are experiencing.”

Superior has set strategic goals for its recovery, including improving its returns profile and reducing debt.

Following the “prolonged downturn, the business has capital requirements in the early days of recovery, but we will continue to be cautious about our capital spending and continue to seek cost improvement,” Dunlap said. “We believe there will be very strong momentum and pricing improvement in the pressure pumping market through 2019.”

In its U.S. land markets segment, customer demand increased, along with “service intensity, primarily across completion-oriented product lines,” he said, mirroring comments made in previous third quarter conference calls by Schlumberger Ltd., Baker Hughes Inc., a GE company, and Halliburton Co.

Supply Chain Stress

“Our customers continue to push the technical limits of their well and completion designs, and are also increasing activity levels as oil prices recover,” Dunlap said. “It is not surprising that as a result, we began to observe supply chain stress and increased non-productive time as the quarter progressed, particularly in the Permian Basin. I expect these inefficiencies to diminish over time.”

Permian revenue for 2017 should “approximately double, and our overall pressure pumping revenue to approximately triple over 2016 levels,” he said. However, “this incredible surge in activity is clearly creating inefficiencies in the supply chain. As customers continue to learn more about the optimal techniques to drill and complete wells and extremely heterogeneous reservoirs, persistent challenges with labor and last-mile sand transport remain in the background.

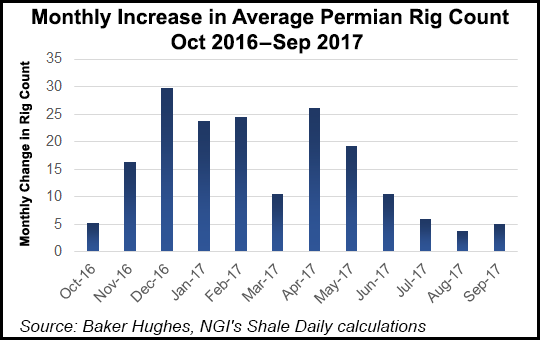

“I believe that activity in the Permian Basin will continue to increase, but likely at a more measured pace than we have observed during the past 12 months. A measured pace of increase should allow the supply chain and our customers to become more efficient and for outcomes to become more predictable.”

Superior reported quarterly net losses from continuing operations of $57.2 million (minus 37 cents/share) on revenue of $506 million. In the year-ago period, net losses were $113.9 million (minus 75 cents) on revenue of $326.2 million, and 2Q2017 losses amounted to $62.0 million net (minus 41 cents) on revenue of $470.1 million.

U.S. land revenue was $331.4 million, a 4% increase sequentially and a 95% increase year/year. GOM revenue was $91.7 million, a sequential increase of 9% and a 25% jump from 3Q2016. International revenue climbed 22% from the second quarter and rose slightly from a year ago.

“Operationally, we delivered during the quarter in what clearly remains a challenging market for oilfield services,” said Dunlap. “The pace of acceleration in the U.S. land markets slowed during the quarter as the average rig count increased only 7%. After peaking mid-quarter, the rig count has declined steadily.”

In the U.S. land market, Superior saw a decline in one of its premium offerings, zipper fractures (frack), which involves stimulating two parallel horizontal wells simultaneously to improve production.

“In our pressure pumping business, revenue did not grow to the degree we expected,” Dunlap said. “Although sand volumes increased in July, we saw a decrease in higher volumes zipper frack operations in August and September, coupled with less urgency in general around the pace of completions. This resulted in lower volumes of sand being pumped sequentially.”

The change in customer behavior, however, has been transitory. Already, sand volumes have picked up in the fourth quarter and the “completion pace has accelerated…

“We feel this pace should continue throughout the quarter. However, it is too early to gauge how pressure pumping utilization will be impacted by holiday schedules, which can vary year-to-year.”

Overall, the onshore pressure pumping market is undersupplied, “and we continue to win price increases in the fourth quarter and feel confident that trend will continue into 2018.”

Pursuing Longer Laterals

What has continued “unabated is our customers’ drilling intensity and pursuit of longer laterals. As a result, we saw strong growth in premium drill pipe and rental tool demand in U.S. land markets. Coiled tubing and well test utilization also continued along a strong growth trajectory.”

To illustrate how far customers are pushing lateral lengths, one of Superior’s Complete Automated Technology (CAT) rigs recently drilled out 46 plugs and a lateral length of more than 17,000 feet for an Eagle Ford Shale customer in South Texas.

“We believe this unique technology will continue to gain favor as customers seek efficiency improvement in the longest of laterals,” he said.

Overall, however, “labor remains extremely tight in the service line, and pricing gains are also challenging, given significant industry overcapacity…”

Going into 2018, capital expenditures and pressure pumping “will be directed toward maintaining the 750,000 hp that will be deployed by first quarter 2018,” Dunlap said. Superior now has around 600,000 hp deployed, with the other 150,000 hp set to be launched by early next year.

“There may be opportunities to deploy some expansion capital and premium drill pipe, bottom hole assemblies or CATS rigs, all of which are product lines whose performance has a strong correlation to lateral length. However, as much uncertainty exists in the market today, expect us to remain cautious with our uses of cash.”

The management team expects the U.S. land completions market during the fourth quarter to remain strong, with pressure pumping pricing on the rebound through the end of the year.

Superior expects to enter 2018 “with a capital spending level similar to our 2017 program,” Dunlap said. “Much of this will be allocated toward U.S. land businesses with improving return profiles. At this point, any expansion area investment will be restricted to premium drill pipe and CATS rigs. As occurred this year, should business results improve ahead of expectations, we will post spending forward to stand our businesses up to meet growing market demands.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |