NGI The Weekly Gas Market Report | Markets | NGI All News Access

Forecasted Warm Start to Winter Sees NatGas Forward Prices Fall

With long-term weather forecasts pointing to possibly another warm winter ahead, natural gas forward markets fell an average 12 cents between Oct. 13 and 19, according to NGI’s Forward Look.

Things were off to a rocky start from the get-go as mild temperatures in the southeastern United States were hard to ignore, with power burn in that region alone falling 2 Bcf over the weekend. The cooler temperatures led to a sharp decline in spot trading, which then spilled over into the futures market.

As analysts at Mobius Risk Group put it, “Today’s spot pricing along the Gulf coast reflected the loss of electric load from long-awaited cooler temperatures. As a result, golf courses and playgrounds likely became more crowded, while natural gas spot trading lost participation.” The Nymex November futures contract fell 5.4 cents that day to settle at $2.946.

Tuesday brought about a small recovery in futures pricing amid a tug-of-war between a tighter supply/demand balance and near-term weather headwinds. Alas, weather emerged victorious as Wednesday saw the prompt-month futures contract plunge 10.8 cents to $2.854 as the market faced a seven-day period where heating degree days (HDDs) were forecast to be the second lowest in more than 60 years.

“The loss of demand amidst a backdrop of surging production has many market participants concerned about the implications. What is currently being ignored is a rapid uptick in HDDs forecast for the following seven days,” Houston-based Mobius said Wednesday.

Indeed, weather forecasters at Bespoke Weather Services said they see cold weather risks remaining for November and December, and the latest weather data ticked slightly bullish overnight. The forecaster did note, however, that long-range model guidance is rather mixed and that bullish risks are not quite as consistent as they were with Wednesday’s guidance.

“We see prices sitting above $2.88 support, which is likely to remain strong through the day unless afternoon guidance reverses heavily, and instead see upside towards resistance around the $2.98 level either today or early next week,” Bespoke said.

The Nymex November futures contract held in positive territory for most of the day on Friday, eventually settling up 4.2 cents at $2.915.

NatGasWeather noted that weather models need to become more convincing to significantly shift market sentiment. The forecaster continues to expect a mild ridge to return over all but the far northern U.S. Oct. 29-Nov. 2, thereby resulting in most of the country remaining quite comfortable, especially over the western and southern U.S., where highs will reach the upper 60s to 80s.

“There are ways the pattern trends colder for the first few days of November, although the overnight data continued to show the only areas with meaningful cool fall-like temperatures likely to remain over the far northern U.S. There are ways colder air advances deeper into the US, but the weather data would need to show better potential and would require more solutions to trend in that direction,” NatGasWeather said.

Bearish Weather Forecasts

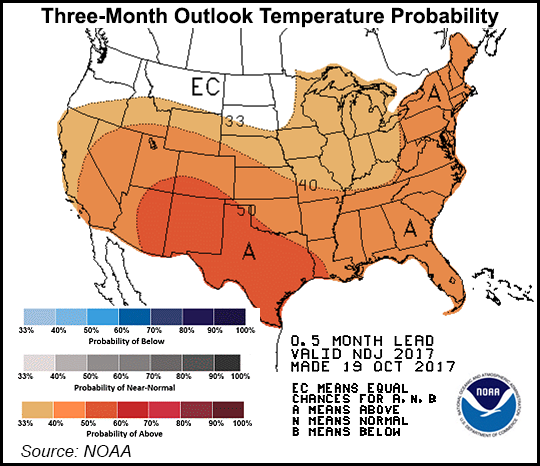

Meanwhile, the U.S. Climate Prediction Center (CPC) released its updated Winter Outlook Thursday calling for warmer-than-normal conditions across the southern two-thirds of the continental United States and the East Coast in the December to February timeframe. The CPC report also calls for below-average temperatures along the Northern Tier of the country from Minnesota to the Pacific Northwest over the same period.

“Natural gas this time of year, with anticipation of winter, you’ve got a forecast that says we’re not going to have one, that’s bearish. There’s going to be a market reaction to that,” Tom Saal, a broker with FCStone Latin America, told NGI on Thursday. “The speculators might have traded a little bit on the forecast, but it’s still a forecast. We’ve got a lot of winter left.”

For its part, NatGasWeather said it expects this winter as a whole to be cooler and closer to normal, especially across the northern U.S. As such, the forecaster expects this winter season to play out marginally colder than normal in terms of national HDDs, aided by strengthening La Nina conditions over the Pacific Ocean.

Historically, La Nina tends to bring colder-than-normal temperatures over the northern U.S. as the winter jet stream directs cold Canadian weather systems across the border, focused over the Midwest, Mid-Atlantic and Northeast. At the same time, it tends to be warmer-than-normal over the southern U.S. due to unseasonably strong high pressure.

“We don’t expect a much colder-than-normal winter, primarily due to the Earth’s background state remaining considerably warmer normal, where U.S. and global temperatures have set at all-time records the past several years,” NatGasWeather said.

This warm global background state influenced last year’s mild Northern Hemisphere winter and could do so again this year, the forecaster said, especially when considering the recent June-August period was the third warmest on record out of an impressive 137 years. The only two warmer years occurred in 2015 and 2016.

The warm start to the winter season — and the past two warm winters fresh on the minds of market players — led to a dramatic decline over the Oct. 13-19 period that resulted in November forward prices falling an average 12 cents, December sliding an average 6 cents and the balance of winter (December-March) dropping a nickel on average, according to Forward Look.

The Northeast, meanwhile, saw even steeper declines amid sharp declines in spot prices due to maintenance events and operational flow orders on several regional pipelines, including Algonquin, Transco and Tennessee. In addition, several pipelines had notices in effect stating that injection activity would be limited for the next several days.

Forward prices at the Algonquin Gas Transmission City-gates (AGT CG) posted the most extreme losses as restrictions remain in place through the pipeline’s Stony Point and Southeast compressor stations. The maintenance is expected to last through the end of the month, but demand is expected to ease considerably next week, and near-term outlooks show continued mild weather for at least the next couple of weeks.

AGT CG November forward prices tumbled 34 cents between Oct. 13 and 19 to reach $3.033, just 15 cents above the benchmark Henry Hub. December forwards plunged 31 cents to $6.091, while the balance of winter (December-March) fell 19 cents to $7.26, according to Forward Look.

Meanwhile, Appalachian pricing also suffered a blow this week. Dominion November was down 21 cents to $1.806, a $1.075 discount to Henry; December was down 9 cents to $2.442, a roughly 65-cent discount to Henry; and the balance of winter (December-March) was down 6 cents to $2.63, 55 cents below Henry.

Weak Shoulder Season

Analysts at Tudor, Pickering, Holt & Co. (TPH) said Northeast cash basis was putting pressure on Q4 production. “As we have entered shoulder season, basis in the Northeast has temporarily widened out with both Dominion South and Leidy trading ~$1.75-2/mcf wide of Nymex in September and October. As with previous periods, we would expect producers to respond by curtailing volumes on the margin in order to preserve production to sell into winter demand,” TPH said Wednesday.

Looking at flow data over the last two months, TPH said it has noticed a notable drop in volumes surrounding Northeast Pennsylvania (-0.5 bcf/d) and a moderate decline in Southwest/Central Pennsylvania. “We fully expect that with winter on the horizon that basis will materially improve, allowing for production to return,” TPH said.

Over in the West, markets were comparatively stronger, while forward prices at Southern California Gas City-gate (SoCal CG) actually skyrocketed. At PG&E, November forward prices slipped 5 cents from Oct. 13 to 19 to reach $3.148, while December fell 1 cent to $3.246 and the balance of winter (December-March) dropped 2 cents to $3.23, Forward Look data show.

At SoCal CG, November shot up 26 cents during that time to $3.313, December jumped 61 cents to $4.024 and the balance of winter (December-March) picked up 32 cents to reach $3.69.

Genscape Inc.’s Rick Margolin, senior natural gas analyst, said he suspects the strength at the SoCal market is a product of the constraints on imports resulting from the early October pipeline explosion in SoCal’s North Desert zone and maintenance, along with low storage inventories headed into winter due to ongoing issues with Aliso Canyon.

California has Issues

To accommodate for the proximate 600 MMcf/d loss following the explosion, SoCal has primarily increased storage withdrawals. There are also constraints on power imports with transmission line maintenance, which is driving more generation into the SoCal market, he said.

Genscape’s Joseph Bernardi, natural gas analyst, agreed, saying import capacity is abnormally low due to three unplanned remediation events, two of which began in the last month. SoCal’s receipts at its Topock points have been restricted to zero since July 2016 due to Line 3000 remediation, a 539 MMcf/d reduction.

On Sept. 18, SoCal began a second unplanned remediation event on their Line 4000, which reduced firm capacity in their Northern Zone by 740 MMcf/d. Finally, the explosion and Force Majeure on SoCal’s 235-2 Line on Oct. 1 took receipt capacity at the Needles points to 0, a 796 MMcf/d reduction. In total, that’s 2,075 MMcf/d of reduced operating capacity, although with some overlap because the Northern Zone contains the Needles and Topock points.

“What that all has meant is that SoCal’s imports have been very close to maximum capacity so far in October, which is relatively speaking a very mild demand period compared to November and December,” Bernardi said.

The Blythe Sub Zone has been flowing 97% full in October, with 31 MMcf/d of available capacity remaining; the Northern Zone has been flowing 93% full, with 37 MMcf/d remaining; and the Wheeler zone has been flowing 97% full with 26 MMcf/d remaining. In total, that’s only 94 MMcf/d of available capacity for imports from those zones remaining.

To put that in perspective, October’s total imports this year have averaged 2,317 MMcf/d, very comparable to last October’s average of 2,357 MMcf/d. Last November saw imports average 2,494 MMcf/d (137 MMcf/d increase from October ”16), and last December’s average imports were 2,954 MMcf/d (597 MMcf/d increase from October ”16), Bernardi said.

“So over the next two months, SoCal may need ~600 MMcf/d more imports by December when it has only ~100 MMcf/d of remaining import capacity. And again, these are monthly averages, to say nothing of daily extremes. Any additional unplanned maintenance on SoCal’s import lines (after already having two events pop up in the last month) would make the situation even more dire,” he said.

SoCal could get the additional ~500 MMcf/d from a few different sources: Aliso Canyon withdrawals; the “TGN-Otay Mesa” Mexican border point and California production points.

Storage Gap

While the limited return of Aliso Canyon does give SoCal some additional storage flexibility, it’s still constrained compared to its pre-leak status because of the inventory cap around 24 Bcf (relative to the prior maximum working inventory of 86 Bcf). That’s a difference of 62 Bcf, which is comparable to the 56 Bcf difference between the current system-wide inventory and the previous three-year average for this date before the Aliso leak.

“While it’s tough to predict with certainty how much withdrawal capacity Aliso’s return will add compared to last year, it won’t be enough to cover the monthly average increases of 137 MMcf/d and 597 MMcf/d in November and December, should this year match last year. That would require 22.6 Bcf of withdrawals from Aliso in those two months alone – to say nothing of January through March. Based on the CPUC’s directed inventory guidelines (max 23.6, min 14.8), they only have a buffer of 8.8 Bcf/d,” Bernardi said.

As for TGN-Otay Mesa and California production, these points typically post low or zero volumes, but can increase when incentivized by price. In total, they have about 520 MMcf/d of average available cap remaining, although they normally don’t post receipts at anything close to operating capacity.

“That said, the increases that have occurred are mostly correlated with price increases this summer, especially for the production points. SoCal’s production receipts recently exceeded 100 MMcf/d for the first time since February, and on Thursday reached their highest point (112 MMcf/d) in nearly two years. TGN Otay Mesa receipts have also jumped nearly 50 MMcf/d today, after sitting at zero for most of this summer,” Bernardi said.

Meanwhile, the largest increase in December forward pricing occurred on Monday, a day after SoCal posted a notice extending the end date for the Line 4000 maintenance from Nov. 21 to Dec. 30. SoCal added in this notice that Needles would be available for limited receipts, estimated at 350 MMcf/d. Right now, Needles is limited to 0 by the L235 Force Majeure, but prior to that maintenance, its firm operating capacity was 796 MMcf/d.

“Although the pipe still hasn’t given any firm end date for that force majeure, this notice suggests that they think Needles receipts will only be back to 47% of normal capacity by the end of December. So that notice not only extended the L4000 maintenance for over a month to cover basically all of December, but also gave us the only info we’ve got so far on what the time scale for the Line 235 repair might be. With both of these significant import constraints still in place, that’s very bullish SoCal Citygate, particularly in the big demand month of December,” Bernardi said.

Still, Margolin said “the market doesn’t fully appreciate the impact of structural gas demand contraction resulting from the growth of renewables, energy efficiency, and demand management tools.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |