Shale Daily | E&P | Infrastructure | NGI All News Access | NGI The Weekly Gas Market Report

Schlumberger, BHGE Cite Deceleration in North America Onshore

North American onshore activity began to moderate during the third quarter as customers became wary of commodity prices, and the outlook into 2018 has diminished, two of the world’s largest oilfield services (OFS) operators said Friday in separate conference calls.

Schlumberger Ltd. (SLB) and Baker Hughes Inc., a GE company (BHGE), reported their third quarter results, with executives appearing hesitant to raise expectations.

SLB recorded 3Q2017 net profits of $545 million (42 cents/share), 200% higher than year-ago income of $176. Revenue was nearly flat at $7.905 billion.

However, while the quarterly results were positive, activity moderated and rigs are falling, noted SLB CEO Paal Kibsgaard. In addition, exploration and production (E&P) companies have offered few clues about their 2018 plans.

The declining global oil supply “clearly demonstrates that the oil market is now balanced…creating the required foundation for a further increase in the oil price and the inevitable growth in global E&P investments.”

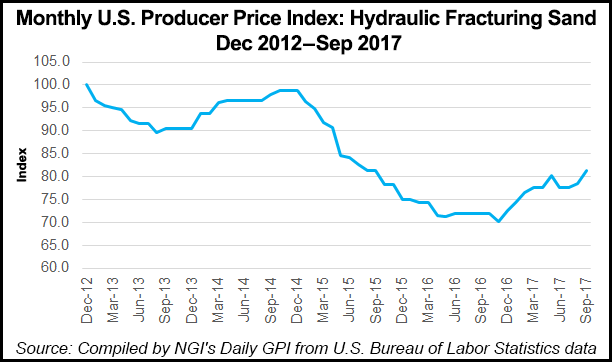

SLB reported solid revenue during the latest period, rising 6% sequentially and again led by the North America land segment, where the company continued to gain market share in both hydraulic fracturing (fracking) and drilling services, “despite the decelerating rig count growth,” Kibsgaard said.

The North America land segment should continue to grow, “but I think the growth rate will slow partly due to the fact to rig count, partly due to the fact that we have deployed most of our fracture equipment and also depending holiday season. So I would say that some growth in North America land, but, obviously, not the same rate as what we’ve seen in previous quarters.”

North American E&Ps have increased capital expenditures (capex) over the past year, but “the production growth is so far fallen short of expectations, driven by supply chain inflation, operational inefficiencies and the need to step out from the Tier 1 acreage.

“This has led to a moderating investment appetite, where the previous pursuit of production growth is now being balanced out with an equal focus on generated solid financial returns and operating within the cash flow.”

The moderation is seen “in the flattening trend of the U.S. land rig count during the third quarter, and it is also reflected in our customers’ 2018 activity outlook. The more tempered activity outlook for U.S. land, combined with the short-cycle nature of the business, has an immediate impact on the outlook for production growth, which were for 2017 and 2018, has been revised down by 100,000 and 500,000 b/d, respectively.”

SLB recorded a “high redeployment rate” for spare frack capacity, Kibsgaard said. “Over the past six months, we have more than doubled the number of active fracturing fleets in North America land and have now redeployed almost all available capacity. This generated transitory costs and inefficiencies across field operations and in our distribution network, which will be addressed during the fourth quarter.”

Meanwhile, the offshore business still is dismal, with U.S. Gulf of Mexico activity weakening further in the third quarter. SLB’s outlook “remains bleak for this region based on current customer plans.”

It’s too early to say what the specific impact of 2018 E&P spend will be on SLB’s business, as customers now are in the planning process, “but we do expect it to be tailwinds in most parts of the world in 2018.”

While the rig count is moderating, demand for SLB’s advanced growth steerable systems “remained at sold-out levels as our customers continue to move toward longer laterals,” said Executive Vice President Patrick Schorn of New Ventures. “Given the demand for our drilling technology offering, we have ramped up manufacturing capacity and will dedicate more capex toward the North America land drilling markets in the coming year.”

BHGE CEO Sees ”Challenging’ Environment

In its first full period as a standalone unit of majority owner (60%) General Electric, BHGE reported a $104 million net loss (minus 24 cents/share). Including GE’s energy business, BHGE revenue was nearly flat year/year at $5.4 billion. Revenue from oilfield services alone was up 7.6% to $2.63 billion.

While the U.S. onshore market recorded growth in the drilling segment, CEO Lorenzo Simonelli pointed to a “deceleration” between July and September. The U.S. rig count climbed only 6% from a year ago, versus a 40% gain for the first nine months.

“We expect the overall oil and gas environment to remain challenging for the rest of the year,” said Simonelli, formerly CEO of GE Oil & Gas. “We have seen some improvement in activity, but we have not seen meaningful increases in customer capital commitments. Oil prices remain volatile and, as a result, our customers remain cautious.”

However, BHGE is “focused on integrating and driving the best of both legacy businesses,” following the merger completion in early July. “As we said, this will be a journey,” Simonelli said.

Customers in North America generally are “quite positive about the outlook,” but BHGE expects activity “to stay flat through the end of the year” until the market has better line of sight into 2018 capex and E&P hedging positions.

Similar to SLB’s outlook for the offshore, BHGE’s subsea market is expected to remain under pressure for the short term, with “little sign of any significant recovery in 2018,” Simonelli said.

In addition, the global liquefied natural gas (LNG) market “continues to be oversupplied…with gas prices pressured” around the world.”

BHGE provides equipment and services for LNG operators.

“The long-term value proposition for LNG remains positive, and we have an industry-leading portfolio in this segment with unsurpassed manufacturing and services capabilities,” Simonelli said. “Opportunities for growth in the short to mid-term exists across the broader midstream and downstream segments in which we participate.”

Those opportunities include gas-to-power projects, stranded gas monetization pipelines and surface compression.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |