NatGas Cash, Futures Tumble; November Retreats 11 Cents

Physical natural gas for Thursday delivery and futures raced each other lower by double digits Wednesday as traders had to digest ongoing warmth and a stiff commensurate loss in heating load. In physical trading all points but one suffered declines with California, West Texas and Appalachia falling by double digits. The NGI National Spot Gas Average dropped 7 cents to $2.59.

Futures bears pushed the market down to technical support levels ahead of an inventory report expected to show a modest contraction of the long-term surplus. At the close November had fallen 10.8 cents to $2.854 and December had given up 6.3 cents to $3.065. November crude oil added 16 cents to $52.04/bbl.

Southern California prices plunged as on-peak power prices and forecast loads ratcheted lower. CAISO forecast that Wednesday’s peak power load of 32,054 MW would subside to 30,317 MW Thursday. Intercontinental Exchange reported that on-peak Thursday power at SP-15 tumbled $14.57 to $40.99/MWh.

Gas at the SoCal Citygate plummeted $0.99 to $4.00 and deliveries priced at the SoCal Border Average shed 17 cents to $2.76. Kern Receipts were off 13 cents to $2.56 and Kern Delivery fell 11 cents to $2.85.

Near-term southern California temperatures are expected to moderate, but by next week a return of temperatures approaching the century mark is in the forecast.

Wunderground.com forecast that Los Angeles’ high Wednesday of 84 would ease to 78 Thursday and 76 by Friday, 2 degrees less than the seasonal norm. Riverside, CA’s Thursday high of 92 was seen falling to 82 Thursday and 73 by Friday, 8 degrees less than its seasonal norm.

Next week is a different story. Los Angeles is expected to see highs of 99 Monday and 96 Tuesday. Riverside is forecast to see highs of 99 both days.

The National Weather Service in Los Angeles said, “The flow will turn offshore on Saturday as a cold air mass settles into the Great Basin behind the trough currently in the Gulf of Alaska. Surface high pressure will build into the Great Basin through the weekend. A warming and drying trend will take shape through the weekend and into early next week.

“Monday and Tuesday will likely be the warmest days of the period when offshore flow teams up the ridge axis aloft to warm the air mass additionally. Temperatures have been nudged higher across the area for Monday and Tuesday with values about 3-5 degrees above guidance for Monday and Tuesday. Record heat is forecast for Monday and Tuesday as guidance values are near or above record levels for Monday and Tuesday.”

Midwest market zones and interior producing zones saw price weakness. Gas at the Chicago Citygate fell a nickel to $2.74 and deliveries to the Henry Hub were quoted 8 cents lower at $2.81. Gas on Transco Zone 4 changed hands 7 cents lower at $2.79 and deliveries to Panhandle Eastern dropped a dime to $2.48.

In the East gas at the Algonquin Citygate fell 6 cents to $2.90 and packages on Dominion South shed 14 cents to $1.01. Parcels on Tetco M-3 Delivery rose 45 cents to $1.94. Gas headed to New York City on Transco Zone 6 was flat at $2.79.

Traders saw the day’s decline as capable of mustering buying interest. “There’s a little warmer weather now for the next few days, but the reality is that it will be short lived,” said a New York floor trader. “It’s starting to get cooler, so for now maybe we’ll get a little dip, and that may be a buying opportunity.

“If you start to see numbers under $2.81, in the $2.70s, then you will start to see a change of attitude. Not only will you see a bail by those longs who are buying at lower levels, but you will see some selling come into the market as well. That could be a trap because any cold weather that creeps into the forecast is going to turn it around.”

He said there have to be a number of nervous fund longs.

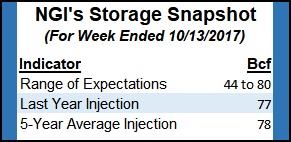

The week’s storage report looks to shave the long-term storage surplus, but recent milder temperatures may swing that trend back around. Last year 77 Bcf was injected and the five-year pace stands at 78 Bcf. Estimates are coming in about 20 Bcf less. ION Energy of Houston predicts a build of 44 Bcf and Citi Futures is calculating an injection of 63 Bcf. A Reuters survey of 26 traders and analysts showed an average 55 Bcf with a range of +44 Bcf to + 80 Bcf.

In the bigger picture storage going forward may be less of a market driver than in the past. With the expansion of pipeline capacity to carry gas out of the Appalachian Basin to Midwest market points, the pipelines themselves serve as de facto storage, lessening the need for additional conventional facilities. One byproduct of the shale revolution has been a relative flattening of gas prices over the last few years. Price signals to incentivize gas storage development (summer-winter spreads and price spread volatility) have been crushed to the point where people have mostly stopped trying to develop new facilities, industry consultant Genscape’s Eric Fell said.

Analysts at ICF International echo those sentiments, saying “low price levels and low price volatility have, at least temporarily but dramatically, diminished the value of storage facilities as a tool to mitigate price risks. As a result, almost all pending new storage projects and capacity expansions have been delayed or canceled.”

Weather bulls must feel like they are paddling upstream. “Warmth continues to dominate much of the next week with little change to the forecast,” said Matt Rogers, president of Commodity Weather Group in a morning report to clients. “Highs still are expected to peak well into the 70s in the Midwest and East over the upcoming weekend and into early next week. A shift toward a cooler pattern has now moved up into the first half of the six to 10 day period, though the first round of cooling can often underperform and is instead more of a shift back to what would be expected for October.

“The second push late in the six to 10 and early 11-15, however, has the potential to be stronger than currently shown here. At the same time, we are watching another burst of strong heat in southern California for the first half of next week that could send temperatures soaring toward the triple digits.”

Near-term total heating and cooling load is expected well below normal in key population centers. The National Weather Service forecasts that for the week ended Oct. 19 New England is expected to see a combined degree day (DD) load of 52, or 59 less than normal. New York, Pennsylvania and New Jersey should have to endure 40 DD or 57 fewer than its seasonal average, and the broader Midwest from Ohio to Pennsylvania is anticipated to see 54 combined DD or 48 less than its seasonal average.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |