NGI The Weekly Gas Market Report | Infrastructure | LNG | Markets | NGI All News Access

Harvey A Harbinger of Global LNG Market Disruptions, Says IEA

Global natural gas markets are well supplied, but the transformation from regional systems to interdependent markets is creating security challenges, including on the U.S. Gulf Coast, the International Energy Agency (IEA) said in an annual assessment.

The second annual Global Gas Security Review issued Wednesday analyzes recent gas balancing issues and risks with related policy developments linked to security of supply, including:

“As recent events demonstrated, the security of natural gas supplies cannot be taken for granted even with the current low price environment and oversupplied market,” said IEA Executive Director Fatih Birol. “From cold spells in southern Europe, to hurricanes in the Gulf of Mexico, to diplomatic tensions among Gulf countries, energy security is impossible to ignore.”

IEA’s review, led by senior gas analyst Jean-Baptiste Dubreuil, details how importing countries in mature and well-interconnected markets still experience unexpected shocks that put strong pressure on the market.

For example, IEA devoted one chapter of its analysis to Hurricane Harvey, which came ashore in South Texas on Aug. 25 as a Category 4 storm, the strongest to strike the state since Carla in 1961.

Gulf Coast Connections

The Gulf Coast increasingly is connected to the global liquefied natural gas (LNG) market, and Harvey may be a harbinger of market disruption from future Gulf Coast storms, researchers said.

Unprecedented rainfall and flooding for days after Harvey made landfall forced mass evacuation of Houston and devastation across the region. Companies evacuated personnel from offshore and onshore gas production facilities.

IEA researchers questioned how Harvey alone affected gas supply security both to Mexico and the global market, given that the United States began to export gas in February 2016.

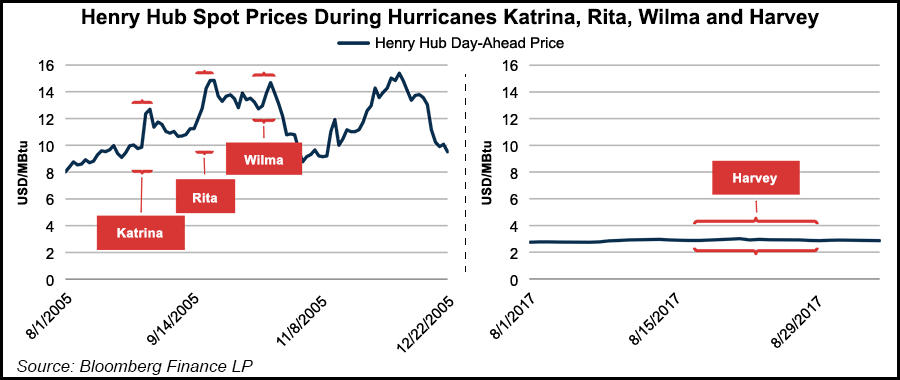

“Harvey’s arrival reminded the region of hurricanes Katrina, Rita and Wilma 12 years ago, which had significant consequences in terms of production shut-ins, resulting in price spikes between late August and October 2005,” researchers noted.

Twelve years ago, the surge in onshore gas supply was a twinkle in the eye of the godfather of unconventional drilling George P. Mitchell. Gas was consumed in the Gulf Coast or transported to other U.S. demand areas. Offshore production’s gas share was around 17%, which meant hurricanes potentially impacted the market when operators repeatedly shut-in production. Damaged power, pipeline and storage infrastructure exacerbated the disruption.

However, the surge in onshore gas supply has diversified production and shifted gas flows. In contrast to the 2005 hurricane season, Henry Hub spot prices remained stable when Harvey blasted ashore.

“Although up to half of Eagle Ford onshore gas production was shut in for a few days and offshore production saw a peak loss of around 26%, U.S. gas production was much more robust,” researchers noted. In Harvey’s wake, gas demand was lower than normal as industrial gas demand decreased from shuttered gas processing plants and/or damage to the infrastructure. Lower temperatures also reduced gas demand.

However, the Sabine Pass LNG export terminal on the Texas coast, the only liquefaction facility in operation on the Gulf Coast, was closed for about two weeks. Meanwhile, Cameron LNG, Freeport LNG and Corpus Christi Liquefaction are set to begin operation by the end of the decade, which should further boost the significance of the Gulf Coast as a link to global LNG markets.

Export Markets ”Clearly’ Vulnerable

“Almost all U.S. LNG capacity currently under development will be located in an area from western Louisiana to Corpus Christi in Texas, totalling 80 bcm,” IEA noted.

“Clearly, the Gulf Coast is vulnerable to disruption, potentially for weeks at a time.” Sabine Pass stopped loading LNG vessels for 12 days, and 10 LNG vessels were waiting in the offshore for loading. As capacity builds on the Gulf Coast, hurricanes could delay cargoes for LNG importers.

U.S. LNG imports have become an increasingly important source for Latin American markets.

Chile, for example, represented 4.4 bcm of gas imports in 2016, of which U.S. LNG accounted for 17%. Pipeline imports from Argentina have virtually dropped to zero since June 2015 and Chile even started to re-export gas to Argentina from its regasification terminals. Indigenous production only has a share of 23% of yearly supplies.

While the United States can now ride out severe disruptions because of onshore supply, big gas import markets like in Chile and Mexico may not be as fortunate.

“Due to a declining national gas production and a soaring demand in the power sector, by 2022, about half of Mexican gas needs will be sourced from the Texas/Gulf region, and the connection between the United States and Mexico will be even stronger as new pipeline capacity of around 40 bcm will be added to the existing 100 bcm,” said researchers.

During Harvey, for example, Mexico’s Control Centre for Natural Gas, or Cenegas, implemented demand-side measures and requested end-users decrease consumption for six days to protect the integrity of the system.

“In addition, capacity at the LNG terminals Madero and Manzanillo was used in order to balance interrupted supply from the U.S. border,” said researchers. “Mexico’s increasing dependency on U.S. pipeline gas will make security of supply measures indispensable in the instance of hurricanes once again affecting U.S. imports.”

Even in the current low-price gas environment, suppliers remain exposed to other “low-probability but high-impact events” that potentially have serious consequences for global gas supplies.

The IEA’s initial review of global gas security last year identified and analyzed critical elements of the market, such as physical production flexibility of the LNG infrastructure and flexibility in contractual arrangements. This year’s edition updates those metrics and shows a continuing improvement in supply availability and contractual flexibility, which are expected to grow in the near future, along with diversified market participants.

Contracts Less Rigid

“LNG contract flexibility appears as an important determinant of the resiliency of the global gas system,” researchers said. An analysis of new signed contracts “shows clear evidence of contractual structures becoming less rigid, a trend evidenced by the growing share of flexible destination contracts, as well as the decrease in contracts’ average duration.”

Contract flexibility should evolve over the next five years.

“Looking forward, the pool of legacy export contracts with fixed destination and long duration can be expected to shrink as these expire and be replaced by more flexible contracts,” said researchers.

“The development of U.S. exports emerges as a major source of additional contractual flexibility. Global portfolio players would play an increasing role and provide additional flexibility from their currently open selling positions.”

To improve the risk assessment of importing countries, IEA also introduced a “typology” of LNG buyers as a tool to measure market exposure, and related security of supply issues. The typology also suggested a way to measure future LNG market evolution.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 | ISSN © 1532-1266 |