Shale Daily | Bakken Shale | E&P | NGI All News Access | NGI The Weekly Gas Market Report

Destination China for Continental’s Bakken Volumes

Continental Resource Inc. has sold its first-ever Bakken Shale crude oil for overseas delivery, with more than 1 million bbl to be delivered to China.

Atlantic Trading and Marketing, which is taking delivery in November, intends to export the oil to China, Continental said. No financial details were disclosed.

“This is a historic day for Continental and begins a new chapter in our long-term strategy to establish multiple international markets for American light sweet oil,” said CEO Harold Hamm.

“This new normal was created by the American shale energy revolution and the lifting of the 1977 crude oil export ban. We expect to see many similar industry transactions in coming months and years.”

Hess Corp.last year sent 175,000 bbl of Bakken crude to Rotterdam, in the Netherlands, the first North Dakota crude to leave North America after the U.S. government lifted the crude export ban in late 2015.

With the foreign oil export ban lifted, sales may be transacted without a license, Hamm said. U.S. oil sales have grown since, primarily to foreign refineries configured to process light, sweet crude oil.

“We recognized back in 2015, when we were working to lift the export ban, that American light sweet oil would be a good fit for these refineries, especially in Europe and Asia,” Hamm said.

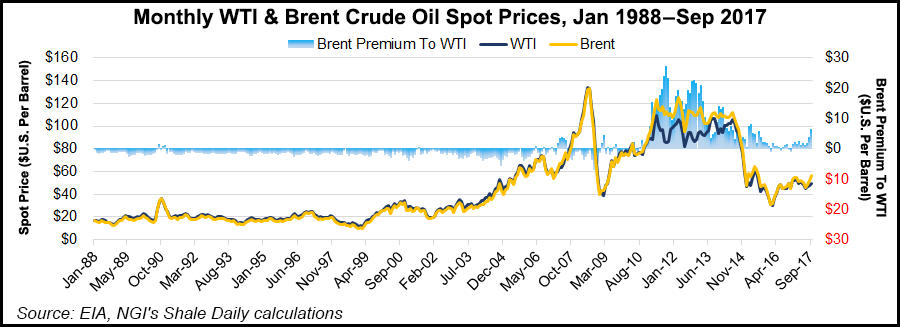

“The current $6.00/bbl discount to Brent should not exist,” he said, given the consistency and quality of West Texas Intermediate (WTI) and relative shipping costs.

“Stabilized U.S. production and increasing industry sales of American crude to international markets will drive down U.S. inventories, correcting much of the recent disparity between Brent and WTI prices. Modern modes of transport in the crude oil sector today eliminate price disparities between markets and allow free markets to work.”

Continental is continuing to develop additional international markets for its light sweet oil, Hamm added.

During the second quarter, the Oklahoma City-based operator reported net production of 20.6 million boe (226,213 boe/d), a 3.1% increase year/year. Crude oil production fell 5.8% year/year, but natural gas output increased by 16.9%, to 605 MMcf/d from 517.7 MMcf/d.

The company placed online 19 gross operated wells in the Bakken in the second quarter, with an average 24-hour initial production rate of 1,606 boe/d, 82% weighted to oil. Five of the wells ranked in the company’s top 10 in terms of all-time production for the play, based on 30 days of production.

In addition to the Bakken, Continental’s capital mostly is directed to Oklahoma’s stacked reservoirs.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |