Too Much Gas? EIA’s Henry Hub Price Forecasts Revised Lower

Henry Hub natural gas spot prices this year and next will be lower than previously forecast, according to the Energy Information Administration (EIA), which now predicting an average of $3.03/MMBtu for 2017 and $3.19/MMBtu next year.

Those price forecasts, included in EIA’s latest Short-Term Energy and Winter Fuels Outlook, are both down from last month, when EIA was forecasting prices would average $3.05/MMBtu this year and $3.29/MMBtu in 2018.

Expected growth in natural gas exports and domestic consumption next year contribute to the forecast increase between 2017 and 2018 Henry Hub natural gas spot prices, EIA said.

In September, the average Henry Hub natural gas spot price was $2.98/MMBtu, up 8 cents/MMBtu from the August level.

New York Mercantile Exchange contract values for January 2018 delivery traded during the five-day period ending Oct. 6 suggest a price range of $2.28-4.63/MMBtu, encompassing the market expectation of Henry Hub prices in January at the 95% confidence level, EIA said.

“Futures prices declined in early September, largely because of reduced demand related to Hurricane Irma in Florida,” EIA said. “Most electricity generation in Florida is natural gas-fired, and electricity generation in Florida on Sept. 11 was 41% lower than the average of the first seven days of September.

“Injections of working natural gas into underground storage exceeded market expectations and historical averages for the first three weeks in September, which further contributed to lower prices.”

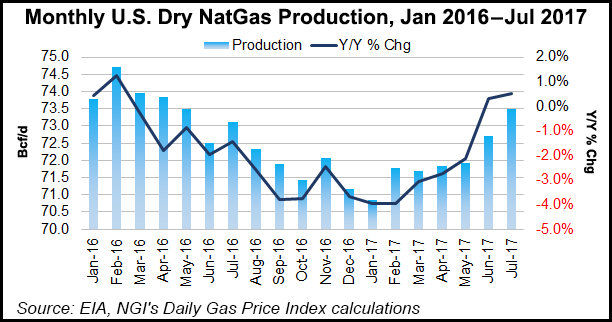

EIA expects domestic dry natural gas production to average 73.6 Bcf/d this year, a 0.8 Bcf/d increase from 2016, and is forecasting 2018 production to reach a record 78.5 Bcf/d.

“As rising natural gas production keeps pace with increasing consumption and demand for exports — particularly for liquefied natural gas (LNG) — EIA projects a balanced market from the last quarter of 2017 through 2018,” the agency said. “LNG export capacity is expected to increase, with LNG exports projected to exceed 3 Bcf/d in 2018, 66% higher than in 2017. Increased takeaway capacity out of the Marcellus and Utica shale plays is expected to help boost production.

The United States was a net importer of natural gas last year, averaging 0.6 Bcf/d, but it is expected to be a net importer this winter.

Increased pipeline capacity to Mexico and LNG export capacity on the Gulf Coast will help push net exports to an average 1.4 Bcf/d through the winter, EIA said.

Earlier this month, the EIA released its Natural Gas Monthly report that revealed that U.S. dry natural gas production increased year/year in July to 2.28 Tcf, a 0.5% increase from July 2016.

The July data also revealed that the largest importer of natural gas from the United States was Mexico via vessel at 14.4 Bcf.

Turning to storage, the government agency said inventories should total 3.8 Tcf at the end of October.

“During the first three months of the 2017 injection season, which starts in April, the rate of natural gas inventory builds was lower than the five-year average,” the agency said. “However, cooler-than-average temperatures in August reduced the use of natural gas for electricity generation, which contributed to builds that were above the five-year average during August 2017 and September 2017.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9966 |