Market Makes Counterintuitive Move Post EIA Stats

November futures made an unusual move Thursday following a report by the Energy Information Administration (EIA) showing a storage injection that was greater than traders were expecting.

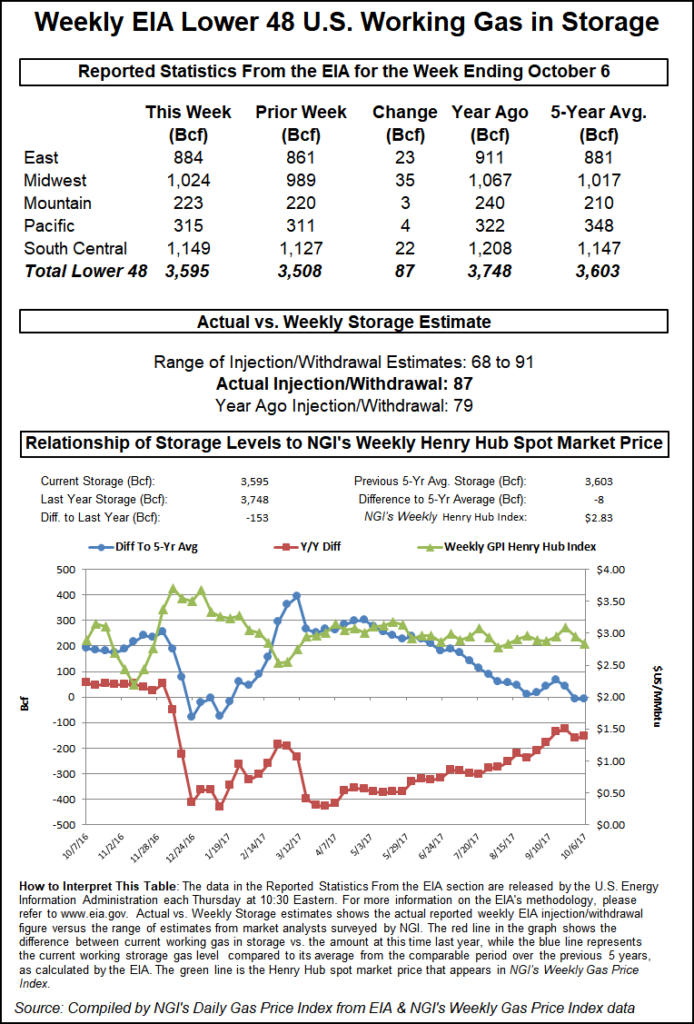

The EIA reported a storage injection of 87 Bcf, about 5 Bcf above consensus estimates. Before the report was issued, the market was hovering around $2.955, and following the data release November futures dropped to $2.931. By 10:50 a.m., November was trading at $2.974, up 8.5 cents from Wednesday’s settlement.

Ahead of the report, traders were looking for a storage build about in line with historical norms. Last year 79 Bcf was injected, and the five-year average stands at 87 Bcf. Citi Futures Perspective calculated a 77 Bcf injection, and Stephen Smith Energy Associates was looking for an 87 Bcf build. A Reuters survey of 24 traders and analysts showed an average 82 Bcf with a range of +68 Bcf to +91 Bcf.

“We took a little dive once the number came out, but did not take out the low from overnight trading,” said a New York floor trader. “The market fell down to $2.93 and then rallied back up. Interesting scenario, interesting results, but we are still stuck in a range so it is not as if anything has changed.”

Inventories now stand at 3,595 Bcf and are 153 Bcf less than a year ago and 8 Bcf below the five-year average.

In the East Region 23 Bcf were injected, and the Midwest Region saw inventories rise by 35 Bcf. Stocks in the Mountain Region were 3 Bcf more, and the Pacific Region grew by 4 Bcf. The South Central Region added 22 Bcf.

Salt storage rose by 10 Bcf to 310 Bcf and non-salt storage increased 11 Bcf to 838 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |