NatGas Cash, Futures Seemingly Quiet, Yet Next-Day Appalachia Prices Swoon

At first glance next-day physical natural gas prices looked relatively stable with the NGI National Spot Gas Average easing 4 cents to $2.56, but looking closer showed a plunge in Appalachia and Northeast prices offset by steady gains in the Midwest, Midcontinent, Texas, and Louisiana. California prices gained in spite of the effects of load-killing wildfires in northern California.

Futures trading consisted of marking time ahead of Thursday’s Energy Information Administration (EIA) inventory report. At the close November had slipped two-tenths to $2.889, and December was off five-tenths to $3.066. November crude oil rose 38 cents to $51.30/bbl.

Northeast locations plunged as weak energy demand and softening next-day power prices gave buyers little incentive to make incremental purchases. ISO New England forecast that peak load Wednesday of 15,300 MW would slide to 14,620 MW Thursday and 14,150 MW Friday. The PJM Interconnection estimated that peak load Wednesday of 34,071 MW would slip to 31,855 MW Thursday before falling further to 30,194 MW Friday.

Gas at the Algonquin Citygate shed 52 cents to $2.50 and packages on Tennessee Zone 6 200 L tumbled 38 cents to $2.48. Gas priced at Tetco M-3 Delivery free fell $1.53 to $1.05 and gas on its way to New York City via Transco Zone 6 was quoted 27 cents lower at $2.62.

Next-day peak power prices were also unsupportive. Next-day peak power at the Indiana Hub shed $2.75 to $33.50 and Thursday on-peak power at the ISO New England’s Massachusetts Hub skidded $8.89 to $28.39/MWh, according to Intercontinental Exchange. Peak Thursday power at the PJM Interconnection fell $5.76 to $31.35/MWh.

Weak Appalachia and Northeast pricing should become a thing of the past once mega-pipeline projects reach completion late 2017 and early 2018, thereby permitting Appalachian gas currently without a market to reach Midwest market centers.

FERC issued an order Wednesday clearing Nexus Gas Transmission LLC to start construction, an expected but no less significant step forward for the delayed greenfield natural gas pipeline.

The order came the same day as the competing Rover Pipeline LLC received clearance from the Federal Energy Regulatory Commission to resume work at four horizontal directional drilling (HDD) locations where work had been stopped since May.

Fires in northern and southern California have scorched at least 115,000 acres, killed 19 people and cut natural gas and electricity service across the state. Fires in southern California are concentrated in Orange County and have knocked out a 500 kV transmission line, according to industry consultant Genscape. The fires in northern California are more destructive and have transgressed urban areas. PG&E reported 75,000 customers without power in and around the city of Santa Rosa.

Next-day gas at Malin rose 8 cents to $2.62 and deliveries to the PG&E Citygate were quoted 5 cents higher at $3.13. Kern Delivery came in at $2.70 up 9 cents and Kern Receipts changed hands at $2.57, up 7 cents.

Traders aren’t looking for a protracted sell-off in the futures as long as expected seasonal weather shows up. Stephen Kessler of Beacon Energy says “I do think there are downside risks to the futures, but given the time of year we are in, a quick washout seems unlikely and sideways action after sell-offs is not a surprise for now. That will ultimately change as we get closer to winter if supportive weather does not pan out, but we are many weeks if not months from that point.”

EIA isn’t looking for any significant sell-off either. Henry Hub natural gas spot prices this year and next will be lower than previously forecast, according to EIA, which is now predicting an average of $3.03/MMBtu for 2017 and $3.19/MMBtu next year.

Those price forecasts, included in EIA’s latest Short-Term Energy and Winter Fuels Outlook, are both down from last month, when EIA was forecasting prices would average $3.05/MMBtu this year and $3.29/MMBtu in 2018.

Expected growth in natural gas exports and domestic consumption next year contribute to the forecast increase between 2017 and 2018 Henry Hub natural gas spot prices, EIA said.

Tom Saal, vice president at FCStone Latin America in Miami in his work with Market Profile says to expect the market to test Tuesday’s value area at $2.890 to $2.876. Market Profile is a breakout trading system and Saal says if initial balance points at $2.894 and $2.827 are breached look for trading objectives higher at $2.928 and lower at $2.794.

“Oversold daily stochastics provide a good buying signal for consumers, especially in a shoulder month,” said Saal in a morning note to clients.

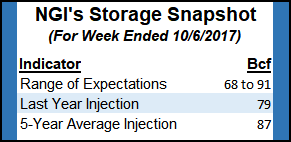

Thursday’s storage report should give traders a better idea what season-ending inventory levels might look like. Estimates are close to historical averages. Last year 79 Bcf were injected and the five-year pace stands at 87 Bcf. Citi Futures Perspective is looking for a 77 Bcf build and Stephen Smith Energy calculates an 88 Bcf injection. A Reuters survey of 24 industry cognoscenti revealed an average 82 Bcf with a range of +68 Bcf to +91 Bcf.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |