NGI Weekly Gas Price Index | Markets | NGI All News Access

Weekly NatGas Losses Continue As Building Storm Aims At Heart Of The GOM

With heating load falling below historical norms it became a tough slog for weekly natural gas prices to gain much traction, and for the week ended Oct. 6 only a few points followed by NGI made it to the positive side of the trading ledger. The NGI Weekly Spot Gas Average continued the trend from the week before and fell 12 cents to $2.49.

Activity at NOVA/AECO C rebounded from the prior week and showed the week’s greatest gain at actively traded points posting a rise of $C0.29 to $C0.61/Gj. Trading at NOVA AECO C was not without excitement, however, as gas did trade during the week as low as -$C0.19/Gj.

Gas on Texas Eastern M-2 Receipt lost the most of actively traded locations dropping 56 cents to $0.66.

All regions fell into the red with Appalachia seeing the greatest setback dropping 35 cents to average $1.09, followed by the Southeast giving up 20 cents to $2.79.

The Midwest, South Louisiana, and the Midcontinent all fell by double digits; the Midwest down 17 cents to $2.64, South Louisiana off 12 cents to $2.77, and the Midcontinent falling 10 cents to $2.53.

Single-digit declines ranged from South and East Texas giving up 7 cents to $2.81, and $2.78, respectively to losses as small as 2 cents in California to $2.76.

November futures shed 14.4 cents on the week to $2.863.

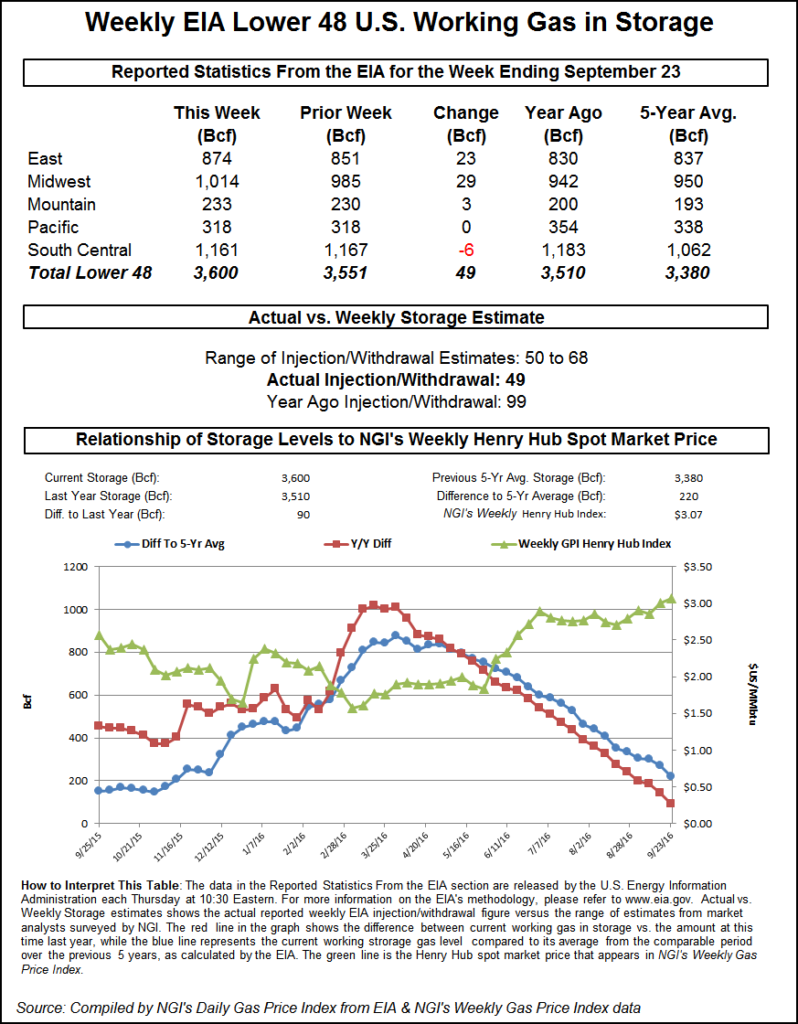

Thursday’s activity saw a market unwilling to respond to supportive storage data as the Energy Information Administration (EIA) reported a build of 42 Bcf for the week ending Sept. 29, well below historical norms, and below market expectations as well. At the end of the day on Thursday, November had eased 1.7 cents to $2.923, and December was off 1.9 cents to $3.103.

The storage injection was about 9 Bcf lower than consensus estimates, and just before the report was released, the market was hovering around $2.970. Following the release, November futures rose to a high of $2.995, and by 10:45 a.m., November was trading at $2.962, up 2.2 cents from Wednesday’s settlement.

Before the storage report, traders were looking for a build significantly higher, but less than historical norms.

Last year 76 Bcf was injected and the five-year average stands at 91 Bcf. Tradition Energy calculated a 47 Bcf injection, and Citi Futures was looking for a 61 Bcf build. A Reuters survey of 22 traders and analysts showed an average 51 Bcf with a range of +42 Bcf to +68 Bcf.

“We had heard 51 Bcf and the number made its high right after the number came out,” a New York floor trader told NGI. “The market held $3, and I think some shorts jumped on that. We are not seeing any great momentum to the upside and we are still stuck in the trading ranges.”

Wells Fargo Securities LLC analysts called the report “slightly bullish” and noted that since the end of April (22 weeks) “the surplus versus the five-year average has fallen by 310 Bcf, indicating the market continues to be 2 Bcf/d undersupplied.

“Our cumulative injection forecast for the next two weeks is 153 Bcf, 3 Bcf below last year’s cumulative injection of 156 Bcf and 12 Bcf below the five-year average of 165 Bcf.”

Inventories now stand at 3,508 Bcf and are 161 Bcf less than last year and 8 Bcf less than the five-year average.

In Friday’s trading gas for delivery over the weekend and Monday fell hard as what is viewed as a well-supplied market proved no match for weakness extending from the Rockies and California to Texas, Louisiana, the Midcontinent, Midwest and Appalachia. The NGI Daily Spot Gas Average retreated 8 cents to $2.50.

Futures responded to continuing weather outlooks featuring warm temperatures and reduced heating load and at the close November had lost 6.0 cents to $2.863 and December was down 5.7 cents to $3.046.

New England was one of the few spots that showed gains as Monday on-peak power prices moved into positive territory. Intercontinental Exchange reported on-peak Monday power at the ISO New England’s Massachusetts Hub rose a stout $13.81 to $46.03/MWh and Monday peak power at the PJM West Terminal added $9.10 to $47.53/MWh.

Gas at the Algonquin Citygate added two cents to $2.68 and deliveries to Iroquois Zone 2 gained 2 cents to $2.82. Gas on Tetco M-3, however, plunged 45 cents to 91 cents and gas headed for New York City on Transco Zone 6 skidded 12 cents to $2.57.

Deliveries to the Chicago Citygate fell 9 cents to $2.70 and packages at the Henry Hub were quoted a penny higher at $2.92. Gas on El Paso Permian fell 7 cents to $2.41 and parcels on Panhandle Eastern changed hands two cents lower at $2.51.

Out West gas at Opal fell 6 cents to $2.53 and Kern Delivery came in at $2.64, down 5 cents. Gas at the PG&E Citygate was off 7 cents to $3.09, gas priced at the SoCal Citygate was seen 15 cents lower at $2.91.

“We’ll have to see how this market plays out next week. We may see prices down in the $2.70s,” a New York floor trader told NGI. “We are still in that $2.75 to $3.25 trading range.

Analysts are now focusing on the bullish aspects of a market with storage now less than the five-year average. “The 42 Bcf hike was about 8-9 Bcf less than the average street forecast and 17 Bcf below our expectation,” said Jim Ritterbusch of Ritterbusch and Associates in comments Friday. “As a result, the long standing surplus against five year average levels flipped to a small deficit of 8 Bcf with a further moderate stretch in the deficit expected with next week’s [Energy Information Administration] report. This newfound deficit is being shrugged off by the market for now given mild temperature forecasts that are stretching through the next couple of weeks with an elevated pace of production also restricting buying interest. But, this deficit is providing no margin for any unplanned supply disruptions or demand spikes.

“And with storage only slightly above the 3.5 Tcf level, achievement of our expected 3.85 Tcf peak now appears out of reach. The money managers appeared comfortable in setting on a significant net short position for now with the weather factor diminished but we feel that an inevitable close back to above $3 will force a large amount of fund short covering in setting the stage for a more significant price rally that could easily carry up to the $3.20-3.25 zone should the weather forecasts turn cold later this month. But, we also advise raising stop protection to below the $2.88 level on a close only basis.”

Hurricanes Harvey, Irma, and Maria left the market virtually unscathed price wise, but brewing storm Nate is headed directly for the heart of Gulf of Mexico (GOM) production infrastructure.

Tropical Storm Nate, gaining steam as it headed north toward an expected landing on the northern Gulf Coast, had by Friday midday reduced natural gas production from the offshore by more than half to a multi-year low about 1.713 Bcf/d.

Exploration and production companies and pipeline operators in Nate’s path were evacuating personnel and shutting in operations in the GOM, while natural gas processing facilities in Louisiana were suspending operations.

In its 4 p.m. CDT update Friday, the National Hurricane Center said the center of Nate was 80 miles east of Cozumel, Mexico moving toward the north-northwest near 21 mph. Winds were up to 60 mph. That motion was expected to continue, with a turn toward the north/northeast Saturday night and into Sunday. On the forecast track, Nate was expected to move “near or over” the northern Gulf Coast Saturday night or Sunday as a hurricane.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |