Markets | NGI All News Access | NGI Data

Physical NatGas, Futures Part Company As Supportive Storage Data Loses Luster

Physical natural gas for Friday delivery managed to piggyback on to Wednesday’s gains, and with the exception of the Northeast most points were a nickel to a dime higher. Gains in Louisiana, the Rockies, California, the Midwest, and Midcontinent were able to offset weakness in the Northeast and South Texas, and the NGI National Spot Gas Average added 4 cents to $2.58.

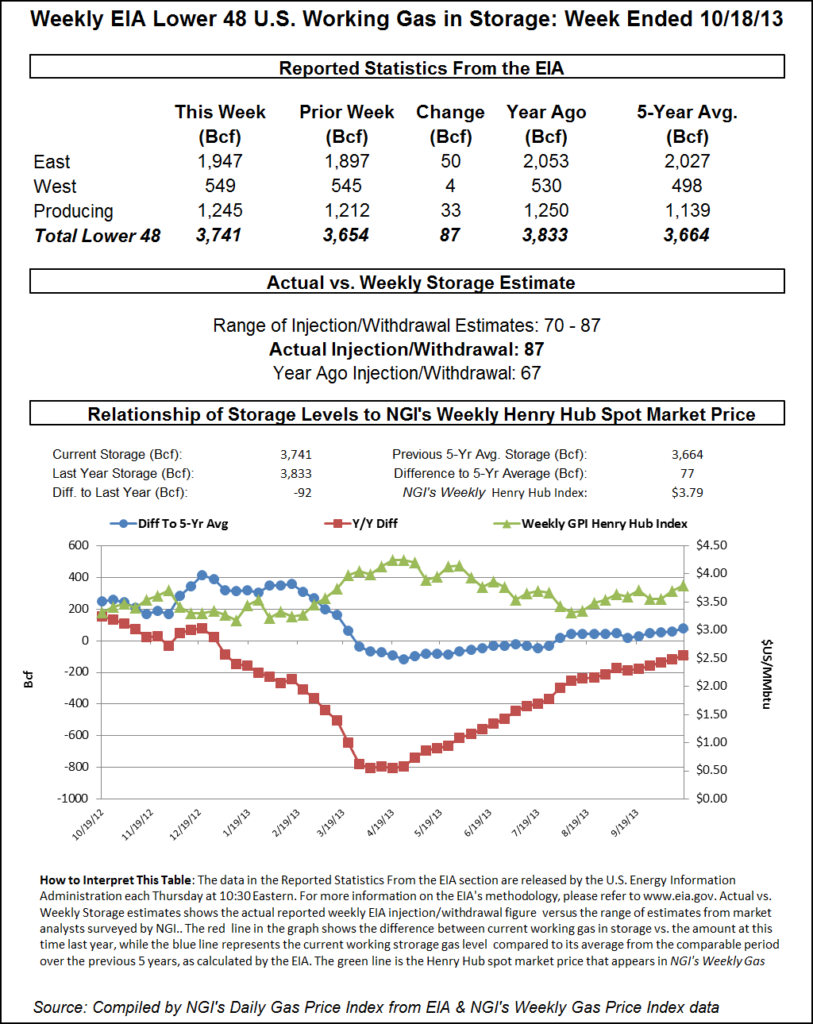

Futures prices once again showed their unwillingness to respond to supportive storage data as the Energy Information Administration (EIA) reported a build of 42 Bcf, well below historical norms, and below market expectations as well. At the end of the day November had eased 1.7 cents to $2.923, and December was off 1.9 cents to $3.103. November crude oil rose 81 cents to $50.79/bbl.

The 10:30 a.m. EDT inventory report by the EIA showed a storage injection that was far less than what traders were expecting.

The storage injection was about 9 Bcf lower than consensus estimates. Just before the report was released, the market was hovering around $2.970. Following the release, November futures rose to a high of $2.995, and by 10:45 a.m., November was trading at $2.962, up 2.2 cents from Wednesday’s settlement.

Before the storage report, traders were looking for a build significantly higher, but less than historical norms.

Last year 76 Bcf was injected and the five-year average stands at 91 Bcf. Tradition Energy calculated a 47 Bcf injection, and Citi Futures was looking for a 61 Bcf build. A Reuters survey of 22 traders and analysts showed an average 51 Bcf with a range of +42 Bcf to +68 Bcf.

“We had heard 51 Bcf and the number made its high right after the number came out,” a New York floor trader told NGI. “The market held $3, and I think some shorts jumped on that. We are not seeing any great momentum to the upside and we are still stuck in the trading ranges.”

Wells Fargo Securities LLC analysts called the report “slightly bullish” and noted that since the end of April (22 weeks) “the surplus versus the five-year average has fallen by 310 Bcf, indicating the market continues to be 2 Bcf/d undersupplied.

“Our cumulative injection forecast for the next two weeks is 153 Bcf, 3 Bcf below last year’s cumulative injection of 156 Bcf and 12 Bcf below the five-year average of 165 Bcf.”

Inventories now stand at 3,508 Bcf and are 161 Bcf less than last year and 8 Bcf more than the five-year average.

In the East Region 13 Bcf were injected, and the Midwest Region saw inventories rise by 25 Bcf. Stocks in the Mountain Region were 3 Bcf higher and the Pacific Region grew by 4 Bcf. The South Central Region shed 3 Bcf.

Next-day prices slumped at Northeast points as temperature forecasts, although above normal, showed a slight downward bias. Forecaster Wunderground.com reported that Boston’s high of 78 Thursday was expected to slide to 75 Friday and Saturday, 10 degrees above normal. New York City’s Thursday peak of 81 was seen easing to 80 Friday and Saturday, 12 degrees above its seasonal norm.

Gas delivered to the Algonquin Citygate fell 12 cents to $2.66 and deliveries to New York City via Transco Zone 6 slid 9 cents to $2.69. Packages on Tetco M-3 Delivery tumbled 27 cents to $1.36 and gas on Dominion South fell 1 cent to 83 cents.

The National Weather Service in New York City said “a weak cold front will gradually move into the area tonight, stall nearby on Friday, and lift north as a warm front on Saturday. Another cold front will approach on Sunday, stall nearby Sunday night, and lift north as a warm front on Monday.”

Elsewhere prices firmed. Deliveries to the Chicago Citygate added 8 cents to $2.79 and gas at the Henry Hub rose 10 cents to $2.91. Gas on El Paso Permian jumped 13 cents to $2.48, and gas priced at the NGPL Midcontinent rose a nickel to $2.62.

Kern River gained 14 cents to $2.59 and Kern Delivery was seen 9 cents higher at $2.69. Gas at the PG&E Citygate was quoted a penny higher at $3.16 and gas priced at the SoCal Border Average changed hands 14 cents higher at $2.70.

As if Harvey, Irma, and Maria were not enough, get ready for Nate.

Tropical Storm Nate formed at 8 a.m. EDT Thursday morning in the Southwestern Caribbean near the coast of Nicaragua, and brought torrential rains to portions of Nicaragua and Costa Rica as it moved northwest at 9 mph, according to Wunderground.com “Nate will be a significant rainfall threat to Central America over the next two days, and is likely to threaten Mexico’s Yucatan Peninsula as a tropical storm or Category 1 hurricane on Friday, and arrive on the U.S. Gulf Coast this weekend as a hurricane. New Orleans is given a 50% chance of experiencing winds of 39+ mph Saturday night.

“Satellite Imagery early Thursday afternoon showed that although the intensity of Nate’s heavy thunderstorms had waned slightly after the center made landfall, the overall structure of the storm was holding together, with the low-level spiral bands remaining prominent. Conditions were favorable for development, with moderate wind shear of 10-20 knots, sea surface temperatures a very warm 30°C (86°F), and an unusually moist atmosphere with a mid-level relative humidity of 85%,” Wunderground.com said.

Overnight weather models turned slightly warmer due in large part to factors resulting from a budding tropical system in the western Caribbean. “Forecast changes are in the warmer direction, most notably from the Midwest to the Southeast,” said MDA Weather Services in its morning six- to 10-day outlook for clients.

“Some of these adjustments can be attributed to the changing details surrounding what is currently Tropical Depression Sixteen in the western Caribbean, and this disturbance remains one to watch for pattern influences into the early stages of this period across the Eastern Half. Other factors include an increase in pattern amplification during the latter stages, with a deepened trough over the West Coast acting to enhance warm anomalies into the Midcontinent at that time.”

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |