Markets | NGI All News Access | NGI Data

NatGas Cash Tumbles On Forecasts Of Declining Energy Usage; November Loses 4 Cents Of Its Own

Both the physical market and futures took it on the chin in Thursday’s trading as forecast drops in eastern energy requirements pulled the plug on market points from New England deep into Appalachia.

Only a couple of points followed by NGI traded in positive territory, and losses of a nickel to a dime in Texas, Louisiana, the Midwest and Midcontinent were easily swamped by double-digit declines in the Northeast and Appalachia. The NGI National Spot Gas Average tumbled 16 cents to $2.46.

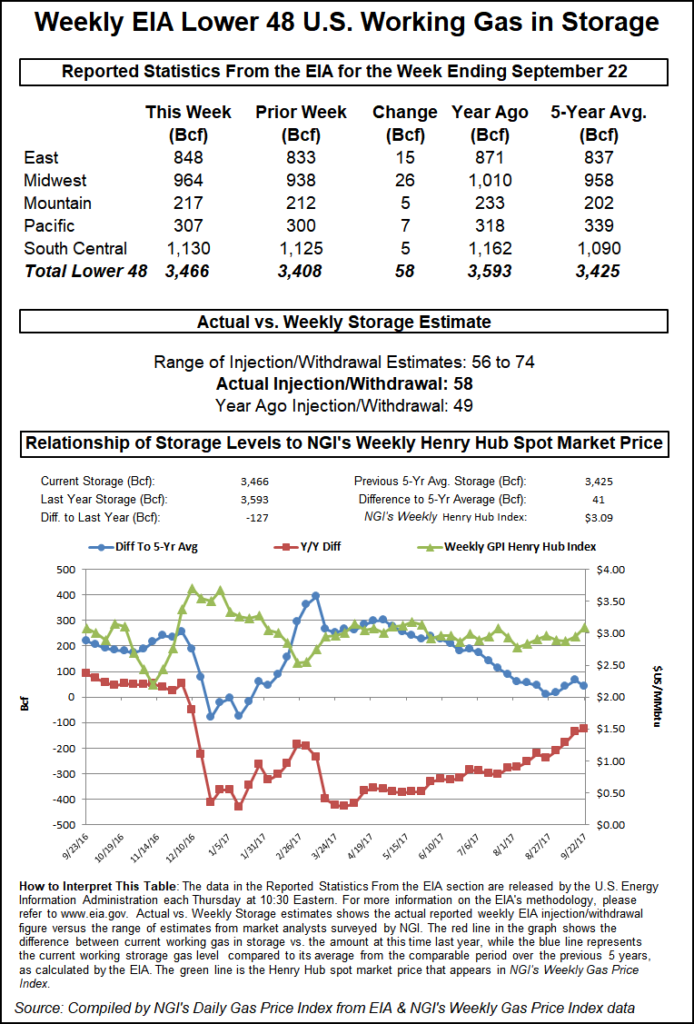

The futures markets fared only slightly better as even supportive storage figures for the week ended Sept. 22 were unable to generate any kind of positive market response. The Energy Information Administration (EIA) reported storage injections of 58 Bcf, about 8 Bcf less than what traders were expecting, but prices nevertheless headed south. At the close November had fallen 4.4 cents to $3.017, and December was off by 3.4 cents to $3.184. November crude oil fell 58 cents to $51.56/bbl.

November futures initially inched higher Thursday following the release of the storage numbers. Just before the 10:30 a.m. EDT report, November futures were hovering around $3.036, and following the release November futures rose to $3.081. By 10:45 a.m. November was trading at $3.069, up eight-tenths of a cent from Wednesday’s settlement.

Traders had been looking for a larger storage build. Last year 49 Bcf was injected and the five-year average build for the week stands at 84 Bcf. ION Energy calculated a 60 Bcf injection and Wells Fargo was looking for a 70 Bcf build. A Reuters survey of 24 traders and analysts showed an average build of 66 Bcf with a range of +59 Bcf to +73 Bcf.

“We are trading the range, but we poked slightly higher, so I am favoring the upside,” said Tom Saal, vice president at FCStone Latin America.

“The muted response is due to the fact we are trading a winter month in a shoulder month time frame. The market is trading the way it should. It was definitely a bullish number but the market has to work off last week’s number [97 Bcf] which was 5 or 6 Bcf higher than expected.

“The economist in me says we are trading a shoulder month,” he said.

As positive as the number may have seemed, it was only enough to nudge the market upward. “It’s going to take a lot more than this [number] to move the market higher. At least we are solidly above $3,” said a New York floor trader.

Inventories now stand at 3,466 Bcf and are 127 Bcf less than last year and 41 Bcf greater than the five-year average. In the East Region 15 Bcf were injected, and the Midwest Region saw inventories rise by 26 Bcf. Stocks in the Mountain Region were 5 Bcf greater and the Pacific Region grew by 7 Bcf. The South Central Region added 5 Bcf.

In physical trading forecast sharp declines in energy usage into the weekend made incremental gas purchases for power generation less attractive if not unnecessary. ISO New England forecast peak power load Thursday of 16,280 MW would drop to 14,140 MW Friday, and fall to 13,470 MW Saturday. The New York ISO predicted peak power load Thursday of 20,756 MW would subside to 18,445 MW Friday, and drop to 16,559 MW Saturday. At the PJM Interconnection Thursday peak power load of 36,577 MW was expected to slide to 32,385 MW Friday and reach 27,482 MW Saturday.

Gas at the Algonquin Citygate shed 27 cents to $1.70 and parcels on Iroquois Waddington skidded 40 cents to $2.23. Deliveries to Tennessee Zone 6 200 L fell 14 cents to $1.65.

In the Mid-Atlantic gas tendered to Tetco M-3 Delivery fell 34 cents to $1.18 and parcels bound for New York City on Transco Zone 6 plunged $1.57 to $1.21. Gas on Dominion South shed 20 cents to 99 cents.

Gas at the Chicago Citygate was quoted 5 cents lower at $2.80 and deliveries to the Henry Hub came in down 3 cents to $2.92. Packages on El Paso Permian changed hands 7 cents lower at $2.39, and gas priced at Northern Natural Demarcation fell 7 cents to $2.67.

At Opal Friday gas fell 3 cents to $2.46 and gas on Transwestern San Juan shed 11 cents to $2.35. At PG&E Citygate next-day volumes came in 3 cents lower at $3.16 and gas at the SoCal Citygate changed hands 11 cents lower at $2.87.

Forecasters are expecting greater warmth over pivotal East and West Coast Energy markets. “[Thursday’s] 11-15 day period forecast is warmer than yesterday’s forecast across the West and East Coast,” said WSI Corp. in its morning report to clients. Portions of the Southwest and central U.S. are cooler.” Continental United States (CONUS) population-weighted cooling degree days “are down 0.5 for Days 11-14 and are now forecast to be 17.9 for the period, and CONUS” gas-weighted heating degree days “are up 0.3 to 13.4 for the period. These are 25.5 below average.

“The forecast could waver in either direction should the timing deviate slightly. The central U.S. has some warmer potential late, while the Northeast could run a tad cooler or not as warm,” WSI said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 | ISSN © 2577-9877 |