E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Permian Resource Recovery Far From Over, Says IHS Markit

Energy researchers at IHS Markit have completed the first, three-year phase of a massive Permian Basin research project that models and interprets key geologic characteristics to better estimate its remaining hydrocarbon potential, with initial results indicating the ancient basin still holds an estimated 60-70 billion bbl of technically recoverable resources.

To conduct the analysis, researchers used proprietary historical well and production database that included more than 440,000 Permian wells, and a proprietary software tool that, for the first time, enabled them to leverage interpreted formation “tops” data to identify accurate formations for completion intervals on hundreds of thousands of wells.

The results of the analysis “significantly alters the understanding of the Permian Basin’s resource potential,” according to the research firm.

“When a geologist looks for new oil reserves, we typically go back to geologic targets where we know oil was targeted and produced previously, and in a well file, we call those targets the producing or completion formations,” said IHS Markit’s John Roberts, executive director, global subsurface content operations.

“This producing formation data is a critical element in assessing and correlating future drilling and production activity, but since that information is highly competitive, many operators have historically under-reported that information, which has created much ambiguity in the data.”

Roberts and Prithiraj Chungkham, director of unconventional resources, co-authored “The Permian Basin Interpreted in 3D: The IHS Markit Permian Basin Unconventionals Kingdom Geology Project.”

“Using a new technology we developed, we’ve leveraged our proprietary IHS Markit interpreted formation-tops data to identify accurate formations for completion intervals on hundreds of thousands of wells, and the results change the game for this basin and for geologists’ interpretations,” Roberts said. “It has significantly changed our understanding of the extent of many formations in the Permian Basin and the potential of those formations to yield additional hydrocarbons.”

The research team spent more than three years building the technology and updating the company’s historical well and production records that cover the Permian’s nearly 100-year history.

Gathering Years of History

“We’re a mix of geologists, private detectives and data scientists who have new tools that now enable us to re-examine the historical data and completely reassess the potential of this mature, giant basin in a 3D model,” Roberts said. “I’m one of more than 60 geologists who have been recording and correlating formation ”tops’ data for the Permian Basin for over 30 years, so this represents a lifetime of work for many of us, and it’s exciting to finally see the pieces of the puzzle fall into place.

“For a scientist, it’s like looking through a more powerful microscope and suddenly seeing something clearly for the first time — it is very exciting.”

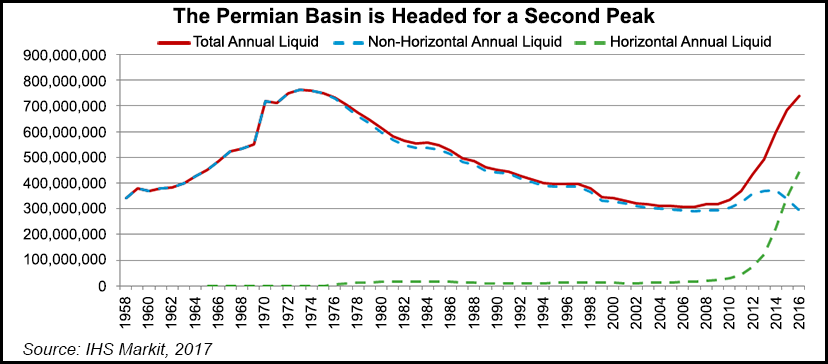

The Permian, primarily in West Texas and extending into southeastern New Mexico, has produced cumulatively more than 39 billion bbl (cumulative) of oil since production began the 1920s, reaching a previous production peak in 1973.

“As conventional oil production in the play declined steadily during the following three decades, many in the industry thought the Permian’s best days were behind it, but unconventional drilling and completion technology changed the game in the 2000s,” IHS Markit noted.

“This advance made possible the extraction of unconventional shale resources that were previously uneconomic to produce, and changed the view of geologists, who, for decades, had bypassed these less desirable targets in favor of conventional reservoirs.”

The onset of horizontal drilling and and new hydraulic fracturing (fracking) completion technology over the past decade helped reverse the Permian’s production decline, and the basin is on track to soon eclipse its previous peak, according to IHS Markit.

“The Permian Basin is America’s super basin in terms of its oil and gas production history, and for operators, it presents a significant variety of stacked targets that are profitable at today’s oil prices,” Chungkham said.

In the analysis, researchers modeled and interpreted more than 70 formations and benches across the Permian and delivered them in a work-station ready 3D format, “so Permian operators or new-entrants can fast-forward their analysis.”

Potential for Short-Lateral, Low Volume Fracking Wells

In particular, he said, “the tremendous improvement in assigned-producing formations adds significant detail and dramatically changes the views of the basin and our understanding of where future hydrocarbon potential exists, allowing for faster economic evaluation of acreage and productive potential.”

Based on the analysis, “a previously undiscussed opportunity for production may be from the tight, noncontinuous plays produced through short-lateral wells and low-volume fracking. This offers lower risk, improved upside potential and ultimately, lower recovery costs, which is good news for operators.”

Understanding the economic limits of both geography and geology in the Permian is key for operators and investors, said Roberts. And researchers “are not done yet. We are already at work on the second-phase of the Permian Basin analysis, which is to further delineate the various Wolfcamp sub-benches.”

According to a base case in a new modeling scenario issued last week by consultant Wood Mackenzie, the Permian’s peak output could increase by 500,000 b/d as new technology adoption accelerates. In the reference case analysis, Permian production is forecast to increase to more than 5 million b/d in 2025.

However, there are risks as producers adapt to the speedy growth and attempt to pull more oil and natural gas from the massive resource base, Wood Mackenzie’s researchers said. Geological constraints could arise as the play is aggressively developed, which could lead to production shortfalls, and potentially to higher prices early next decade.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |