Weekly NatGas Cash, Futures Part Company As Market Reels From Storage Stats

Both physical and financial natural gas markets were poised to make healthy gains by midweek, but the weekly Energy Information Administration (EIA) storage report stunted gains in the physical market, and pushed the October futures into the loss column for the week.

The NGI Weekly Spot Gas Average was higher by 14 cents to $2.77, and gains were widespread excluding the Rocky Mountains and California. The week’s greatest gainer was Iroquois Zone 2 with a rise of 76 cents to $3.01 and the week’s weakest was found north of the border at Nova/AECO C with a drop of $C0.16 to average $C1.16/Gj.

Regionally the Northeast came out on top with an advance of 56 cents to average $2.75 and the week’s laggard proved to be California with a loss of 6 cents to $2.88.

Double-digit advances were posted by Appalachia, 35 cents to average $1.71, South Louisiana up 13 cents to $3.03, the Southeast with a rise of 12 cents to $3.09, and South Texas with a gain of 11 cents to $2.99.

The Rocky Mountains, the only other regional decliner, shed a nickel to $2.58.

October futures fell 6.5 cents on the week, which was enough to fall below the psychological $3 price level to $2.959.

The trading complexion of the week changed significantly with the EIA storage report. Thursday’s trading began Wednesday evening with October futures at around $3.08, but by 10:00 a.m. EDT on Thursday, the October contract had already slid to $3.02. Just before report time the market was hovering around $3.032.

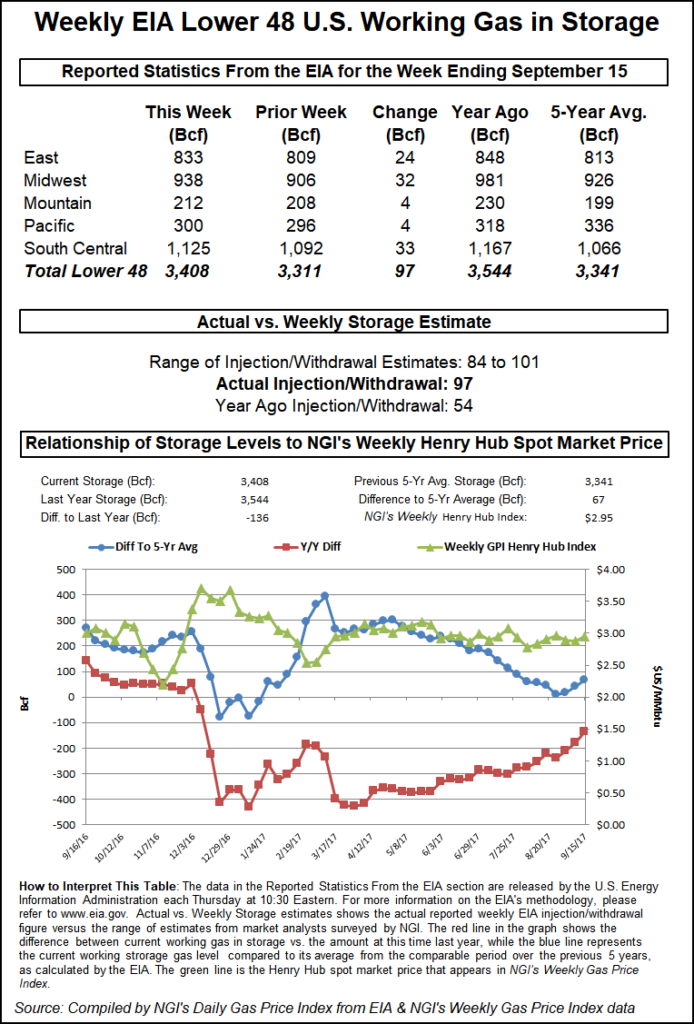

The EIA reported a storage build for the week ended Sept. 15 of 97 Bcf at 10:30 a.m. EDT, about 6 Bcf greater than expected, and the bears were off to the races. October futures promptly dropped to $2.982, and by 10:45 a.m. October was trading at $2.979, down 11.5 cents from Wednesday’s settlement. At the close on Thursday, October had dropped 14.8 cents to $2.946, and November fell 14.2 cents to $3.007.

Prior to the report traders were looking for a lesser storage build, but nonetheless well above historical norms. Last year 54 Bcf was injected for the week and the five-year average stands at a 73 Bcf build. Citi Futures Perspective calculated an 84 Bcf injection and Stephen Smith Energy was looking for an 88 Bcf build. A Reuters survey of 25 traders and analysts showed an average build of 91 Bcf with a range of plus 84 Bcf to plus 100 Bcf.

“I had heard 91 Bcf, so it was a little bit of a bearish number, and we sold off on it,” said a New York floor trader.

“To call this a buying opportunity is a little bit of a scary assumption, but you know we will get over $3 again. This market has been see-sawing back and forth at $3 for months, but I would wait a little bit, a couple of days.

“The initial influx is going to be everyone wants to sell it, sell it, sell it and you may have hit some stops to bring it to this level. If you do buy it at these levels I would put a stop in at $2.75,” the trader told NGI.

One school of thought has the market setting up for more volatility. “After a pretty constructive week, the market took NG1 down by nearly 15 cents in a matter of hours, settling back below the $3/MMBtu level,” noted Breanne Dougherty, analyst with Societe Generale in New York.

“We definitely were more in line with the momentum of earlier this week, and do not see support for today’s aggressive downward move. We remain bullish to the Nymex as a whole through 2018, we see the curve as particularly undervalued through 1H 2018; the closer winter gets, the more volatile things are likely to become.”

Inventories now stand at 3,408 Bcf and are 136 Bcf less than last year and 67 Bcf greater than the five-year average. In the East Region 24 Bcf was injected, and the Midwest Region saw inventories rise by 32 Bcf. Stocks in the Mountain Region were 4 Bcf greater, and the Pacific Region grew by 4 Bcf as well. The South Central Region added 33 Bcf.

In Friday’s trading physical natural gas deliveries went begging as buyers were reluctant to commit to three-day deals in light of easy spot gas purchases via cell phones and electronic devices.

Stout gains in New England were unable to overcome pervasive weakness in Texas, Louisiana, the Midcontinent, Midwest, Rockies and California. The NGI National Spot Gas Average on Friday for weekend and Monday delivery fell 4 cents to $2.66.

Futures trading was held to a 3 cent range and at the close October had risen 1.3 cents to $2.959 and November had gained 1.4 cents to $3.021. November crude oil added 11 cents to $50.66/bbl.

Physical prices in New England were one of the few bright spots, posting double-digit gains for weekend packages as Monday power quotes made incremental power purchases viable. Intercontinental Exchange reported that Monday on-peak power at the ISO New England’s Massachusetts Hub jumped $30.70 to $59.58/MWh.

Gas at the Algonquin Citygate vaulted 64 cents to $2.77 and deliveries to Iroquois Waddington were quoted up 19 cents to $2.94. Gas priced at Tennessee Zone 6 200 L jumped 51 cents to $2.47.

The National Weather Service in southeast Massachusetts reported that rapidly diminishing post tropical storm Jose southeast of Nantucket “will slowly drift back to the southwest the next few days. This will maintain strong winds, rain and rough seas [Friday], which then diminish. Clearing skies will move in from the west tonight and Saturday.

“Warmer weather arrives Sunday and Monday, before a backdoor front brings cooler weather and possibly a few showers by midweek.”

Other locations saw mostly lower pricing. Gas on Tetco M-3 Delivery fell 13 cents to $1.40 and packages headed for New York City on Transco Zone 6 were up 2 cents to $3.01. Gas on Dominion South fell 18 cents to $1.31.

Packages at the Chicago Citygate were quoted 7 cents lower at $2.89 and gas at the Henry Hub shed 16 cents to $2.95. Gas on El Paso Permian changed hands 12 cents lower at $2.36 and parcels on Panhandle Eastern fell 8 cents to $2.53.

At Opal weekend and Monday gas came in 11 cents lower at $2.50 and Kern Delivery was seen 11 cents less at $2.57. Gas at the SoCal Citygate fell 18 cents to $2.81 and gas priced at the SoCal Border Average dropped 13 cents to $2.55.

Futures traders were unimpressed with the day’s activities. “We are under $3 and it doesn’t look too promising,” said a New York floor trader. “We are just kind of stuck in this range where we have been stuck forever.”

Analysts see a trading range as well. “[A]lthough the bulk of [Thursday’s] 24 Bcf increase in the supply overhang will likely be negated with next week’s Energy Information Administration data, this supply is currently being viewed as ample,” said Jim Ritterbusch of Ritterbusch and Associates in comments Friday.

“Indications of a near record pace of production is also weighing on the market with yesterday’s strong storage build providing reinforcement in this regard. But despite several bearish market considerations, we see further downside from yesterday’s close limited to only about 6 cents just as we saw restricted upside possibilities above the 3.14 area.

“From here, we will look to trade this market off of this month’s nearby futures price parameters of 2.88 to 3.16 as a longer term position type trade is apt to remain elusive. In the absence of what would appear to be favorable position type trades from either side of the market, option writing strategies designed to capture premium would be advised.”

Drilling statistics were hardly music to the bulls ears. The U.S. rig count fell by one, but within that was a gain of four natural gas-directed drilling rigs. That was unable to offset declines in oil-directed drilling, according to data compiled by Baker Hughes Inc.

The Permian Basin had a good week, adding six rigs, but that wasn’t enough to prevent the ongoing pullback in the U.S. rig count from continuing.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |