U.S. NatGas Rigs Down One, With Oil Rigs on Steeper Decline

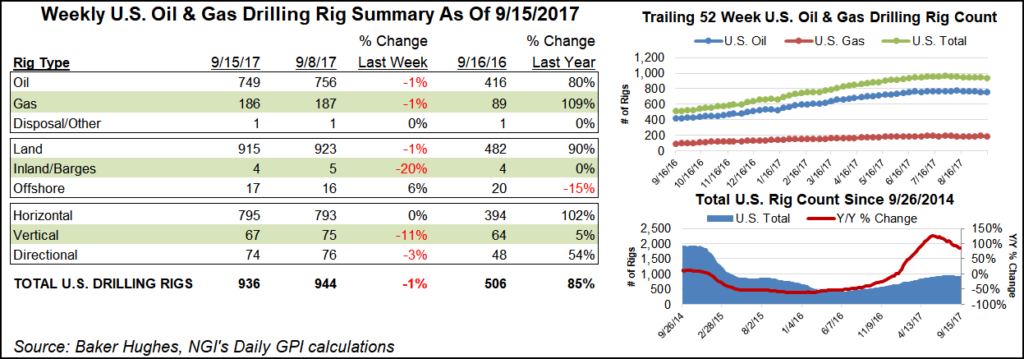

Natural gas-directed drilling in the United States held steady as oil-directed activity retreated for the week ended Friday, according to data released by Baker Hughes Inc. (BHI).

Seven U.S. oil-directed rigs packed up shop for the week, with one natural gas-directed rig also dropped, and the domestic rig count finished at 936.

That’s still well well above the 506 rigs running a year ago, but the latest BHI tally shows U.S. drilling activity continuing to retreat in the wake of the weakening in crude oil prices earlier this year. The U.S. count is now down 22 rigs from its recent high of 958 for the week ended July 28.

In the United States, two horizontal units were added as eight vertical units and two directional units left the patch, according to BHI.

In Canada, 10 oil-directed units returned to boost the Canadian rig count to 212 for the week, up from 132 in the year-ago period.

The combined North American rig count finished up two to 1,148 rigs versus 638 rigs running a year ago.

The week’s declines were focused in Texas and Louisiana, according to BHI’s breakdown, with the Gulf Coast states dropping three rigs each.

Among plays, the Cana Woodford dropped three rigs week/week to end at 64. The Eagle Ford Shale and the Permian Basin dropped two rigs each, finishing at 71 rigs and 380 rigs respectively. In the Permian, one of those losses came in New Mexico, which dropped a rig to finish at 67 for the week, BHI data show.

The declines in the Eagle Ford come as exploration and production companies continue to pick up the pieces following Hurricane Harvey. Major Eagle Ford producers such as Oklahoma City-based Devon Energy Corp. have been forced to cut production guidance due to the storm.

Devon said it’s reducing its total 3Q2017 production guidance by 15,000 boe/d net from pre-storm output of 60,000 boe/d. SM Energy Co., EOG Resources Inc. and Chesapeake Energy Corp. have also announced Harvey-related cuts.

Elsewhere, North Dakota’s Williston Basin dropped a rig to finish at 52, according to BHI, while the Denver Julesburg-Niobrara also dropped a rig to end at 28.

In Appalachia, where the initial start-up of the 3.25 Bcf/d Rover Pipeline figures to support production growth in the constrained region, the Marcellus Shale added a rig to end at 47, up from 29 in the year-ago period. The new Marcellus rig appears to have gone to work in West Virginia, which climbed to 16 rigs for the week, up from 10 a year ago.

The future for natural gas is looking “very favorable,” according to the Energy Information Administration’s International Energy Outlook 2017, released Thursday. EIA projects worldwide natural gas consumption to increase to 177 Tcf in 2040 from 124 Tcf in 2015, the largest increase in fossil fuel consumption over the forecast period.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 1532-1231 |