E&P | NGI All News Access | NGI The Weekly Gas Market Report | Permian Basin

Resolute Sells Aneth Field in Utah to Focus on Permian

Resolute Energy Corp., which has turned its operational focus to the Permian Basin, has agreed to take up to $195 million for a package of Paradox Basin prospects in the Aneth field of southeastern Utah.

The Denver-based producer agreed to sell the field to Elk Petroleum Ltd. for $160 million outright and would recoup up to $35 million more if oil prices exceed “certain levels” over the next three years.

The deal would sharpen Resolute’s attention on the Permian’s Delaware sub-basin.

“This sale is the final step in our previously announced strategy to transform Resolute into a pure-play Delaware Basin company,” CEO Rick Betz said. “Closing this transaction will significantly improve our cost structure, strengthen our balance sheet and position the company to accelerate the development of our prolific Delaware Basin property and continue our strong growth profile.”

Resolute’s second quarter lease operating expense (LOE) for the Permian was $4.87/boe, “which will approximate our company LOE after completion of the transaction,” Betz said.

Proceeds from the Aneth sale would be used to repay an outstanding balance under a revolving credit facility, estimated at $130-135 million at the end of September.

Resolute’s Aneth-dedicated workforce is expected to transition to Elk, a Rockies-focused producer headquartered in Australia.

Elk has become an established enhanced oil recovery (EOR) producer, and currently ispartnering with EOR expert Denbury Resources Inc. on the Grieve carbon dioxide projectin Wyoming.

The Aneth field, discovered in 1956, has produced to date close to 448 million bbl of oil. In 1985, an ExxonMobil Corp. predecessor, as the operator of McElmo Creek Unit, initiated a successful EOR project that is still in operation.

The staff transition to Elkwould allow Resolute to reduce future cash general and administrative expenses by about $6 million and stock-based compensation by about $3 million annually, Betz said.

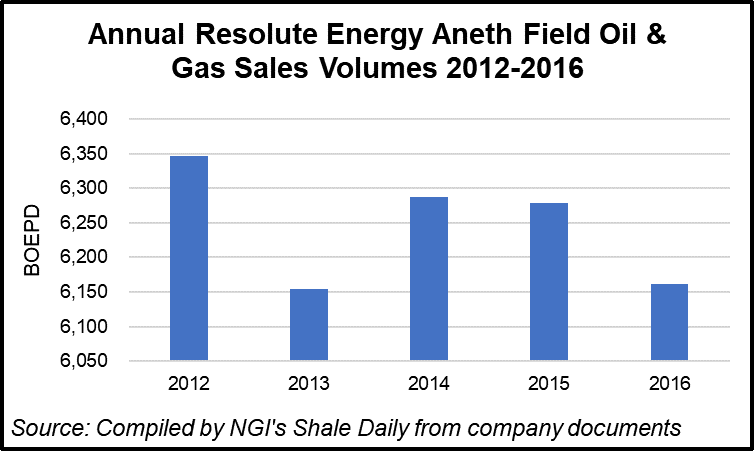

Resolute’s current 2017 production guidance is 24,000-28,000 boe/d. Assuming the Aneth sale closes by Nov. 1, as anticipated, production for 2017 would be reduced by about 1,000 boe/d. July production was 23,600 boe/d in the Permian, and 29,500 boe/d for the company overall.

Under the terms of the definitive agreement, Elk agreed to fund a “performance deposit” of $10 million creditable against the purchase price. The contingent provisions of the agreement would require Elk to pay Resolute:

â— $40,000 for each day in the 12 months after closing that the West Texas Intermediate spot oil price exceeds $52.50/bbl, up to $10 million;

â— $50,000 for each day in the 12 months following the first anniversary of closing that the oil price exceeds $55.00/bbl, up to $10 million; and

â— $60,000 for each day in the 12 months following the second anniversary of closing that the oil price exceeds $60.00/bbl, up to $15 million.

The transaction is subject to customary closing conditions and purchase price adjustments.

Petrie Partners, LLC and Barclays Capital Inc. acted as financial advisers to Resolute, and it was represented by Arnold & Porter Kaye Scholer LLP.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1266 | ISSN © 2158-8023 |