Markets | NGI All News Access | NGI Data

Weekly NatGas Drops, California Bakes, But Futures Surge To Six-Week High

For the abbreviated trading week ended Sept.1, weekly natural gas prices in most sections of the country moved little in contrast to the devastating events that took place on the Texas Gulf Coast. The NGI Weekly National Spot Gas Index fell 11 cents to $2.60.

Of the actively traded points the location showing the greatest gain was El Paso S Mainline with a rise of 80 cents to $3.67 as southern California baked in a late summer heat wave. Iroquois Waddington brought up the rear with a loss of $1.22 to $1.39.

Regionally double-digit moves were posted by the Northeast, Appalachia, and California with losses of 86 cents to $1.77, a loss of 47 cents to $1.38 and a gain of 28 cents to $3.28, respectively.

Texas, Louisiana, the Midwest, Midcontinent, Southeast and Rocky Mountains were all within a nickel of unchanged.

October futures posted a 14.6-cent gain to $3.070, the highest settlement is six weeks.

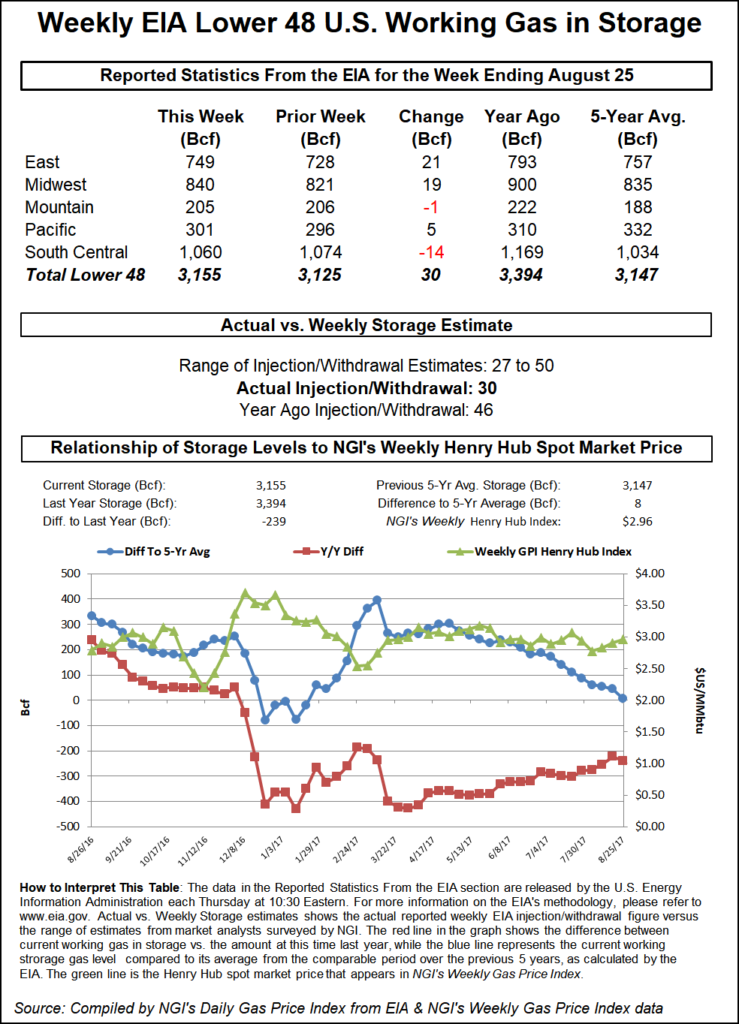

Thursday saw the Energy Information Administration (EIA) report a storage build of 30 Bcf, about 2 Bcf less than expectations, and that was enough for the bulls to seize the reins. At the close October had increased10.1 cents to $3.040 and November had improved 8.8 cents to $3.102. October crude oil surged $1.27 to $47.23/bbl.

At first the market response to the slightly bullish storage number was muted, even though the EIA reported a natural gas storage injection that was less than what traders were expecting. When the number was released October futures rose to $2.950 and by 10:45 a.m. October was holding $2.948, up nine-tenths from Wednesday’s settlement.

Prior to the report traders were looking for a storage build on either side of the actual figures. Last year 46 Bcf was injected and the five-year average stands at 67 Bcf. Citi Futures calculated a 35 Bcf injection and Ritterbusch and Associates estimated a 29 Bcf build. A Reuters survey of 19 traders and analysts showed an average 32 Bcf with a range of plus 27 Bcf to plus 50 Bcf.

Traders were unimpressed by the figure. “I wouldn’t consider a 4-cent range off a [storage] number as significant,” a New York floor trader opined to NGI. “The market sneezed higher,” he said.

“I didn’t think it meant much,” said Mike DeVooght, president of DEVO Capital. “Fundamentally natural gas is a mixed bag here, but the potential of getting a 25 cent to 30 cent rally is very, very possible right here.”

The Wells Fargo analytical team saw the report as supportive. “Since the end of April (17 weeks) the surplus versus the five-year average has fallen by 298 Bcf (17.5 Bcf per week), reflecting a market more than 2 Bcf/d undersupplied. However, we believe power-burn demand will be relatively mild due to cooler than normal weather forecasts for much of the U.S. over the next two weeks.

“Our cumulative injection forecast for the next two weeks is 135 Bcf, 37 Bcf above last year’s cumulative injection of 98 Bcf and 17 Bcf above the five-year average of 118 Bcf,” they said.

Traders are positive the market can move higher and are looking for a spot to scale-in sell. “We got a settlement well above $3, and what a lot of people aren’t understanding is we still have a cooling season left, said John Woods, trader and president of J.J. Woods and Associates in New York.

He admitted that the net result of lower demand or lower supply off the impact of Harvey was “a crap shoot, but you are going to find out more before next Thursday. You will probably start to get some information by late Friday. What we have is a wait and see game. There is no one with an accurate number.

“We still have a season, we still have things to do, so look for higher natgas. Right now I am looking at $3.12 to $3.15, and that is the top end of the trading range.

“From there I would go short since that puts us into September and the shoulder month, and it should subside from there. If you do get some adverse weather and a rally, sell into it. You typically don’t have the big price moves in the shoulder months. If there is a move the smart money will take the other side of everybody just jumping on the long side. You don’t want to battle the market, but you will take the other side,” he said.

Inventories now stand at 3,155 Bcf and are 239 Bcf less than last year and 8 Bcf greater than the five-year average. In the East Region 21 Bcf was injected, and the Midwest Region saw inventories rise by 19 Bcf. Stocks in the Mountain Region were down 1 Bcf and the Pacific Region was up 5 Bcf. The South Central Region fell 14 Bcf.

In Friday’s trading the risks of lessened supply going into the long weekend were of little concern and traders for the most part elected not to commit to four-day deals. Prices for the holiday weekend slumped. Weakness in Appalachia, the Northeast and California overwhelmed firmer markets in the Midwest, Midcontinent, the Southeast and Louisiana, and the NGI National Spot Gas Average fell 5 cents to $2.58.

Weather reports continue a pattern of a warm West and cooling East, and that was good enough for futures traders to lift the October contract 3.0 cents to $3.070 and the November contract 3.4 cents to $3.136. October crude oil rose 6 cents to $47.29/bbl.

Although CAISO forecast peak load Friday was on track to set a record, Tuesday gas prices in southern California declined as Tuesday power slid at points serving the baking southern California market. Intercontinental Exchange reported Tuesday peak power at Palo Verde eased 67 cents to $102.66/MWh, but power delivered to SP-15 Tuesday tumbled $22.38 to $83.16/MWh.

At 4:20 pm PDT Friday peak load had reached 50,116 MW, but CAISO forecast the day’s peak at 50,310 MW, just ahead of the record 50,270 MW reached in July 2006 during a heat storm.

Gas on PG&E Citygate rose a nickel to $3.40, but gas on El Paso S Mainline skidded 32 cents to $3.51. Deliveries to the SoCal Citygate were quoted 36 cents lower at $3.81, and gas priced at the SoCal Border Average dropped 35 cents to $3.18.

CAISO forecast peak load Friday at 50,749 MW, just above the previous record set in 2006 during a heat storm at 50,270 MW. At 2 p.m. PDT load was running 46,999 MW.

Eastern points fell. Gas at the Algonquin Citygate dropped 35 cents to $1.21 and deliveries to New York City via Transco Zone 6 shed 66 cents to $1.65. Gas on Tetco M-3 Delivery changed hands 33 cents lower at $1.05 and packages on Dominion South came in 38 cents lower at $1.05.

At the Chicago Citygate weekend packages rose a nickel to $2.84 and at the Henry Hub gas rose a penny to $2.90. Gas on El Paso Permian gave up a nickel to $2.75 and gas priced at Northern Natural Demarcation added a nickel to $2.79.

In Thursday’s storage report the Energy Information Administration (EIA) reported that the year-on-five-year surplus had now been whittled down to just 8 Bcf, and according to traders recent market strength represents a “wake-up call.”

“Given the lack of major supply surplus that was available to the market last year, we feel that this market will need to establish some risk premium related to the possibility of supply disruptions related to weather or other issues,” said Jim Ritterbusch of Ritterbusch and Associates in a morning report to clients.

“But, for now, upside is being restrained by an extension of cool temperature views into about the middle of this month. Although some warmer trends appear likely beyond next week, it doesn’t appear to be enough deviation from normal to sustain yesterday’s price advance.

“Regardless, the ability of nearby futures to push above the $3.03 resistance level is forcing some of the money managers to reduce short holdings following a recent incursion into the short side by a net margin of almost 44,000 contracts. Meanwhile, the physical trade is having some difficulty keeping pace with the futures rally, especially with industrial demand likely to be reduced via a three-day holiday at many plants.”

Weather forecasters see a continuing pattern of a warm West and cooler East for the next two weeks. For the next five days meteorologist John Dee said, “Ridging will continue to occur across the western U.S., keeping temps above average there. A northwest flow aloft will provide for mostly below average temps across the eastern half to two-thirds of the U.S., keeping demands for cooling below average there.”

Tropics-wise, Hurricane Irma was front and center on traders’ minds. “Ideas are for it to see further strengthening as it works through the central Atlantic,” Dee said.

In its 5 p.m. EDT report the National Hurricane Center said Irma was located 1,495 miles east of the Leeward Islands and was moving west at 13 mph. A turn toward the west-southwest is expected on Saturday. Maximum sustained winds were near 120 mph with higher gusts. Fluctuations in strength, up or down, are possible during the next few days, but Irma is expected to remain a powerful hurricane through the weekend, NHC said.

© 2024 Natural Gas Intelligence. All rights reserved.

ISSN © 2577-9877 | ISSN © 1532-1258 |